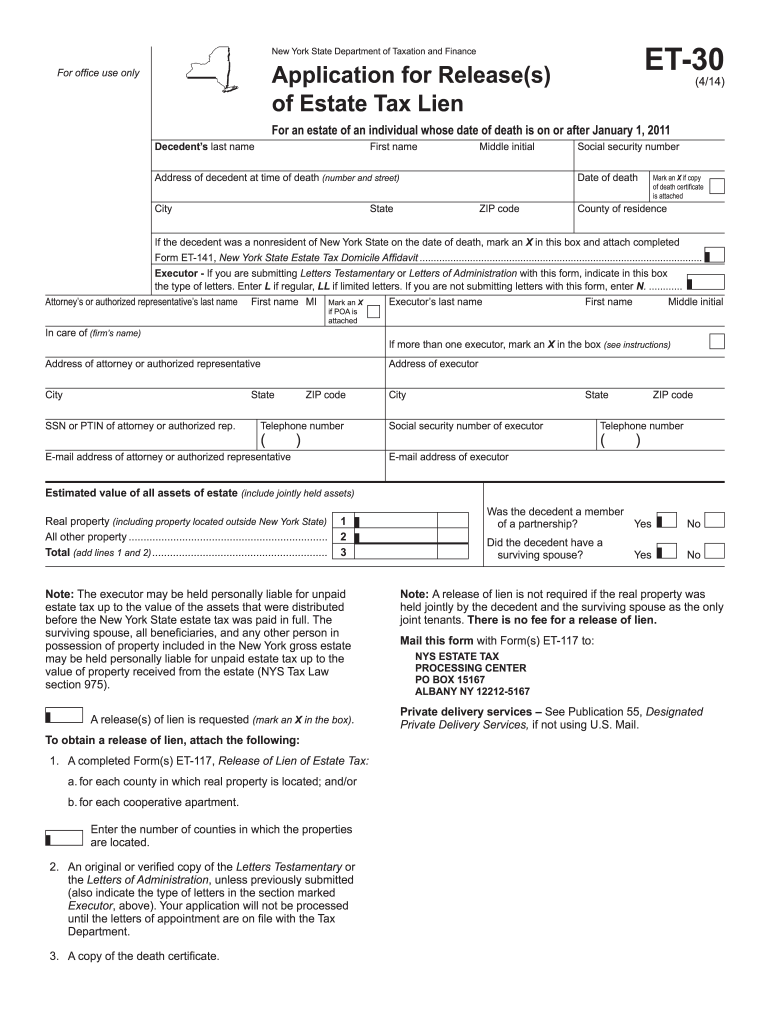

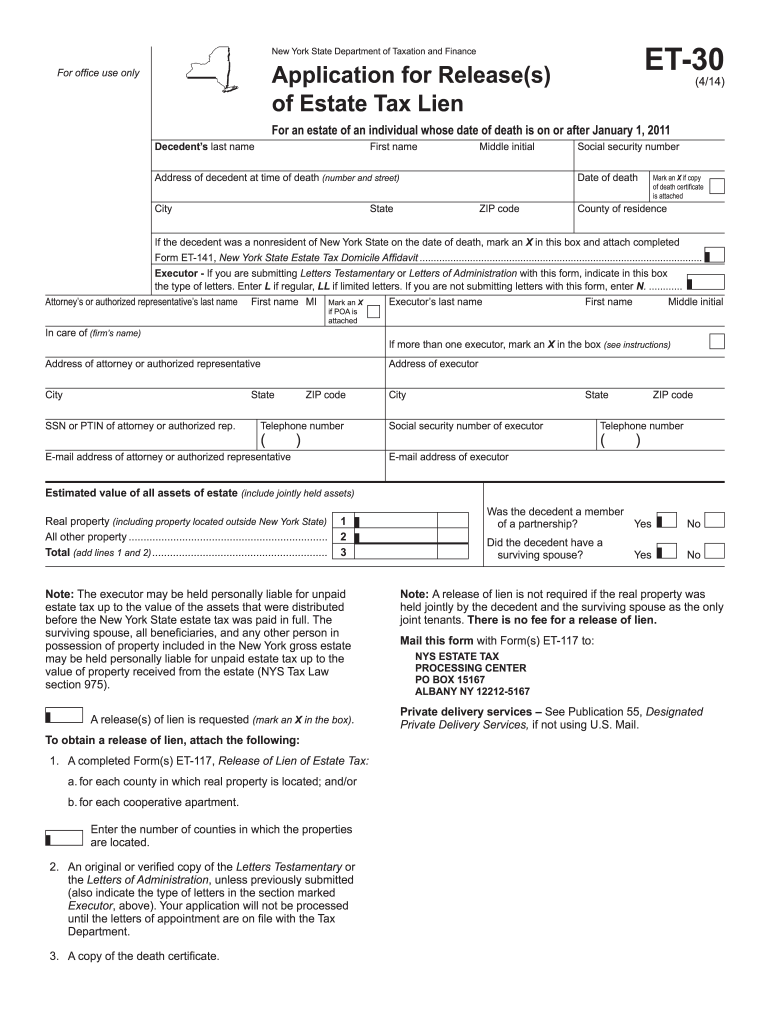

Get the free form et 30

Get, Create, Make and Sign et 30 form

How to edit et 30 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out et 30 fillable form

How to fill out et 30?

Who needs et 30?

Video instructions and help with filling out and completing form et 30

Instructions and Help about et 30 fillable

Hey guys this is Alan with the growing Network welcome today I've got something special lined up for you guys and that's we're going to dry-aged this Way New York strip loin that I procured from broadleaf my friend chef Jacob Burton at Stella culinary has a YouTube channel, and he will be discussing how and why to dry-aged your steaks, and I'll point a link to his website and YouTube channel below so let's go ahead and unpack this guy and get to the dry aging process okay let's go ahead and take a sharp knife I'm using a boning knife roll break the crystal I have several videos on YouTube already that how to dry-aged I typically will use the dry bag steak to my bags, and they work out spectacular, and so we're going to go ahead and do that for this dry aging process as well chef Jacob Burton is going to be using an own method and Lee's discussing that on his video so make sure you check that out now as with most things there's more than one way to skin a cat this looks phenomenal, so we're going to go ahead and Pat this dry, and we'll get to the next step okay I finish patting my Way New York strip loin dry with paper towels just so you guys know this isn't an Australian Way it's got a marbled rating of a five which is quite spectacular, and it's going to make it an awesome add to the dry aging process so typically what I would do during a normal trimming process would be to trim off some of this connective tissue on the back but during the dry aging process you would typically lose 10 to 15% so, and then you would trim at that time so let's go ahead and say that trimming once we finish dry aging, but we're going to go ahead and trim this up a little pay for the trimming there is a chain on this side right here, so we want to go ahead and remove that and this chain has got a lot of gristle and unused