PA MV-13ST 2019-2026 free printable template

Show details

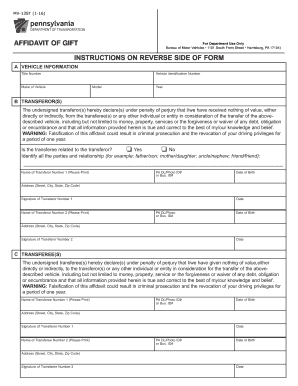

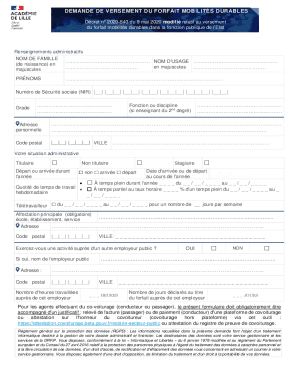

MV-13ST 1-19 AFFIDAVIT OF GIFT www. dmv.pa.gov For Department Use Only Bureau of Motor Vehicles 1101 South Front Street Harrisburg PA 17104 INSTRUCTIONS ON REVERSE SIDE OF FORM A VEHICLE INFORMATION Title Number Make of Vehicle Vehicle Identification Number Model Year B TRANSFEROR S The undersigned transferor s hereby declare s under penalty of perjury that I/we have received nothing of value either directly or indirectly from the transferee s or any other individual or entity in...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign penndot gift affidavit form

Edit your pdffiller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your penndot form mv 13st form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mv13st online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form mv 13st. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA MV-13ST Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mv 13 form

How to fill out PA MV-13ST

01

Obtain the PA MV-13ST form from the Pennsylvania Department of Transportation (PennDOT) website or your local PennDOT office.

02

Provide your personal information in the designated fields, including your full name, address, and phone number.

03

Indicate the type of service you are requesting by selecting the appropriate option.

04

Fill in the vehicle information, including the make, model, year, and VIN (Vehicle Identification Number).

05

If applicable, provide information regarding the previous title, registration, or transfer details.

06

Review the form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the completed form either online, by mail, or in person at a local PennDOT office as instructed.

Who needs PA MV-13ST?

01

Anyone who is applying for a title or registration for a vehicle in Pennsylvania needs to complete the PA MV-13ST form.

02

Individuals transferring ownership of a vehicle also need to fill out the PA MV-13ST form.

Fill

mv 13st affidavit of gift

: Try Risk Free

People Also Ask about affidavit of gift form mv 13st

How much is a ticket for no registration in Texas?

Search Harris County Common Moving ViolationsTotal Fine and CostNo Texas Driver's License$155.00Violation of Driver's License Restriction$100.00Expired Inspection Certificate**$105.00Expired Vehicle Registration (Non Commercial)*$75.0015 more rows

What is PA Department of Revenue vehicle tax?

Pennsylvania sales tax is 6% of the purchase price or the current market value of the vehicle (7% for residents of Allegheny County and 8% for City of Philadelphia residents).

What is the MV 4st used for in PA?

This form is used to obtain a Pennsylvania Certificate of Title for vehicles currently titled in Pennsylvania.

Do I have to pay tax on a gifted car in PA?

Vehicles received as gifts are not subject to sales tax. However, the recipient of the gift must show that either the purchaser paid sales tax on the vehicle at the time of purchase or he/she paid use tax on the current fair market value of the vehicle in order to register the vehicle in Pennsylvania.

Do you have to pay taxes on a gifted car in PA?

Vehicles received as gifts are not subject to sales tax. However, the recipient of the gift must show that either the purchaser paid sales tax on the vehicle at the time of purchase or he/she paid use tax on the current fair market value of the vehicle in order to register the vehicle in Pennsylvania.

Do both parties have to be present to transfer a title in PA?

❒ Both owner and all co-owners must be present for signature and notarization purposes. ❒ Form MV-1 completed in full by an authorized PennDOT agent.

Do both parties have to be present to transfer a car title in PA?

❒ Both owner and all co-owners must be present for signature and notarization purposes. ❒ Form MV-1 completed in full by an authorized PennDOT agent.

What is MV 1 used for in PA?

