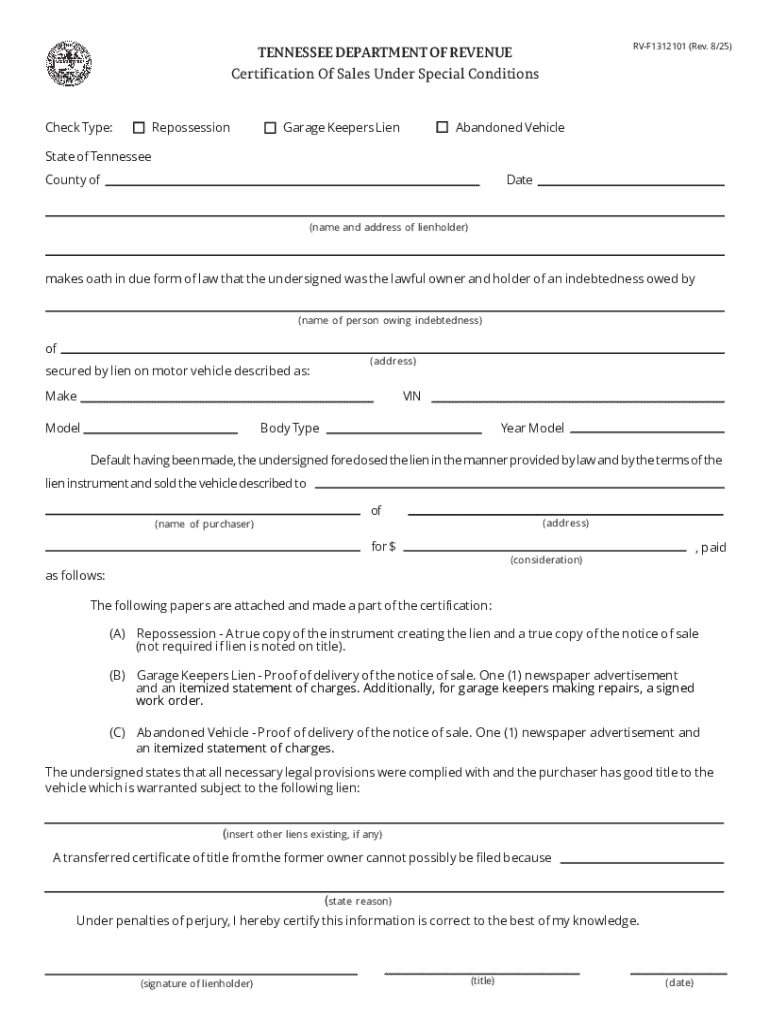

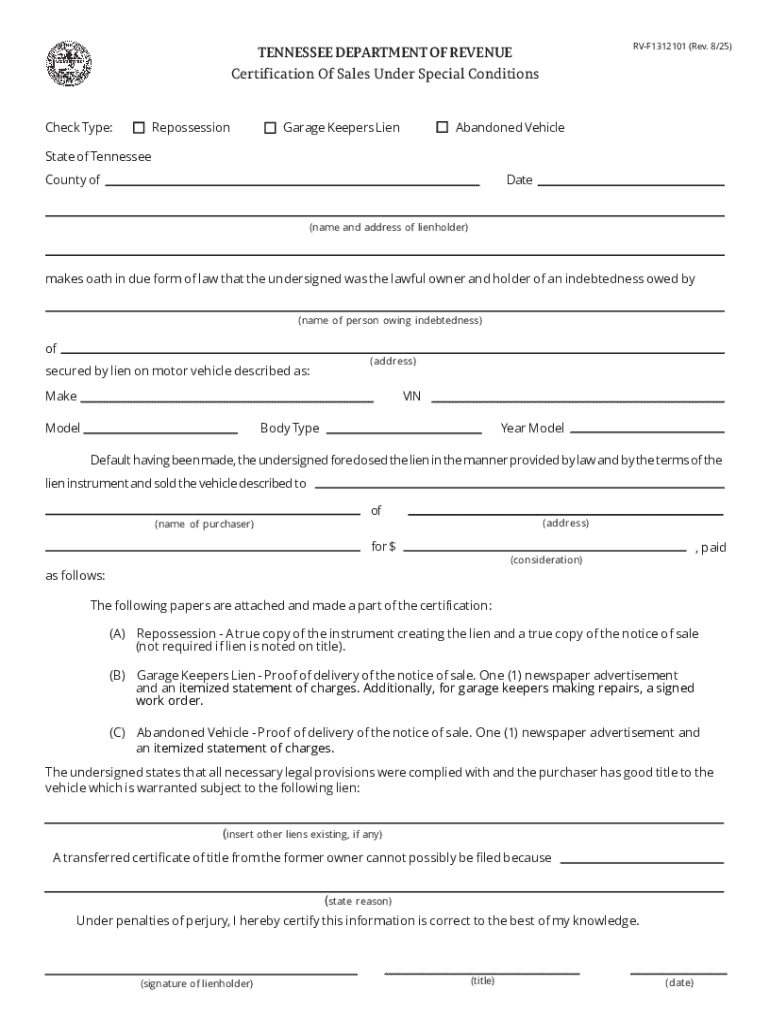

Get the free Certification of Sales Under Special Conditions

Get, Create, Make and Sign certification of sales under

How to edit certification of sales under online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certification of sales under

How to fill out certification of sales under

Who needs certification of sales under?

