Get the free 2025 Schedule 1 (Form 1040) (sp)

Get, Create, Make and Sign 2025 schedule 1 form

Editing 2025 schedule 1 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 schedule 1 form

How to fill out 2025 schedule 1 form

Who needs 2025 schedule 1 form?

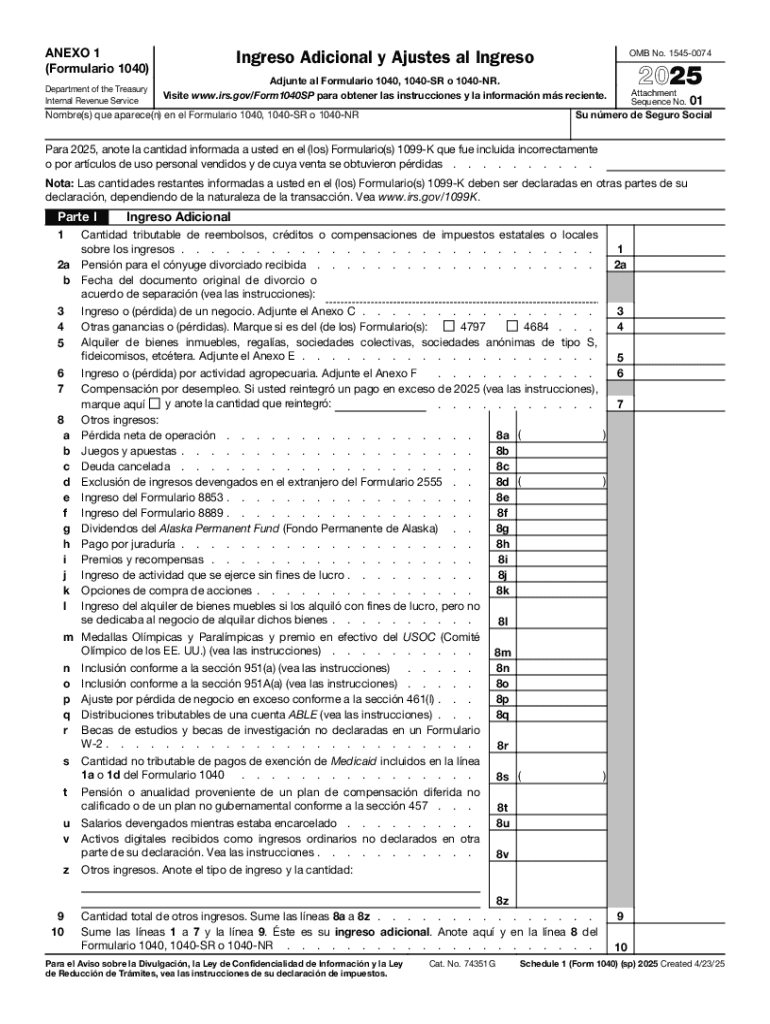

Navigating the 2025 Schedule 1 Form: Your Comprehensive Guide

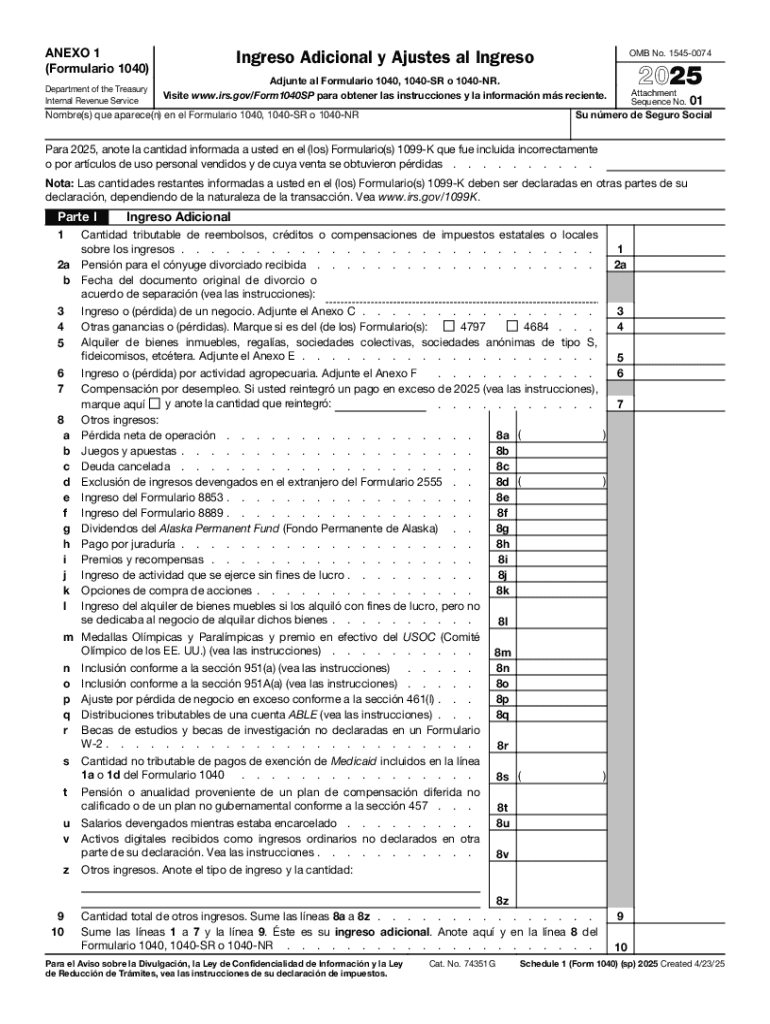

Understanding the 2025 Schedule 1 Form

The 2025 Schedule 1 Form is an essential document for taxpayers in the United States, specifically designed to report various adjustments to income alongside the standard Form 1040. Its primary purpose is to allow taxpayers to list income that is not included on the main tax form, which ultimately impacts overall tax liabilities. This form is crucial for documenting elements such as educator expenses, student loan interest deductions, and additional income types like capital gains and unemployment compensation.

In 2025, understanding the nuances of this form is particularly important as it not only influences individual taxpayer liabilities but also assists in identifying qualification for various credits and deductions that can enhance financial outcomes. Tax filers will find that changes and updates specific to 2025 may impact how they approach their filings.

Key changes for this year include new limits on certain deductions and the introduction of additional credits that may prove beneficial in reducing tax liability. Staying informed about these changes ensures taxpayers can accurately complete their Schedule 1 Form and optimize their financial situations.

Detailed breakdown of the 2025 Schedule 1 Form

The 2025 Schedule 1 Form is divided into multiple parts, each serving a unique function in reporting income and claiming deductions. Understanding each section is vital for accurate filings.

Part : Identification section

The first part of the form requires basic identification information. This section includes details such as your name, address, and Social Security Number (SSN). Providing accurate information is critical to avoid processing delays or complications with the IRS.