A Pennsylvania Certificate of Title will only be issued when the out-of-state title is submitted with the completed Form MV-1, "Application for Certificate of Title." Likewise, a temporary Pennsylvania registration plate may only be issued when the out-of-state title is submitted with the application for Pennsylvania

How much is the penalty for late registration of vehicle in Texas?

A vehicle may be operated for up to five working days after the registration expires without penalty. After those five days, you can receive a citation of up to $200.

What is the Pennsylvania MV 41 form?

Application for State Replacement Vehicle Identification Number Plate/Decal - Complete Sections A, C (MUST be completed by a Police Officer) and F. Correction of Body Type, Number of Axles, or Other Corrections to the Vehicle Title or Registration Data - Complete Sections A, D and F.

What happens if you don't register your car for a year in Texas?

Generally speaking, the fine for having an expired vehicle registration (on a non-commercial vehicle) in Texas is only going to cost you around $75 before any applicable court costs or surcharges.

What happens if you drive without registration in Texas?

A citation for “Expired Registration” can be expensive and time-consuming. If you're convicted, the fine can be as much as $200 plus court costs. Texas registered vehicles are required to receive an annual inspection which includes a comprehensive safety inspection to ensure basic road worthiness.

How do I transfer a car title as a gift in PA?

A copy of your current insurance identification card (PDF) is required if registration is to be issued. If the vehicle is being given as a gift, the Form MV-13ST (PDF), “Affidavit of Gift” must be attached to the title application.

How do I gift a car to a family member in PA?

A copy of your current insurance identification card (PDF) is required if registration is to be issued. If the vehicle is being given as a gift, the Form MV-13ST (PDF), “Affidavit of Gift” must be attached to the title application.

Do both parties have to be present to get a title notarized in PA?

Need not be present BUT if the Title requires a Notarized signature Please make sure it is completed.

What is the penalty for not registering a vehicle in Texas?

You have 30 calendar days from the date the seller signed the vehicle over to you to apply for title and registration at the tax office. If you miss the deadline, Texas requires that you pay a financial penalty that can reach up to $250.

Can you gift a vehicle to a family member in PA?

In the state of Pennsylvania, you can gift a vehicle to a family member, as long as you have the proper documentation. If you received a vehicle as a gift, or the vehicle is being transferred from a family member, you must complete a vehicle title transfer at your local PA DOT office.

How much does it cost to transfer a car title in PA as a gift?

ing to PennDot, it costs $58 to do a Pennsylvania title transfer. The fee is the same whether getting an original title, duplicate title, or at a registered dealer. If there's a lien on the vehicle, the cost will be $86.

How do I fill out a certificate of title in PA?

0:19 1:26 How to Sign & Transfer a Pennsylvania Car Title - YouTube YouTube Start of suggested clip End of suggested clip So. If you look up here at the top. This is where you're going to put your purchasers. Name that'sMoreSo. If you look up here at the top. This is where you're going to put your purchasers. Name that's us advanced B marketing services that's what you're gonna write right there.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mv 13st form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including pa mv 13st, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute mv 13st form pa online?

Easy online mv13 form pa completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit form mv 13st affidavit of gift on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share gift affidavit pa from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is PA MV-13ST?

PA MV-13ST is a form used in Pennsylvania for the reporting of a vehicle's sales tax exemption. It is typically related to vehicles that are being titled or registered without the payment of sales tax under certain conditions.

Who is required to file PA MV-13ST?

Individuals and organizations that are applying for a sales tax exemption when titling or registering a vehicle in Pennsylvania are required to file PA MV-13ST.

How to fill out PA MV-13ST?

To fill out PA MV-13ST, you need to complete the required sections on the form, which may include details such as the vehicle information, the owner's information, and the reason for tax exemption. It is advisable to follow the instructions provided with the form carefully.

What is the purpose of PA MV-13ST?

The purpose of PA MV-13ST is to provide a formal declaration of eligibility for a sales tax exemption when registering or titling a vehicle in Pennsylvania.

What information must be reported on PA MV-13ST?

Information that must be reported on PA MV-13ST includes the vehicle identification number (VIN), the make and model of the vehicle, the owner's information, and the reason for the exemption.

Fill out your PA MV-13ST online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit Of Gift Mv 13st is not the form you're looking for?Search for another form here.

Keywords relevant to pa form mv 13st

Related to pa mv13st

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.