India SBI Bank Self-Declaration of the Current (Overseas) Address 2015-2025 free printable template

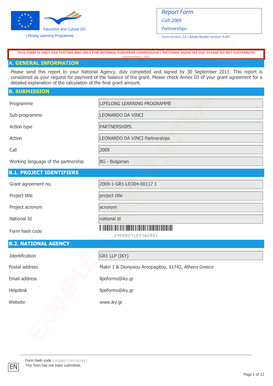

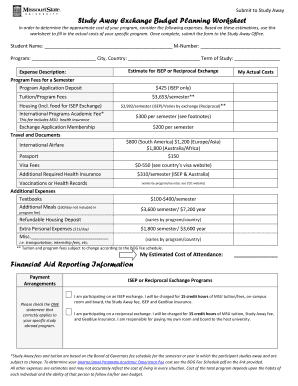

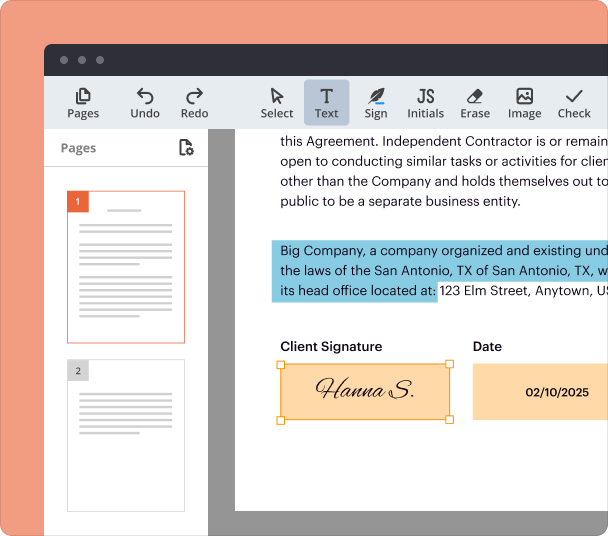

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

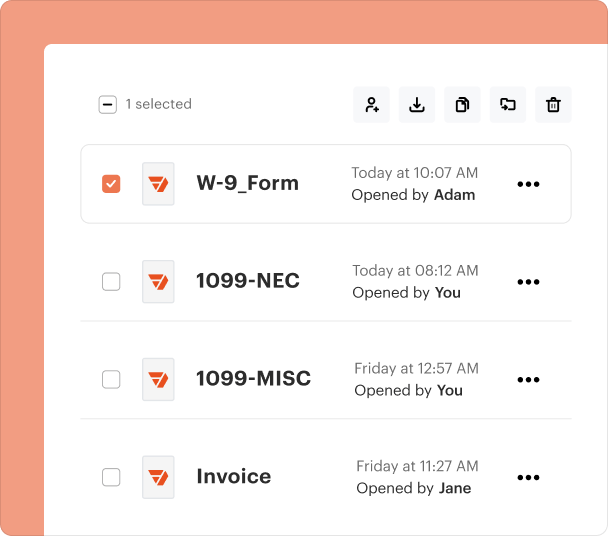

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

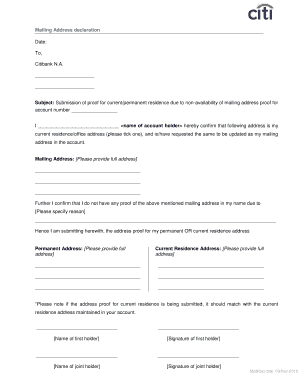

Comprehensive Guide to the India SBI Bank Self-Declaration Form

The India SBI Bank self-declaration form is a crucial document that you need to fill out when applying for various types of accounts, particularly when you are an NRI (Non-Resident Indian). This guide presents a step-by-step approach on how to fill out the form, ensuring accuracy and completeness. Let’s dive into the process to make your experience seamless and efficient.

What is the purpose of the self-declaration form?

The self-declaration form serves several essential purposes, particularly for NRIs seeking to open bank accounts. It confirms your identity and current overseas address, which is vital for account verification.

-

Importance of self-declaration for account opening: This form is mandatory when opening accounts like NRE, NRO, FCNR(B), and RFC, helping banks verify your identity.

-

Usage in NRE/NRO/FCNR(B)/RFC account applications: The form confirms your international status and obligation to comply with Indian banking laws.

-

Significance of providing accurate overseas address: An updated address is key for maintaining correspondence and documentation requirements.

What documents do need for the self-declaration form?

When preparing to fill out the self-declaration form, having all necessary documents at hand is critical. This checklist will prevent delays and ensure that your application is processed smoothly.

-

Valid identification documents: Typically, you will need a passport or any government-issued ID to establish your identity.

-

Proof of overseas address: This can be a utility bill, rental agreement, or any official correspondence that clearly displays your name and current address.

