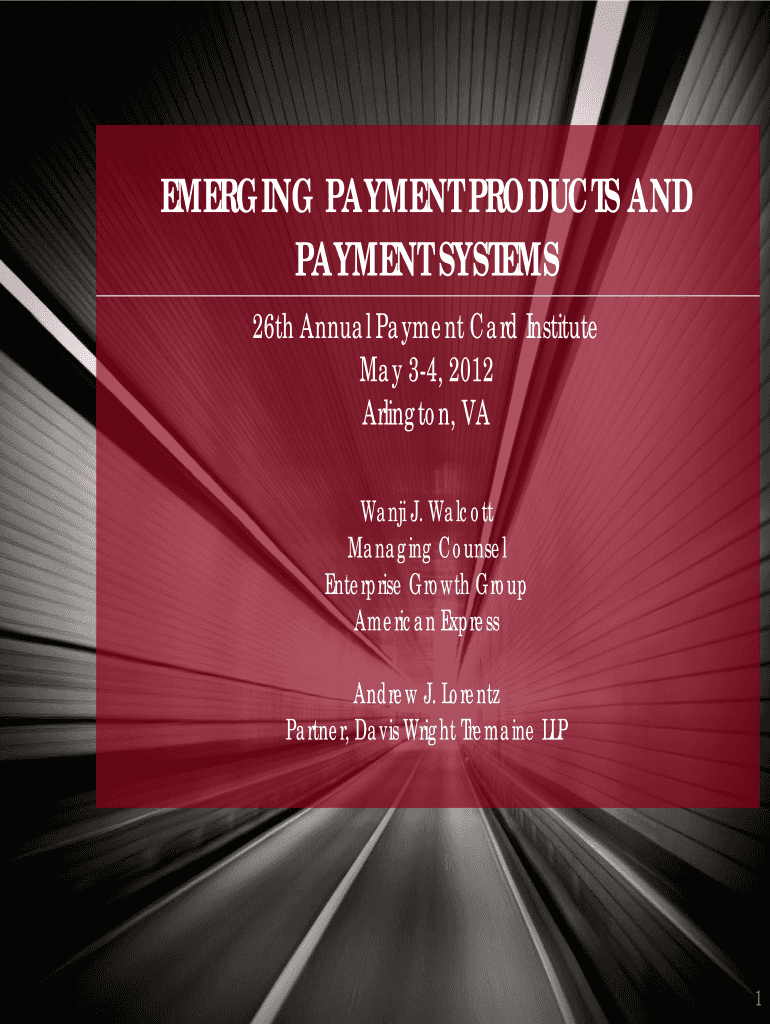

Get the free Emerging Payment Products and Payment Systems

Show details

This document outlines the agenda and discussions related to mobile payments and emerging payment systems, focusing on technologies like NFC and Cloud, as well as new entrants in the payment market.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign emerging payment products and

Edit your emerging payment products and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your emerging payment products and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit emerging payment products and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit emerging payment products and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out emerging payment products and

How to fill out Emerging Payment Products and Payment Systems

01

Identify the purpose of the Emerging Payment Products and Payment Systems form.

02

Gather necessary business information including company name, address, and contact details.

03

Detail the types of payment products and systems you are interested in.

04

Provide a description of how these products and systems will be integrated into your business.

05

Specify your target market and demographic insights.

06

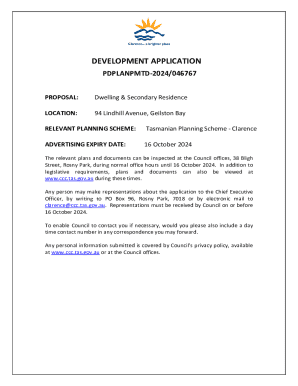

Include any relevant regulatory or compliance information.

07

Review the completed form for clarity and accuracy.

08

Submit the form to the appropriate department or authority.

Who needs Emerging Payment Products and Payment Systems?

01

Businesses looking to innovate their payment solutions.

02

Merchants who want to offer modern payment options to customers.

03

Financial institutions aiming to enhance their service offerings.

04

Startups developing new payment technologies.

05

E-commerce platforms requiring advanced payment systems.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 types of electronic payment systems?

Electronic Payment Systems, or EPS, are swift, hassle-free, and secure methods for monetary transactions. They are the digital alternatives to cash and cheques. They come in different forms, like credit and debit cards, bank transfers, and digital wallets. Newer forms include mobile payments and cryptocurrencies.

What are NextGen payments?

The next-generation payment method refers to innovative technologies like contactless payments, mobile wallets, blockchain, biometrics, and tokenization.

Which of the following are examples of emerging payments?

These five forces — contactless payments, BNPL, crypto, digital wallets, and open banking — have dominated headlines in recent years, and for good reason. These emerging payments trends are driving the future of the financial industry.

What are the three types of payments?

Traditionally, cash, debit cards, credit cards, and checks were the main types of payments. Now, more advanced forms of digital payments are becoming more popular. This includes online payment services, digital currencies, and electronic transfers.

What are the new trends in the payment industry?

Key trends like blockchain, mobile payments, cashless solutions, and AI-driven fraud detection are reshaping the future of payment processing. As innovation accelerates and competition intensifies, businesses must adapt quickly to meet evolving consumer demands or risk falling behind.

What do upcoming payments mean?

Upcoming payment is a unique feature available to users that displays the list of payments initiated by the user that are awaiting processing either on the same day or on a future date.

What is the new payment system?

Fed innovations continue to this day. In 2023, the Federal Reserve launched an instant payment service called FedNow® to help make everyday payments fast and convenient for American households and businesses.

What are emerging payments?

A device-free, cardless, cashless payment for retail and eCommerce using the most advanced facial recognition technology. Offers a single integration and orchestration solution that connects merchants directly to digital wallets, buy now, pay later and other alternative payment methods globally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Emerging Payment Products and Payment Systems?

Emerging Payment Products and Payment Systems refer to innovative financial technologies and services that facilitate transactions and payments, often utilizing digital platforms or alternative currency mechanisms to improve efficiency, security, and user experience.

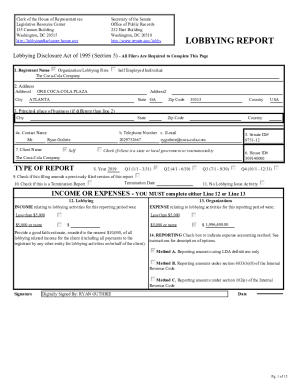

Who is required to file Emerging Payment Products and Payment Systems?

Entities involved in the development, operation, or offering of emerging payment products and systems, such as fintech companies, banks, and payment service providers, are typically required to file relevant reports with regulatory authorities.

How to fill out Emerging Payment Products and Payment Systems?

To fill out Emerging Payment Products and Payment Systems, entities must gather necessary data, adhere to the specific guidelines provided by regulatory bodies, and accurately complete forms that detail their products, services, operational methodologies, and compliance measures.

What is the purpose of Emerging Payment Products and Payment Systems?

The purpose of Emerging Payment Products and Payment Systems is to enhance transaction accessibility, security, and efficiency, while promoting innovation in financial services and providing consumers with versatile payment options.

What information must be reported on Emerging Payment Products and Payment Systems?

Information that must be reported includes details about product offerings, transaction methods, security protocols, user demographics, compliance measures, and potential risks associated with the usage of these payment systems.

Fill out your emerging payment products and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Emerging Payment Products And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.