Get the free Missouri Employer Withholding Tax

Get, Create, Make and Sign missouri employer withholding tax

How to edit missouri employer withholding tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out missouri employer withholding tax

How to fill out form 2643a - missouri

Who needs form 2643a - missouri?

Form 2643A - Missouri Form: Your Comprehensive Guide

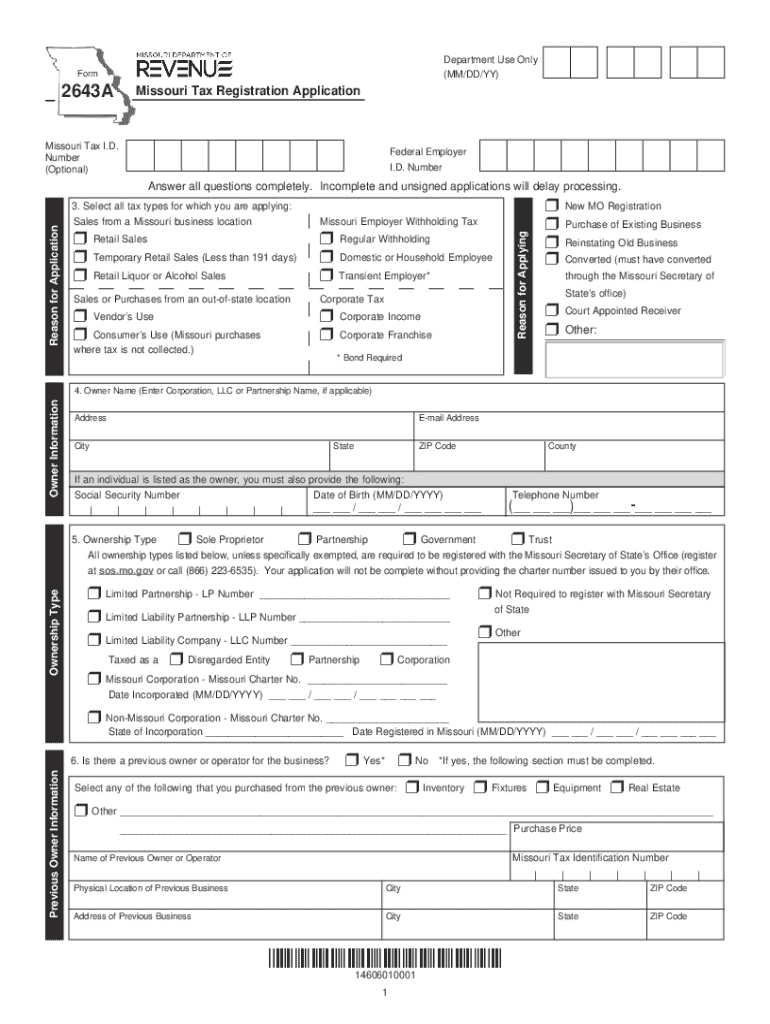

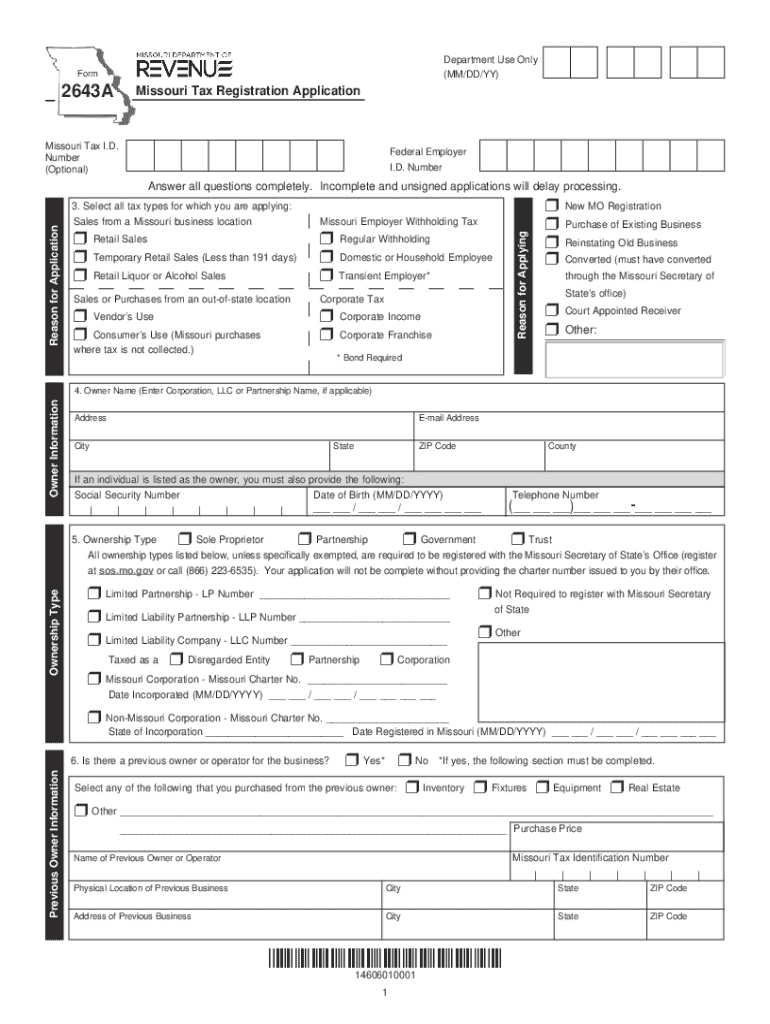

Overview of Form 2643A

Form 2643A is an essential document used in Missouri, primarily for reporting specific financial information to the state. Its purpose revolves around ensuring compliance with state tax regulations, allowing individuals and organizations to accurately report their income and financial activities. This form is critical for maintaining transparency in financial dealings, as it helps the state assess tax liabilities efficiently.

Accurate submission of the Form 2643A is vital, as any discrepancies or errors can lead to delays in processing, potential audits, and other regulatory complications. Individuals and organizations are encouraged to familiarize themselves with the form's requirements to avoid pitfalls during submission. Situations that require the completion of this form include filing taxes for various income sources, disclosing specific financial transactions, or addressing changes in financial status that impact tax obligations.

Understanding the components of Form 2643A

Form 2643A consists of several key sections that gather essential information required for proper submission. Understanding these components is critical for filling out the form correctly. The main sections are divided into personal information, employment and income details, and tax identification information, each serving a specific function in the reporting process.

Common terminology associated with this form includes 'tax year', 'adjusted gross income', and 'employment verification', among others. Familiarizing yourself with these terms will greatly enhance your comprehension of the form and its requirements.

Step-by-step instructions for filling out Form 2643A

Before you start filling out Form 2643A, preparation is key. Gather all necessary documents, including your financial records for the reporting year, W-2 forms, previous tax returns, and any financial statements that may be relevant. Understanding submission deadlines is crucial, as missing these can result in penalties or delays.

Once you have your documents ready, follow this detailed walkthrough for each section of the form:

Here are some tips for completing each section: double-check entered information, avoid shorthand or abbreviations, and if unsure on any item, consult the guidelines or a tax professional.

Utilizing interactive tools for form completion

Using tools like pdfFiller can streamline the form completion process significantly. pdfFiller not only allows you to fill out Form 2643A digitally but also offers interactive features that enhance the user experience. This makes navigating the form easier, reducing potential errors.

