Get the free 2025 Form 1040-SR (sp)

Get, Create, Make and Sign 2025 form 1040-sr sp

How to edit 2025 form 1040-sr sp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 1040-sr sp

How to fill out 2025 form 1040-sr sp

Who needs 2025 form 1040-sr sp?

Comprehensive Guide to the 2025 Form 1040-SR SP Form

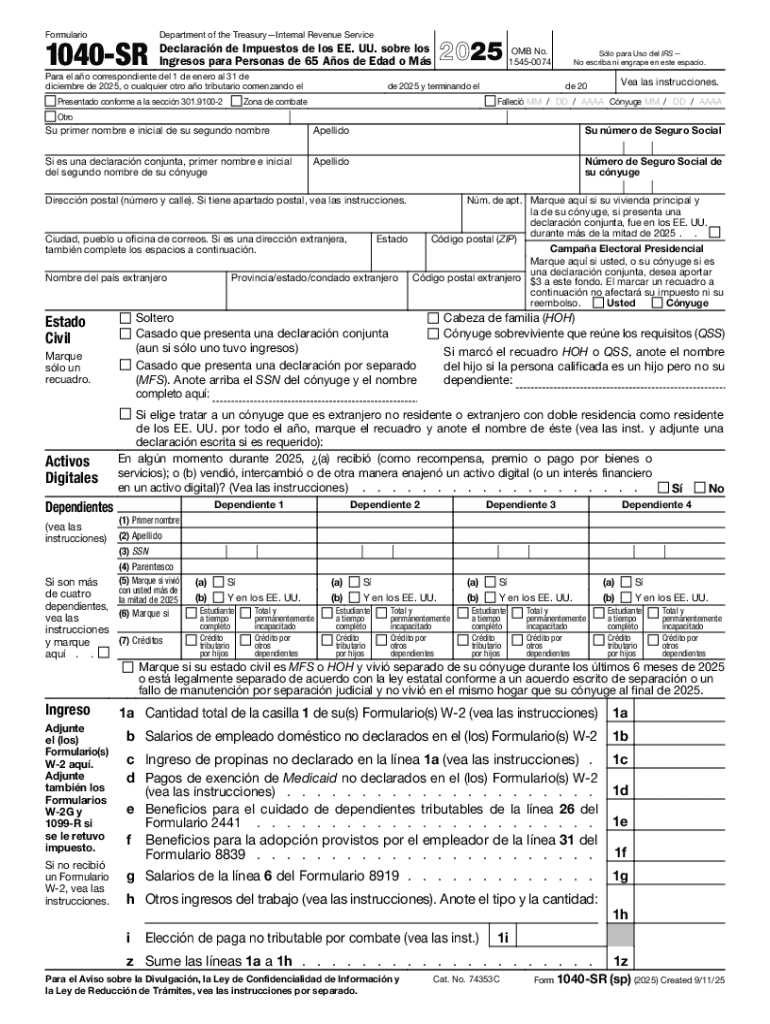

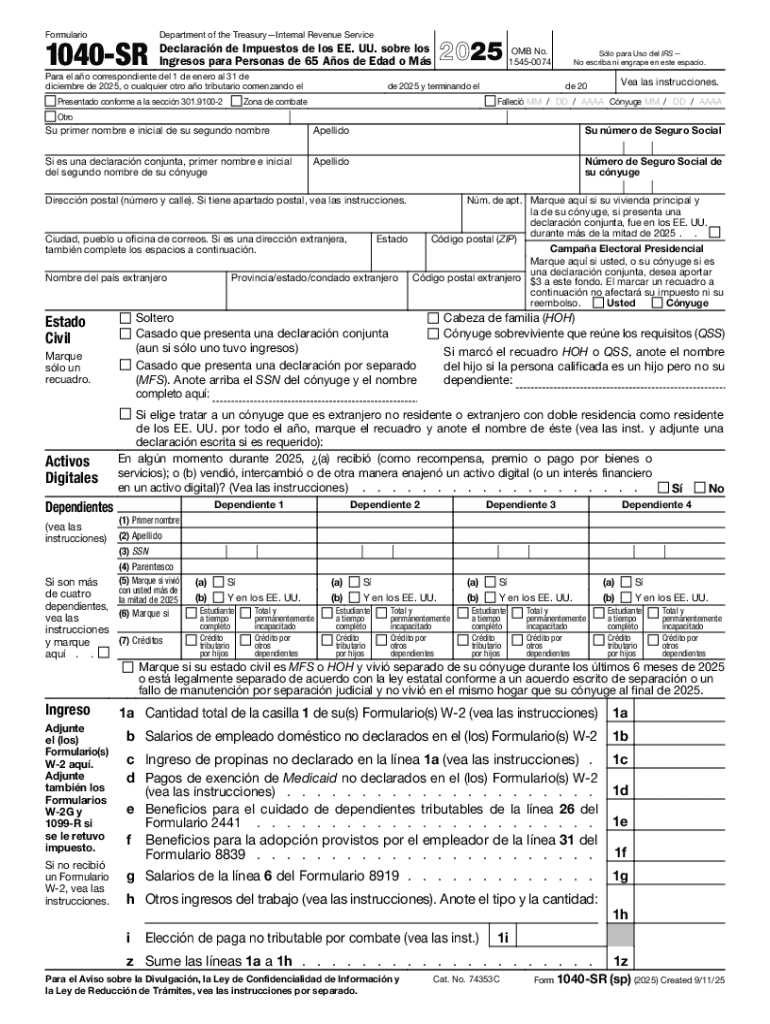

Understanding the 2025 Form 1040-SR SP

The 2025 Form 1040-SR SP is specifically designed to cater to the needs of seniors filing their tax returns in a simplified manner. This variant of the standard Form 1040 helps to facilitate tax reporting for individuals aged 65 and older, allowing for a streamlined process that takes into account unique tax considerations relevant to retired individuals.

The 1040-SR SP form mirrors the 1040-SR but is crafted to include Spanish-language instructions, ensuring accessibility for Spanish-speaking seniors. This initiative aims to break language barriers, providing a comprehensive resource for older taxpayers seeking to understand their tax responsibilities.

Who needs to use this form?

Eligibility to file the 2025 Form 1040-SR SP primarily revolves around age and income thresholds. Typically, individuals who are at least 65 years old at the end of the tax year are encouraged to use this form. Moreover, those who derive most of their income from sources such as pensions, Social Security, or interest income may find the 1040-SR SP advantageous.

Key dates and deadlines for 2025

Keeping track of tax deadlines is crucial for timely and accurate filing. In 2025, the IRS has set April 15 as the deadline to file your 2025 Form 1040-SR SP unless it falls on a weekend or holiday, in which case the deadline may be extended to the next business day. For those who need extra time, an extension can be requested using Form 4868, which grants an additional six months for filing, pushing the new deadline to October 15.

Navigating the layout of 1040-SR SP

The layout of the 2025 Form 1040-SR SP is structured for clarity and ease of use. The form can be broken down into several key sections, enabling seniors to easily enter essential information required for their tax filings. The personal information section gathers basic details, such as name, address, and Social Security number.

Following this, the income and adjustments section allows taxpayers to report all sources of income, including pensions and Social Security benefits. The deductions and credits area highlights applicable deductions for seniors, including the standard deduction, which is higher for those over 65. A visual guide demonstrating a filled-out form can provide further clarity on how to complete each section accurately.

Filling out your 2025 Form 1040-SR SP

Filling out the 2025 Form 1040-SR SP can be straightforward if approached methodically. Start with Step 1, which focuses on compiling your personal information. Ensure all details are accurate to prevent processing issues. Next, proceed to Step 2, where you will report all types of income, which can include wages, dividends, and any retirement distributions.

In Step 3, adjustments and deductions come into play. Seniors should decide whether to take the standard deduction, which for 2025 is higher for individuals over 65, or itemize deductions if they have significant qualifying expenses. Lastly, Step 4 covers tax credits available to seniors, including the Retirement Savings Contributions Credit, which could further reduce tax liabilities.

