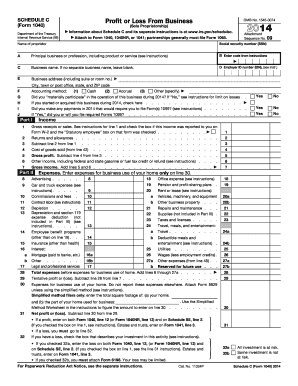

Get the free net profit or loss from irs form 1040 schedule c

Get, Create, Make and Sign schedule c example form

Editing schedule c tax form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pa schedule c instructions form

How to fill out schedule c tax form:

Who needs schedule c tax form:

Video instructions and help with filling out and completing net profit or loss from irs form 1040 schedule c

Instructions and Help about schedule c form

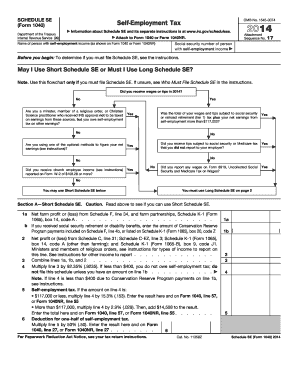

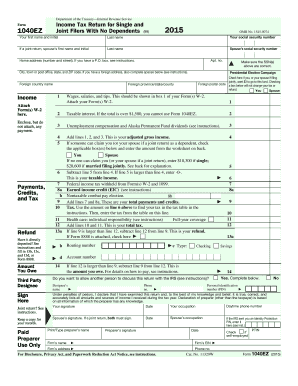

Hey guys welcome on into today's video where we're going to be filling out a schedule CEA form 1040 this is going to be the net profit from a business for a sole proprietorship now if you're not a sole proprietor, and you're a partnership or a joint venture then generally you have to fill out a form 1065 I've also made an example video of how to fill out that particular form it's a bit more complicated I'll link it down in the video description for those that are looking for that particular form example but for today's a schedule CEA form 1040 example we're going to be doing it for a business who's going to be making a YouTube video, so they're a YouTube content creator pretty topical here considering I'm going to be uploading this to YouTube but even if you're not a YouTube creator you have other form of sole proprietorship that you're running and making an income from for your business you should also be able to apply what I talked about in this video to that as well so to fill out the schedule CEA instead of the regular Schedule C you have to have had business expenses of 5000 or less use cash method of accounting instead of accrual accounting and for most of you that are just running a sole proprietorship small business particularly out of your home you're probably not going to be using accrual method of accounting just you're getting cash in and cash is going out you're not doing accounts receivable and all that other more complicated stuff depreciation all that kind of stuff so moving on here did not have an inventory at any time during the year did not have a net loss from your business had only one business as either a sole proprietor qualified a joint venture or statutory employee had no employees during the year do not deduct expenses for business use of your home so just quickly had no employees that doesn't count if you let's say you hired out contract work that doesn't count as an employee so if you hired out some extra contract work don't worry about that that doesn't count as an employee and then of course use of your home you're not deducting that than you're good to go here do not have a prior year uh walnut a severity losses from this business and are not required to file a Form 4562 for depreciation amortization for the business so if all of these apply to you, and you can check off all those boxes then you're going to be able to fill out this very simple Schedule C easy but if one of these applies to you then you're going to have to go ahead and fill out the Schedule C so working our way through here right at the top name of the proprietor that's where you're going to type your name the person whose sole proprietorship this is and then their social security number we're just going to make one up here alright moving on down here to Part A principal business or profession including product or service so like I said we're going to be doing an example here for a YouTube creator and their principal product is going to be videos...

People Also Ask about pa schedule c ez

Can I fill out my own Schedule C?

Do you fill out your own Schedule C?

What is a Schedule C tax form used for?

How do I fill out a Schedule C tax form?

How is Schedule C income taxed?

How do I report Schedule C income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form c ez without leaving Google Drive?

How do I make changes in net profit or loss?

How do I make edits in net profit or loss without leaving Chrome?

What is net profit or loss?

Who is required to file net profit or loss?

How to fill out net profit or loss?

What is the purpose of net profit or loss?

What information must be reported on net profit or loss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.