Common mistakes include entering the wrong SSN or mislabeling the filing status. To avoid these pitfalls, verifying your details through official documents is recommended.

Part : Adjustments to income

Part II outlines specific adjustments that can lower your taxable income. Understanding which deductions apply to you can lead to significant savings during tax season.

Subsection: Educator expenses

Educator expenses allow teachers to deduct up to $300 of qualified expenses. To qualify, educators must work at least 900 hours a school year for a school that provides education for kindergarten through grade 12.

Subsection: Student loan interest deduction

Taxpayers can deduct up to $2,500 of interest paid on student loans, provided their modified adjusted gross income falls below certain thresholds. Being aware of the maximum deduction limits and the income phase-out range is essential for maximizing this benefit.

Part : Additional income types

This section is crucial for reporting other income not typically included on a Form 1040. This includes capital gains and unemployment compensation.

Subsection: Capital gains

When reporting capital gains, it is important to distinguish between short-term and long-term gains. Short-term capital gains are taxed at ordinary income rates, while long-term gains benefit from lower tax rates. Recent changes may have adjusted how these gains are reported, particularly for taxpayers selling assets this year.

Subsection: Unemployment compensation

Unemployment benefits are typically taxable, but it is crucial to determine what portion is non-taxable if any. Taxpayers should review documentation from employers carefully to distinguish taxable amounts.

Part : Deductions made on Schedule 1

Part IV details various deductions that can reduce taxable income. Understanding these deductions is key to calculating your overall tax obligation effectively.

