Schedule C / Form 2106 Worksheet - Universal 2009-2025 free printable template

Show details

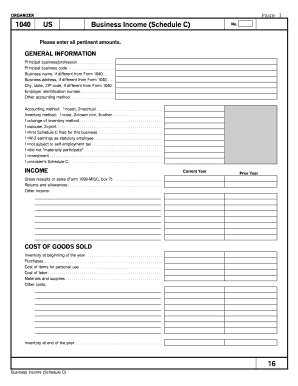

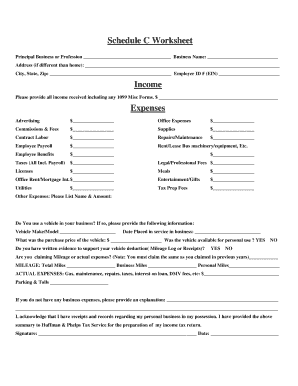

Schedule C / Form 2106 Worksheet Universal Name Social Security # Tax Year Total Income Attributed To 1099 W2 Total Expense INCOME Attributed To W2 1099 COST OF GOODS SOLD Materials that went directly

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign schedule c expenses worksheet pdf form

Edit your schedule c expenses worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule c worksheet pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule c expenses list online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit printable schedule c worksheet form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule c pdf form

How to fill out Schedule C / Form 2106 Worksheet

01

Collect all necessary documentation, including income statements and expense receipts.

02

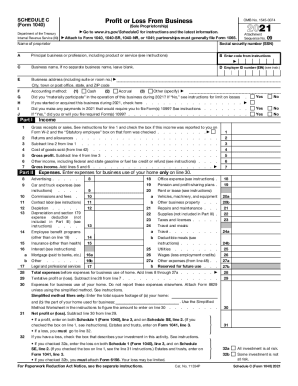

Download or obtain a copy of Schedule C (Form 1040) and the Form 2106 Worksheet.

03

Fill in your personal information, including your name and taxpayer identification number.

04

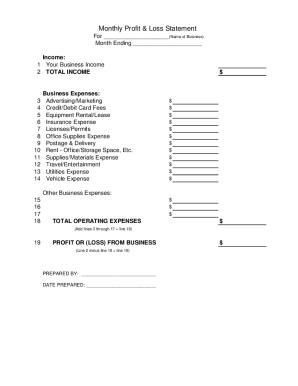

Report your business income on Line 1 of Schedule C.

05

List your business expenses in the corresponding categories on Schedule C, such as supplies, utilities, and rent.

06

Calculate total expenses and subtract from total income to determine net income.

07

For Form 2106, detail your employee business expenses, including travel, meals, and lodging.

08

Ensure that all expenses are categorized correctly on the Form 2106 Worksheet.

09

Review all entries for accuracy before submission.

10

Keep copies of all forms and supporting documents for your records.

Who needs Schedule C / Form 2106 Worksheet?

01

Self-employed individuals who report business income.

02

Individuals who are independent contractors.

03

Business owners who file their taxes using Schedule C.

04

Employees who incur business-related expenses and want to claim deductions.

Fill

schedule c organizer

: Try Risk Free

People Also Ask about sample samples of schedule c deductions checklist

What is home office expense Schedule C?

Self-employed people can generally deduct office expenses on Schedule C (Form 1040) (opens in new tab) whether they work from home or not. This write-off covers office supplies, postage, computers, printers, and all the other ordinary and necessary things that you need to run a home office.

What is form Schedule C for?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

What is a Schedule C expense form?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

Does a Schedule C require a balance sheet?

Information needed for Schedule C To complete your Schedule C, you need the following: Profit and loss statement. Balance sheet for the tax year.

How do I fill out a Schedule C worksheet?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

What is Schedule C Form 8829?

Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C (Form 1040) and any carryover to next year of amounts not deductible this year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule c fillable form in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your schedule c deductions and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I edit schedule c business expenses on an iOS device?

Create, edit, and share schedule c expenses categories from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out schedule c expenses on an Android device?

Use the pdfFiller mobile app and complete your printable schedule c expenses worksheet and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Schedule C / Form 2106 Worksheet?

Schedule C is a form used to report income or loss from a business that is operated as a sole proprietorship. Form 2106 Worksheet is used to calculate employee business expenses, allowing employees who incur expenses related to their job to deduct those expenses from their income.

Who is required to file Schedule C / Form 2106 Worksheet?

Individuals who are self-employed or operate a sole proprietorship must file Schedule C. Employees who incur unreimbursed business expenses related to their job and wish to deduct them are required to file Form 2106 Worksheet.

How to fill out Schedule C / Form 2106 Worksheet?

To fill out Schedule C, individuals must provide details of their business income, cost of goods sold, and business expenses. Form 2106 Worksheet requires listing all unreimbursed expenses, categorizing them, and providing totals that can be deducted.

What is the purpose of Schedule C / Form 2106 Worksheet?

The purpose of Schedule C is to report profit or loss from a business for tax purposes. The purpose of Form 2106 is to allow employees to deduct qualifying business expenses that were not reimbursed by their employer.

What information must be reported on Schedule C / Form 2106 Worksheet?

Schedule C requires reporting business income, cost of goods sold, various business expenses (e.g., advertising, car and truck expenses, depreciation), and net profit or loss. Form 2106 requires details of unreimbursed employee expenses, including vehicle expenses, travel expenses, and other job-related costs.

Fill out your Schedule C Form 2106 Worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Schedule C is not the form you're looking for?Search for another form here.

Keywords relevant to schedule c template

Related to schedule c business expenses list

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.