PK Tameer Bank Loan Application Form 2015-2025 free printable template

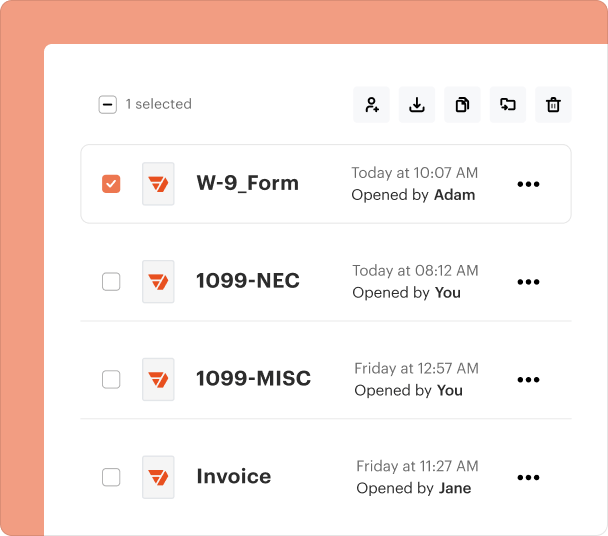

Fill out, sign, and share forms from a single PDF platform

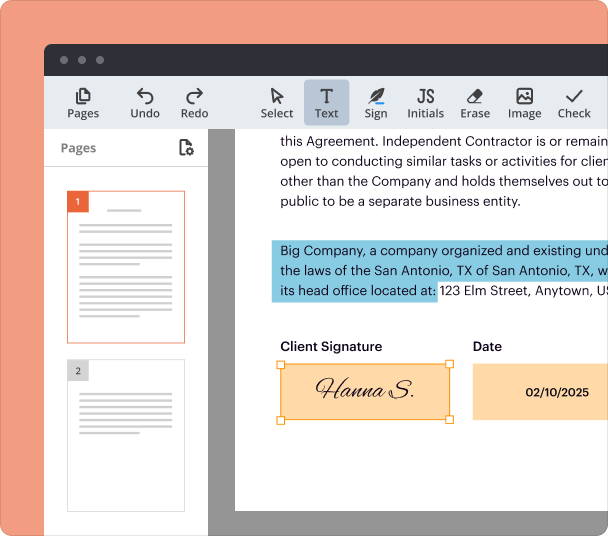

Edit and sign in one place

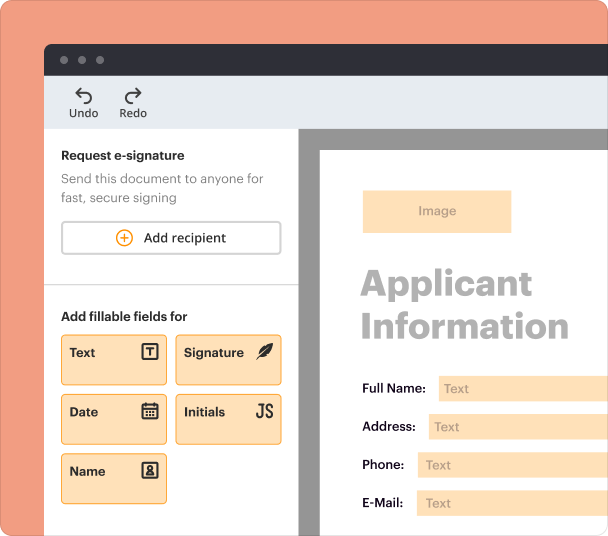

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

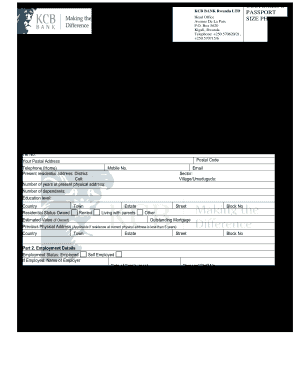

Understanding the PK Tameer Bank Loan Form

What is the PK Tameer Bank Loan Form?

The PK Tameer Bank loan form is a formal document utilized by individuals seeking financial assistance from Tameer Bank. This form collects essential data about the applicant’s personal and financial background, enabling the bank to assess their eligibility for various loan products.