-

Additional documentation for specific account types: You may need to provide further evidence if applying for specialized accounts, like an FCNR account, to comply with specific regulations.

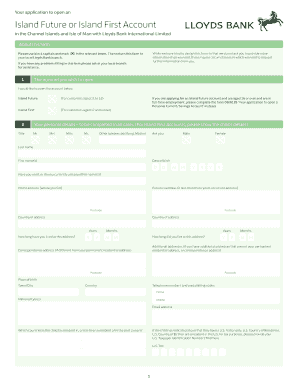

How do fill out the self-declaration form?

Filling out the form correctly is essential to avoid delays in processing. Here’s a detailed guide on what to focus on when completing the self-declaration form.

-

Filling in personal details: Include full name, date of birth, and nationality, as these are crucial for gender verification.

-

Submitting your current overseas address: Be sure to write your overseas address accurately to ensure smooth correspondence.

-

Indicating account type (NRE/NRO/FCNR(B)/RFC): Ensure you select the right account type that corresponds with your residency status.

-

Including declaration statement regarding address changes: If your address changes after submission, you must state this clearly for the bank to keep your records updated.

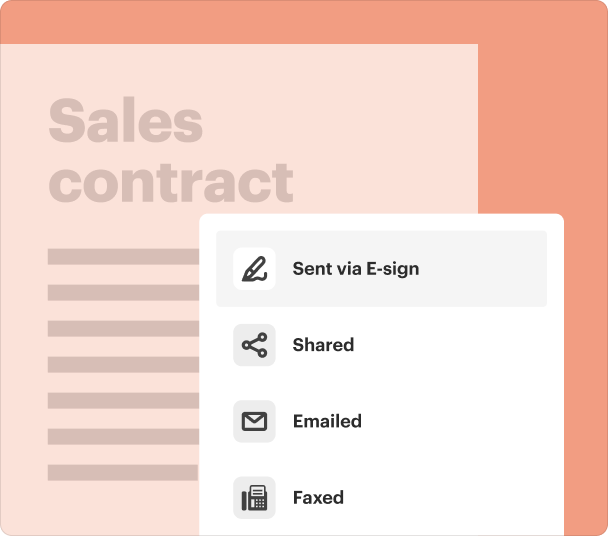

What are the interactive features of pdfFiller?

pdfFiller offers interactive capabilities that enhance your experience in completing the self-declaration form.

-

Utilizing pdfFiller’s editing tools for modifications: Easily make changes to your form without hassle.

-

eSignature capabilities for quicker approvals: Sign digitally to expedite the approval process.

-

Collaborating with team members on document submissions: Share your form with others for feedback before submission.

What mistakes should avoid when submitting the self-declaration form?

Common errors can lead to processing delays or even rejections of your application. Here’s what you should be wary of.

-

Leaving fields blank: Ensure every section is filled in completely, as any missing information can halt progress.

-

Providing outdated or incorrect address information: Double-check your address to avoid complications.

-

Failing to submit necessary supporting documents: Attach all required documents to prevent rejection.

What are the implications of an accurate declaration?

Providing accurate information on the self-declaration form is paramount for legal and functional reasons.

-

Legal responsibilities regarding false declaration: Misrepresentation can lead to legal consequences.

-

Impact on account status and banking services: An accurate form helps avoid issues with your account thereby accessing your banking services smoothly.

-

Importance of keeping your information updated: Regularly update the bank on any changes to maintain the integrity of your account.

How do submit my self-declaration form?

Choosing the right method for submission can affect how quickly your form is processed. Here are some definitive steps for best practices.

-

Best practices for submission (email, in-person, etc.): Know the preferred submission methods of your local SBI branch.

-

Ensuring successful delivery and confirmation of receipt: Always request confirmation to ensure the bank has received your document.

-

Follow-up steps post-submission for account activation: Keep a record of your submission for future reference, and check back if confirmation is delayed.

Frequently Asked Questions about current address declaration form

What happens if my address changes after submission?

If your address changes after submitting the form, it is essential to inform the bank immediately. Provide the updated address in writing to maintain accurate records.

How long does it typically take to process the form?

Processing times can vary, but generally, it takes a few working days to a couple of weeks. Always ask the bank for their estimated processing timeline.

Who can I contact if I face issues with the self-declaration form?

For assistance, reach out to the customer service of SBI directly. They can provide guidance on document submission and any other questions you may have.

Can I submit the form online?

Yes, PDF forms can typically be submitted online, depending on the branch's capabilities. Check with your local SBI bank for their online submission process.

Is there a fee associated with submitting the self-declaration form?

Most banks do not charge a fee for submitting the form, but it's best to verify with your specific branch. Always ensure all documents are complete to avoid any additional costs.

pdfFiller scores top ratings on review platforms