Subsection: Health savings account contributions

Contributions to Health Savings Accounts (HSAs) are tax-deductible, with limits of $3,650 for individuals and $7,300 for families. Investing in HSAs not only offers a deduction but also allows for tax-free growth for qualified medical expenses.

Subsection: Moving expenses for active duty members

Military personnel or active duty members may qualify to deduct moving expenses incurred due to a permanent change of station. Eligibility under this provision can significantly impact their taxable income positively.

Part : Credits and additional information

Credits can directly reduce the tax owed, making this section vital for many taxpayers. Understanding what's available can lead to substantial tax refunds.

Subsection: Credit for other dependents

The Credit for Other Dependents allows for a credit worth up to $500 per qualifying dependent who does not meet the criteria for the Child Tax Credit. It’s essential to know the specific qualifications to maximize this credit.

Subsection: Earned income tax credit (EITC)

The EITC is designed for low to moderate-income workers, and its value can significantly affect tax refunds. Calculating this credit accurately, based on income and number of dependents, is crucial for resourceful tax refund planning.

Step-by-step instructions for completing the 2025 Schedule 1 Form

Completing the 2025 Schedule 1 Form can be straightforward if approached systematically. Having the necessary documents ready can make the process even more efficient.

Preparation checklist: What you need to gather

Step 1: Filling out personal information

Accurate entry of personal information sets the foundation for the entire form. Cross-reference details with your identification to ensure no inaccuracies, as mismatches may cause delays.

Step 2: Reporting adjustments to income

This involves calculating each allowable deduction. Each type has specific calculations, making it imperative to understand how to report educator expenses and interest paid on loans properly.

Step 3: Detailing additional income

Accurately detail any additional income sources. This includes comprehensively tracking capital gains and unemployment benefits, ensuring that you report amounts correctly.

Step 4: Deductions and credits application

Deductions and credits can deliver significant refunds. Ensure you provide all needed documentation to support your claims, especially for items like health savings accounts and additional credits.

Interactive tools for filing the 2025 Schedule 1 Form

PDFfiller provides intuitive online solutions for completing the 2025 Schedule 1 Form. Utilizing software designed for this purpose can simplify the process significantly.

Online filling options with pdfFiller

PDFfiller offers user-friendly online filling options that allow taxpayers to complete their Schedule 1 Form with ease. The platform's guided approach minimizes errors and maximizes efficiency.

Sign and edit tools integration

With pdfFiller's sign and edit tools, users can make adjustments to their forms seamlessly before submission. This feature enhances document accuracy, ensuring the integrity of your submissions.

Collaboration features for teams

For teams who handle multiple filings, pdfFiller’s collaboration features allow multiple users to work together on shared documents efficiently. This is especially useful for companies or organizations filing on behalf of many employees.

Commonly asked questions about the 2025 Schedule 1 Form

Taxpayers often have queries related to the 2025 Schedule 1 Form. Understanding common topics can facilitate smoother filing processes and ensure compliance.

Tips for efficient document management

Maintaining documentation effectively can reduce stress during tax time and ensure you have everything required for accurate filings.

Best practices for storing and sharing PDF forms

Take advantage of cloud storage options to keep your PDFs secure and easily accessible. Organizing documents into specific folders streamslines retrieval when needed.

Utilizing cloud solutions for document security

Opt for reputable cloud services that prioritize document security to safeguard your sensitive tax information from unauthorized access or loss.

Regularly updating templates to meet current tax laws

Regular updates ensure compliance with current tax regulations, allowing for confidence in the accuracy of filings. Utilizing master templates stored in the cloud can facilitate quick adjustments to changes as they arise.

Encouraging tax literacy

Enhancing tax literacy is vital for individual empowerment in financial decision-making. Understanding obligations and available benefits improves financial health.

Resources for continued education regarding tax forms and regulations can range from IRS online resources, local workshops, and even social media communities focused on financial literacy. Engaging with these resources equips taxpayers with the knowledge to navigate situations confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2025 schedule 1 form?

How do I execute 2025 schedule 1 form online?

How can I edit 2025 schedule 1 form on a smartphone?

What is 2025 schedule 1 form?

Who is required to file 2025 schedule 1 form?

How to fill out 2025 schedule 1 form?

What is the purpose of 2025 schedule 1 form?

What information must be reported on 2025 schedule 1 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.