Common errors and how to avoid them

When filling out the 2025 Form 1040-SR SP, seniors often encounter a few common pitfalls. Errors such as misreporting income, failing to sign the form, or neglecting to include necessary attachments can lead to delays or audits. Thoroughly reviewing entries before submission is crucial. It's also beneficial to compare figures with the previous year’s returns for consistency.

Another important point is ensuring all required documentation is organized and submitted with the form, such as W-2s, 1099s, and any necessary schedules. Double-checking arithmetic for accuracy and verifying that the correct form is being used are simple yet effective practices to avoid mistakes.

Frequently asked questions (FAQs)

Many seniors often wonder if they should file a tax return after retirement. While Social Security benefits are typically not taxable for most, other income sources may necessitate filing. If your combined income exceeds certain thresholds, even a small amount may require filing a return. Understanding how Social Security impacts your taxes is also key; a portion of benefits may be taxable depending on total income.

For those who find themselves owing taxes or needing payment options, the IRS offers various methods to settle debts, including payment plans. It's crucial to explore these options sooner rather than later to avoid penalties.

What’s new for 2025?

Tax legislation can shift annually, impacting deductions and credits relevant to seniors. For 2025, notable changes include adjustments in the standard deduction amounts. The IRS routinely increases the standard deduction in alignment with inflation, which could benefit many older taxpayers. Additionally, there might be new tax credits or modifications to existing ones that make taking advantage of these changes imperative.

Stay updated about these adjustments, as they could significantly affect your tax situation. Consulting tax professionals or utilizing reliable online resources can help clarify any uncertainties regarding new provisions.

Filing options for the 2025 form 1040-SR SP

When it comes to submitting your 2025 Form 1040-SR SP, seniors have various filing options. eFiling has gained popularity due to its efficiency and convenience; it generally allows for quicker processing of returns and refunds. This method is especially advantageous for those who may lack mobility or prefer not to handle physical paperwork.

On the other hand, traditional paper filing is still acceptable but can be prone to delays in processing. Regardless of your chosen method, ensure that submission happens well before the deadline to avoid penalties. It's essential to remember some key practices, especially regarding security when filing online. Keep all sensitive documents secure and use protected networks when submitting your form digitally.

2025 tax refund process

After filing the 2025 Form 1040-SR SP, understanding the tax refund process is essential. Typically, taxpayers can expect to receive their refunds within 21 days if filed electronically and if there are no discrepancies in the returned information. For paper filers, the wait may extend to several weeks longer, reflecting the processing backlog in handling paper submissions.

To track the status of your tax refund, the IRS provides an online tool aptly named 'Where's My Refund?', where you can check updates on your refund status. There are also various options for receiving your refund; some may prefer direct deposit for speed and ease, while others may opt for a physical check.

Interactive tools for managing your taxes

Utilizing tools like pdfFiller to manage your 2025 Form 1040-SR SP can simplify the tax filing process significantly. With pdfFiller, users can easily edit and fill out forms digitally, making corrections effortless. The platform also supports secure eSigning capabilities, enabling seniors to sign their documents without needing to print and scan.

The document management features of pdfFiller help keep all your tax forms organized and readily accessible, reducing clutter and ensuring you can easily reference previous filings or important documentation when needed. By leveraging these tools, seniors can enhance their overall tax experience and mitigate stress associated with the filing process.

Conclusion: empowering your tax filing experience

The 2025 Form 1040-SR SP is more than just a tax form; it represents the IRS’s commitment to making tax filing more accessible for seniors. By empowering users with tools like pdfFiller’s platform, the entire process from filling out forms to managing documentation becomes seamless and efficient. Taking the time to understand the form’s requirements and leveraging available resources can significantly enhance your experience, leading to peace of mind during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2025 form 1040-sr sp?

Can I create an electronic signature for signing my 2025 form 1040-sr sp in Gmail?

How can I fill out 2025 form 1040-sr sp on an iOS device?

What is 2025 form 1040-sr sp?

Who is required to file 2025 form 1040-sr sp?

How to fill out 2025 form 1040-sr sp?

What is the purpose of 2025 form 1040-sr sp?

What information must be reported on 2025 form 1040-sr sp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.