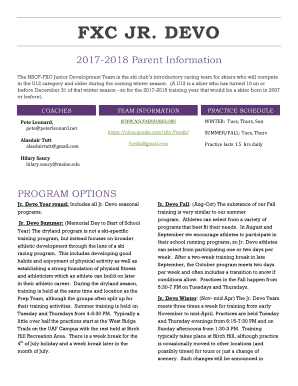

Get the free BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE

Show details

This document is a certificate for buyers to certify their entitlement to exempt purchases, detailing reasons for exemption and applicable items.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign buyers retail sales tax

Edit your buyers retail sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your buyers retail sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit buyers retail sales tax online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit buyers retail sales tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out buyers retail sales tax

How to fill out BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE

01

Obtain the Buyers’ Retail Sales Tax Exemption Certificate form from your state's revenue department website or office.

02

Fill in your business name and address in the designated fields.

03

Provide your sales tax identification number (if applicable).

04

Indicate the reason for the exemption (e.g., reselling the merchandise, being a nonprofit organization).

05

List the items being purchased tax-exempt or provide a description of the general nature of the purchases.

06

Sign and date the certificate, confirming that the information provided is accurate.

Who needs BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE?

01

Businesses engaged in resale of goods or services.

02

Nonprofit organizations purchasing items for their charitable activities.

03

Certain government entities making purchases for official use.

Fill

form

: Try Risk Free

People Also Ask about

What is a sales tax exemption certificate in California?

Generally, purchasers may use an exemption certificate if: they intend to resell the property or service; they intend to use the property or service for a purpose that is exempt from sales tax; or. they act as an agent or employee of a tax-exempt nonprofit organization or government entity.

How to get a sales tax exemption certificate?

Generally, to obtain a sales tax exemption certificate, an exempt institution must first have a valid sales tax account. That account number is put on a form certificate issued by that state and the certificate can be used to purchase goods tax-free.

Can a business refuse a tax-exempt certificate?

Businesses do not have to honor the tax exempt status. It adds paperwork for the vendor and they may not want to deal with it.

Do businesses have to honor tax-exempt reddit?

Businesses do not have to honor the tax exempt status. It adds paperwork for the vendor and they may not want to deal with it. Source: I had a brick and mortar store and researched if I had to accept them. I didn't.

Who determines an organization's tax-exempt status?

A first important distinction to make is that granting nonprofit status is done by the state, while applying for tax-exempt designation (such as 501(c)(3), the charitable tax-exemption) is granted by the federal government in the form of the IRS.

Do businesses have to accept tax-exempt?

The purchaser – not the retailer/business – has the responsibility for determining whether or not a sale is exempt from tax. If the purchaser does not submit a valid tax exemption certificate to the business, the business has the responsibility to assess and collect the sales tax from the purchaser.

Is it illegal to deny tax-exempt?

It's illegal and unconstitutional for the IRS to revoke the tax-exempt status of organizations like schools, hospitals, or churches for politically motivated reasons.

Where to get a tax exemption certificate in the US?

Tax exemption cards are printed by the U.S. Government Printing Office at its facility in Washington and mailed via the U.S. Postal Service to the cardholder's residential address.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE?

The Buyers’ Retail Sales Tax Exemption Certificate is a document that allows qualifying buyers to make purchases without paying retail sales tax, as they are purchasing items for resale or for use in their exempt activities.

Who is required to file BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE?

Buyers who are engaged in business activities that qualify for sales tax exemption, such as resellers and certain non-profit organizations, are required to file the Buyers’ Retail Sales Tax Exemption Certificate.

How to fill out BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE?

To fill out the certificate, the buyer must provide their legal name, address, the type of business, and the reason for the exemption, along with their sales tax identification number and signature.

What is the purpose of BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE?

The purpose of the Buyers’ Retail Sales Tax Exemption Certificate is to enable qualifying buyers to avoid paying sales tax on purchases that are intended for resale or for use in exempt activities, thus reducing their overall costs.

What information must be reported on BUYERS’ RETAIL SALES TAX EXEMPTION CERTIFICATE?

The information that must be reported includes the buyer's name and address, the seller's name, the reason for exemption, the buyer's sales tax identification number, and any additional required details specific to the jurisdiction.

Fill out your buyers retail sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Buyers Retail Sales Tax is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.