Certification of Sales Under Form: Your Comprehensive Guide

Understanding the certification of sales

Certification of sales serves as a critical component in the sales process, specifically focused on tax compliance. It ensures that sales transactions adhere to tax regulations, helping both buyers and sellers understand their obligations. The purpose of sales certification primarily revolves around ensuring compliance with tax laws and protecting vendors from potential tax liabilities that may arise from improper documentation.

The key entities involved in sales certification include sellers, buyers, and tax authorities. Sellers must provide accurate information to ensure they do not inadvertently expose themselves to tax penalties, while buyers may need certifications for tax-exempt purchases. Accurate documentation plays an essential role in the certification of sales, as misrepresentation can lead to severe legal implications.

Types of sales certifications

There are various types of sales certifications, including the Uniform Sales & Use Tax Resale Certificate, which is universally recognized across many states. Additionally, individual states often issue their own specific forms that cater to local tax requirements. Understanding these forms and their variations is important for any seller as it determines the nature of the transaction and the necessary documentation.

Moreover, there are notable variations in requirements across different jurisdictions. Some states may require additional information or specific formats, while others may follow a more standardized approach. It is essential for businesses operating in multiple states to be aware of these differences to ensure compliance and avoid potential penalties.

Step-by-step guide to completing the sales certification form

Completing a sales certification form starts with gathering the necessary documents. It is important to prepare by collecting seller and buyer details, including names, addresses, and tax identification numbers. Understanding the tax-exempt status is crucial, as incorrect declarations can lead to compliance issues.

When filling out the form, each section has specific requirements: First, include the seller's general information, such as business name and address. Secondly, provide the buyer's details similarly. Next, describe the property being sold and clearly declare the intent behind the purchase. Make sure to cross-check for any misleading or incomplete information as these are common pitfall areas.

Filing and submitting the sales certification form

Once the sales certification form is completed, the next step is its submission. There are various submission methods available; you may opt for either electronic or paper submissions. Many states have adopted e-filing systems, which streamline the process and often allow for immediate confirmation of receipt.

It's wise to keep thorough records of all submissions made, as tax authorities may request documentation during audits. Preparing for potential audits involves having copies of submitted forms and the accompanying documentation readily available to demonstrate compliance.

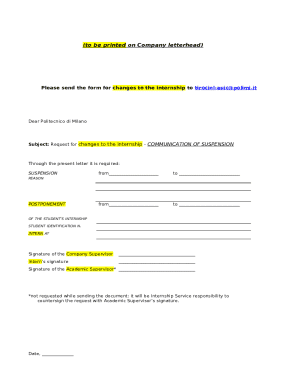

Editing, managing, and storing your certification of sales

Managing sales certification documents doesn't have to be tedious. Utilizing interactive tools, such as those found on pdfFiller, simplifies document editing and signing. Whether you need to add information or obtain electronic signatures, pdfFiller offers features that enhance your document management process.

Best practices for document storage include using cloud-based solutions, facilitating easy access and retrieval when needed. Organizing files logically helps manage them better and ensures that all related documents are stored in one location.

Collaboration and sharing the sales certification form

Sharing sales certification forms should be a collaborative process, especially in team environments. pdfFiller allows users to invite team members to collaborate on documents, enabling them to set specific permissions for editing and reviewing. This feature is vital for ensuring that all stakeholders can contribute while maintaining control over the document's integrity.

Tracking changes and maintaining version control are key aspects of effective document management. With pdfFiller's functionalities, you can easily see who made specific edits, and revert to earlier versions when needed, preserving the history of your document.

Frequently asked questions (FAQs)

Navigating the nuances of sales certifications can raise various questions. Common inquiries often revolve around the specific requirements for different states or clarifications on the exact procedures for correctly completing the form. Many also seek help in troubleshooting issues encountered during the certification process.

Addressing these common problems through practical examples or expert advice ensures users are well-equipped to handle potential hurdles, ultimately facilitating an efficient process for obtaining and submitting sales certification.

Real-world applications and use cases

Sales certifications are prevalent across various industries, particularly in retail and wholesale sectors. Scenarios requiring these certifications often involve tax-exempt sales, such as sales to non-profit organizations or government entities. Ensuring proper documentation in these cases helps businesses maintain compliance and avoid audit complications.

Moreover, success stories abound where proper certification has significantly benefited businesses. For example, a wholesale distributor who streamlined their certification processes saw reduced audit risks and improved relationships with clients due to clarity in tax-exempt transactions. These cases highlight how crucial it is for businesses to understand the certification of sales under form and its practical implications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete certification of sales under online?

Can I create an electronic signature for signing my certification of sales under in Gmail?

How do I complete certification of sales under on an Android device?

What is certification of sales under?

Who is required to file certification of sales under?

How to fill out certification of sales under?

What is the purpose of certification of sales under?

What information must be reported on certification of sales under?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.