usable fat that we don't need this also helps square off your steaks this is where a sharp knife comes in handy so there you go this can be used for making sausages and whatnot, so we'll save this okay we've got bags from Umayyad Ryan stake these are special bags that we're going to use for this dry aging process these aren't your typical food saver bags where food sealer bags will typically not allow air in or out whereas the bags from Mai allow your meat to breathe allows the evaporation of moisture but does not allow bacteria to form on your meat so let's go ahead and place our meat inside the bag so what you want to do is get a good two inches lip on there so when we dry, and we seal it is doesn't have any moisture on it just place the meat inside like so and what's going to want to do is just work it to a corner of the bag, and we'll go in to place this inside our chamber sealer I have a chamber vacuum sealer you can use any Food Saver vacuum sealer and that's out there that will just evacuate the air okay I use my dry bag steak from my and vacuum sealed my New York strip loin we'll go ahead and place this in the refrigerator for 28 days that's...

People Also Ask about

How do I contact NYS tax department?

What is et85?

How much are estate taxes in NY?

How do I avoid estate tax in NY?

How much can you inherit without paying taxes in 2022?

How much is the estate tax in New York?

Who can I call about my NY state tax refund?

What is the due date for an estate tax return?

What is the New York State estate tax exemption for 2022?

Do you have to pay taxes on inheritance in New York?

How do I speak to someone at NYS tax?

What is the NY state estate tax exemption?

How much can you inherit tax-free in NY?

How much is NY state estate tax?

How much inheritance is tax free in New York State?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form et 30 without leaving Google Drive?

Can I edit form et 30 on an iOS device?

How do I complete form et 30 on an iOS device?

What is form et 30?

Who is required to file form et 30?

How to fill out form et 30?

What is the purpose of form et 30?

What information must be reported on form et 30?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.