Get the free APPLICATION FOR TAX SEGREGATION - sccounty01 co santa-cruz ca

Show details

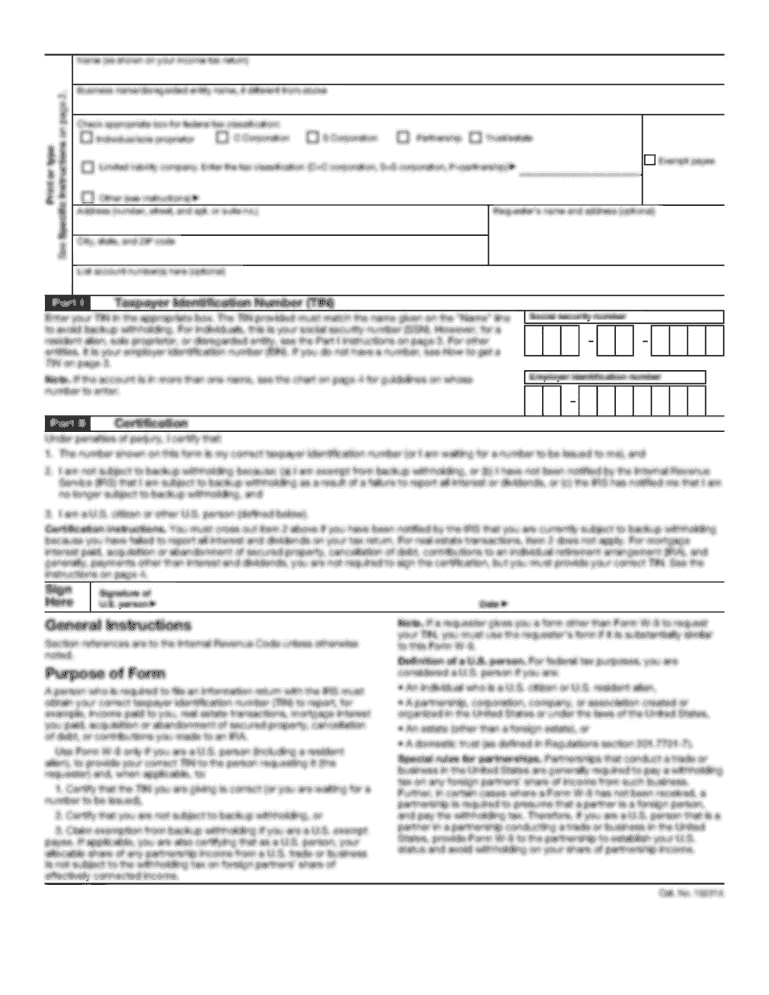

This application form is used for requesting the segregation of property for tax purposes within Santa Cruz County. It requires the applicant to provide information about the property, including parcel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for tax segregation

Edit your application for tax segregation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for tax segregation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for tax segregation online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for tax segregation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for tax segregation

How to fill out APPLICATION FOR TAX SEGREGATION

01

Obtain the APPLICATION FOR TAX SEGREGATION form from your local tax authority or their website.

02

Read the instructions carefully to understand all requirements.

03

Fill out your personal information, including your name, address, and tax identification number.

04

Provide details about the property for which you are seeking tax segregation, including parcel number and location.

05

Indicate the reason for the tax segregation request, such as a change in property use or ownership.

06

Attach any required supporting documents, such as property deeds or previous tax statements.

07

Review the entire application for completeness and accuracy.

08

Submit the application form to the appropriate local tax authority by the specified deadline.

Who needs APPLICATION FOR TAX SEGREGATION?

01

Individuals or property owners seeking to separate their property for tax purposes.

02

Businesses that want to optimize their tax liabilities through property segregation.

03

Investors involved in real estate transactions that require clarification of tax assessment on multiple parcels.

Fill

form

: Try Risk Free

People Also Ask about

How does cost segregation reduce taxes?

Simply, cost segregation is a tax deferral strategy that identifies assets within a building that can be depreciated over a shorter period than the 39-year standard method. It can identify substantial tax-saving opportunities for taxpayers who have constructed, purchased, or renovated a facility.

Can you amend a tax return for cost segregation?

Luckily, no amended returns are necessary to reclassify property after a cost segregation study. In fact, the IRS specifies that taxpayers may not implement changes in accounting method by amending prior returns. Instead, the Form 3115 is used.

How far back can you do a cost segregation study?

The Internal Revenue Service (IRS) gives property owners a generous 10-year window to file cost segregation studies and amend previous tax returns. This means you can potentially claim accelerated depreciation benefits that you missed out on in the past.

How do I enter cost segregation on my tax return?

The tax benefits of cost segregation may be claimed as a depreciation expense on Tax Form 4562 for current-year studies, or through the use of a Form 3115 for look-back studies. Your cost segregation consultant will work with you and your tax provider to make sure all benefits are claimed properly.

Who qualifies for cost segregation?

Benefits from cost segregation studies can be claimed when a taxpayer has constructed a new building and is holding the property as a rental or if they have purchased an existing property, even if the purchase of the existing property was in a prior year.

What is the form 3115 application for change in accounting method?

Form 3115, Application for Change in Accounting Method, is an application to the IRS to change either an entity's overall accounting method or the accounting treatment of any item.

How far back can you do a cost segregation study?

The Internal Revenue Service (IRS) gives property owners a generous 10-year window to file cost segregation studies and amend previous tax returns. This means you can potentially claim accelerated depreciation benefits that you missed out on in the past.

How to apply cost segregation on tax return?

The tax benefits of cost segregation may be claimed as a depreciation expense on Tax Form 4562 for current-year studies, or through the use of a Form 3115 for look-back studies. Your cost segregation consultant will work with you and your tax provider to make sure all benefits are claimed properly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR TAX SEGREGATION?

APPLICATION FOR TAX SEGREGATION is a formal request submitted to the relevant tax authority for the classification or separation of properties for taxation purposes, allowing different tax rates or exemptions to be applied.

Who is required to file APPLICATION FOR TAX SEGREGATION?

Property owners or individuals who wish to have their properties classified under different tax categories or seek exemptions are typically required to file the APPLICATION FOR TAX SEGREGATION.

How to fill out APPLICATION FOR TAX SEGREGATION?

To fill out the APPLICATION FOR TAX SEGREGATION, one must provide accurate property information, including ownership details, property type, and any applicable supporting documentation, and ensure compliance with the specific format required by the local tax authority.

What is the purpose of APPLICATION FOR TAX SEGREGATION?

The purpose of APPLICATION FOR TAX SEGREGATION is to ensure that properties are assessed and taxed appropriately based on their specific characteristics and potential exemptions, aiming to promote fair taxation.

What information must be reported on APPLICATION FOR TAX SEGREGATION?

The APPLICATION FOR TAX SEGREGATION typically requires information such as the property's legal description, owner's identity, assessment details, proposed classification, and any relevant tax exemptions or special assessments.

Fill out your application for tax segregation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Tax Segregation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.