Eligibility Criteria for the PK Tameer Bank Loan Form

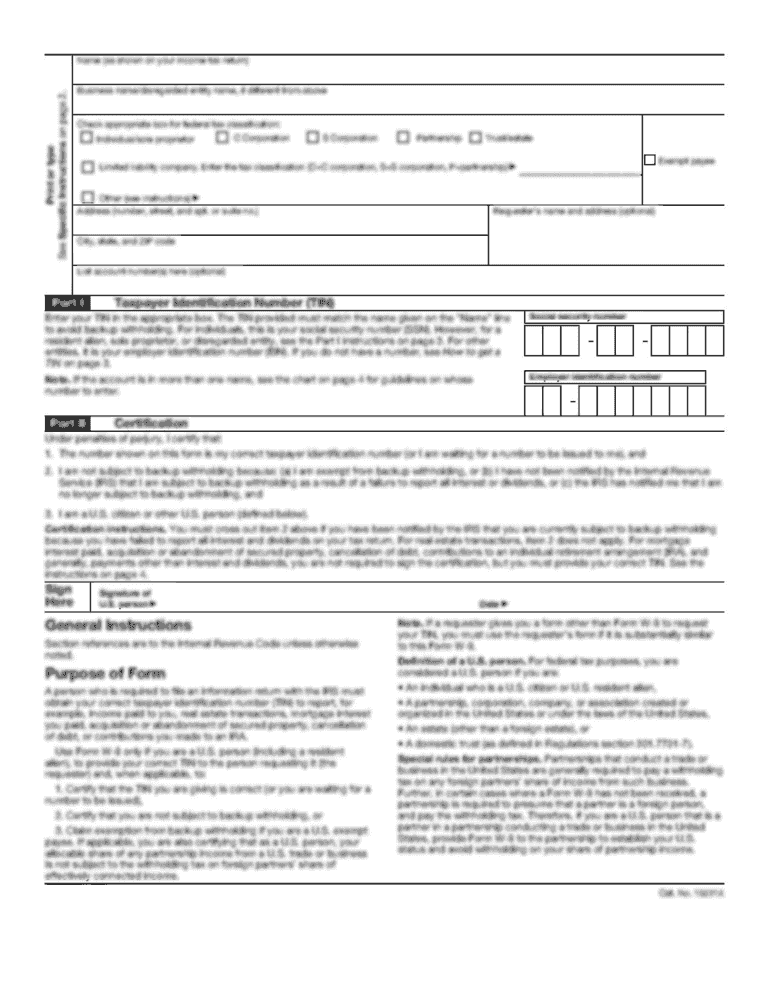

To qualify for a loan through the PK Tameer Bank, applicants must meet certain eligibility criteria. Typical requirements include being of legal age, possessing a valid government-issued identification, and demonstrating a stable source of income. Additionally, credit history may be evaluated to determine financial reliability.

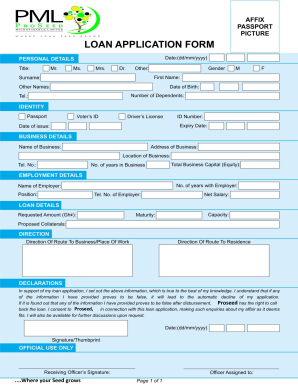

Required Documents and Information

Completing the PK Tameer Bank loan form requires several key documents. Applicants typically need to provide proof of income, such as pay stubs or tax returns, a government-issued ID, and details of any existing debts or financial obligations. This documentation supports the application process and helps the bank make informed decisions.

How to Fill the PK Tameer Bank Loan Form

Filling out the PK Tameer Bank loan form involves several steps. Applicants should start by entering their personal information accurately, followed by details regarding financial status, employment history, and loan purpose. It's essential to review the information for accuracy to avoid delays in processing.

Common Errors and Troubleshooting

Common mistakes on the PK Tameer Bank loan form include incomplete sections and inaccurate information. Applicants are advised to double-check their entries, especially in financial disclosures, to ensure all data is correct. If errors are found after submission, contacting the bank promptly can help resolve issues.

Review and Validation Checklist

Before submitting the PK Tameer Bank loan form, applicants should perform a final review. A checklist may include verifying the completeness of personal and financial information, ensuring proper documentation is included, and confirming that all signatures are present. This reduces the risk of processing delays.

Frequently Asked Questions about telenor microfinance bank loan application form

What types of loans can I apply for using the PK Tameer Bank loan form?

The form can be used to apply for various loan types, including personal loans and home financing, depending on the offerings of Tameer Bank.

How long does the loan approval process take?

The approval process can vary, but typically ranges from a few days to a couple of weeks, depending on the completeness of the application and the current workload of the bank.

pdfFiller scores top ratings on review platforms