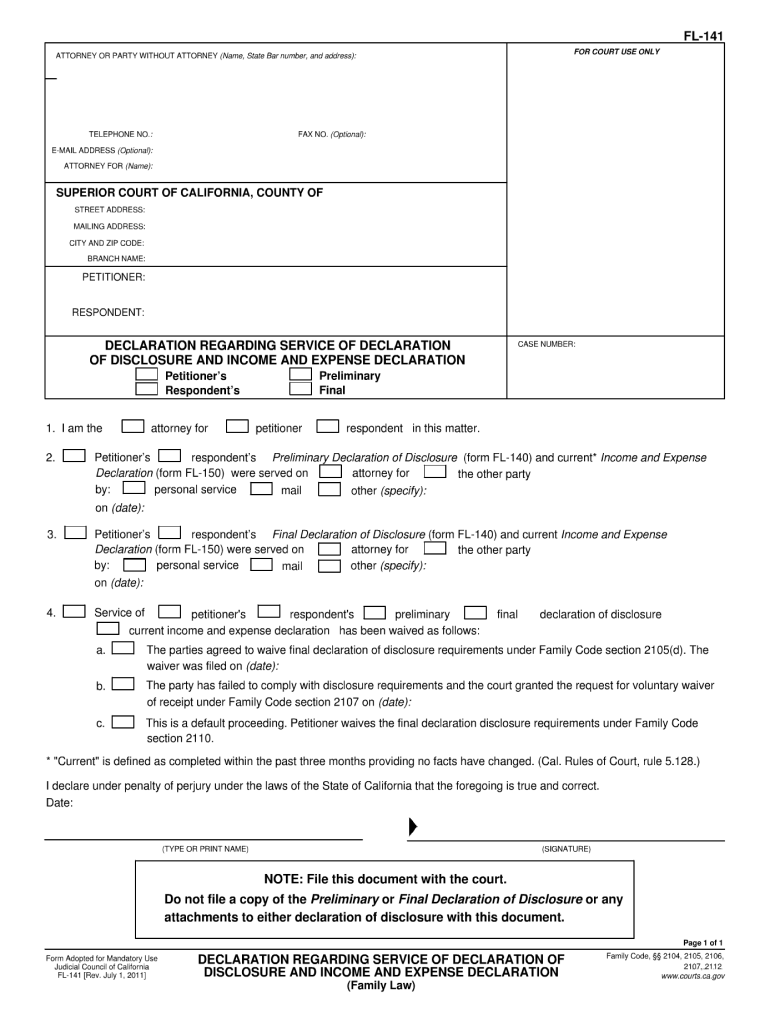

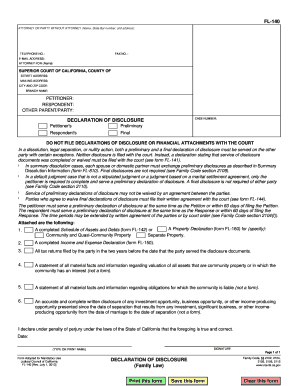

Who needs a Form Fl 141?

Form FL 141, Declaration Regarding Service of Declaration of Disclosure and Income and Expense Declaration, should be filed by both sides with the Californian court that is handling the particular divorce case. The Form is filed in order to certify that the original Preliminary Declaration of Disclosure (FL-140) and Income and Expense Declaration (FL-150) forms were served and to whom.

What is the Form Fl 141 for?

This form is a final part of the financial disclosure process which is mandatory for the usual divorce suitcase. By filing this form, a party to a divorce case can certify the following conclusions:

-

That the parties reach the agreement on waiving the final declaration of disclosure requirements;

-

Or, the party has failed to comply with disclosure requirements and the court gives ?the parties an option of voluntary waiver of receipt;

-

Or, this is a default proceeding where the petitioner waives the final declaration disclosure requirements.

Is Form Fl 141 accompanied by other forms?

There is no need to accompany this particular form with either the Declaration of Disclosure (FL-140) or Income and Expense Declaration (FL-150). This form serves as is and should be filed as separate document.

How do I fill out Form Fl 141?

The following information must be indicated in order to complete the form correctly:

-

Petitioner’s and respondent's personal information;

-

Indication of the type of the declaration;

-

Indication of the parties on which the original form FL-140 and FL-150 were served;

-

Indication of the final agreements between the parties to the current divorce case.

Once completed, this form must be signed and dated.

Where do I send Form Fl 141?

Once completed and signed this form must be filed with the court where the hearings on the case takes place.