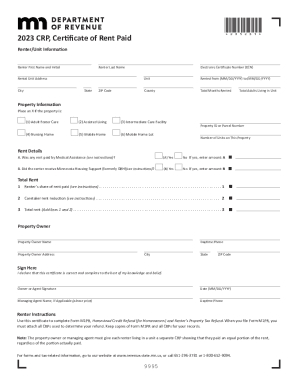

Who needs a 2015 CRP Minnesota?

All renters in Minnesota who are eligible for a property tax refund (eligibility requirements are stipulated in the certificate) can complete this form and have a certain amount of money returned. The refund amount is based on the place of living and total income of the renter. The form is completed by the landlord and given to the renter. The renter has to file it with the Department of Revenue.

What is the 2015 CRP form for?

This form is a 2015 certificate of rent paid. The Department of Revenue uses the information provided to make a decision on the tax refund. The renters use some information from this certificate to fill out the M1PR form.

Is the CRP Minnesota accompanied by other forms?

The taxpayer must file this certificate together with the completed M1PR form. If this form is not included, the refund may be delayed or denied.

When is the 2014 MN CRP due?

The landlord has to give the renter the completed certificate before the 31st of January 2016.

How do I fill out the CRP Minnesota?

The certificate contains some important information for the renter, but it has to be filled out by the landlord. If there are several roommates in the apartment, the landlord must furnish the certificate of rent paid to each of them. The following information must be provided in the form:

-

Renter’s name and address of the rented apartment

-

Property ID number or parcel number

-

Owner’s name and address

-

Number of apartments on the property

-

Lease period

-

Number of adults living in an apartment (married couples are counted as 1)

-

Information about the rent and type of the building

-

The landlord has to sign, date the certificate and write down the business phone.

Where do I send the 2015 Minnesota Form CRP?

The renter sends the completed certificate together with the M1PR form to the Minnesota Department of Revenue.