Collaboration features allow for teamwork on the form, making it easy to share tasks and ensure that every aspect of the form is accurately filled.

Electronic signature options for Form 2643A

In today’s digital environment, eSigning documents is becoming increasingly essential. Form 2643A can be signed electronically, which is not only convenient but also ensures compliance with state regulations. Using pdfFiller, you can eSign the form seamlessly.

Here's a step-by-step guide to eSigning the form with pdfFiller:

The importance of validating your eSignature cannot be overstated. Always ensure that your signature complies with state regulations to prevent any legal complications in the future.

Common mistakes to avoid

Completing Form 2643A may seem straightforward, but there are frequently made errors that can hinder your submission process. Some common mistakes include omitting required fields, misreporting income figures, and failing to check for accurate identification information.

To avoid these issues, develop a checklist for double-checking your submission before finalizing it. Resources such as pdfFiller’s help section can offer further insights for resolving issues related to Form 2643A.

Managing your completed Form 2643A with pdfFiller

Once you have completed Form 2643A, managing it securely is important. pdfFiller offers features to save and store your form, ensuring your sensitive information is protected.

Frequently asked questions

Understanding common queries about Form 2643A can simplify your filing process. Here are answers to some frequently asked questions:

Getting help with Form 2643A

If you encounter challenges while completing Form 2643A, various customer support options are available through pdfFiller. Their platform offers access to help resources directly related to this form.

Final thoughts on Form 2643A utilization

To summarize, utilizing Form 2643A efficiently is paramount for compliance with Missouri tax regulations. Leveraging tools like pdfFiller can streamline the entire process from filling out the form to electronic signing and sharing.

Embracing technology in document management not only enhances accuracy but also saves time, allowing you to focus on other important tasks. Users are encouraged to explore further document solutions provided by pdfFiller to ease their filing process and improve overall document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send missouri employer withholding tax to be eSigned by others?

Can I edit missouri employer withholding tax on an iOS device?

How can I fill out missouri employer withholding tax on an iOS device?

What is form 2643a - missouri?

Who is required to file form 2643a - missouri?

How to fill out form 2643a - missouri?

What is the purpose of form 2643a - missouri?

What information must be reported on form 2643a - missouri?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.