8843 Form

What is 8843 Form?

The 8843 Form is a document issued by the Internal Revenue Service (IRS) in the United States. It is used by certain nonresidents, such as foreign students or exchange visitors, to declare their exempt status for a specific period. This form helps individuals who do not qualify as U.S. residents for tax purposes to establish their exemption and avoid unnecessary tax liabilities.

What are the types of 8843 Form?

There are two types of 8843 Form:

8843 Form for students: This form is used by nonresidents who are in the U.S. as F-1, M-1, or J-1 students.

8843 Form for nonstudents: This form is used by nonresidents who are in the U.S. under other visa categories, such as J-1 exchange visitors or Q-1 cultural exchange participants.

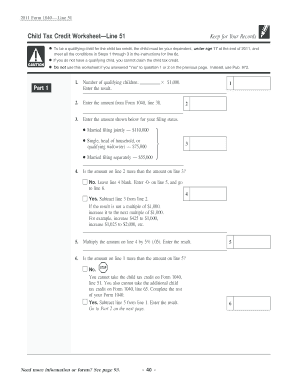

How to complete 8843 Form?

Completing the 8843 Form is a simple process. Here's a step-by-step guide to help you:

01

Enter your personal information, such as name, U.S. taxpayer identification number, and foreign taxpayer identification number.

02

Indicate your visa type and the duration of your stay in the U.S.

03

Provide details about your academic or training program.

04

Sign and date the form.

05

Submit the completed form to the appropriate tax authority or attach it to your tax return, if required.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 8843 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

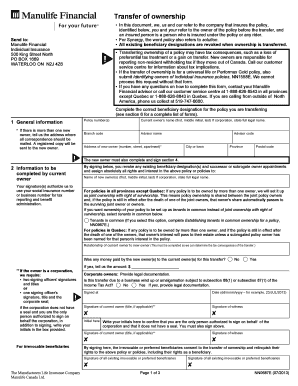

Who needs to fill out form 8843?

What is Form 8843? Form 8843 is not an income tax return. Form 8843 is merely an informational statement required by the U.S. government for certain nonresident aliens (including the spouses or dependents of nonresident aliens).

Do international students need to file form 8843?

I arrived in the U.S. in December 2021 and I didn't work. Do I still have to file Form 8843? All nonresident aliens for tax purposes who spent any portion of 2021 in F or J status are required to complete Form 8843 and send it to the IRS. The deadline is June 15, 2022.

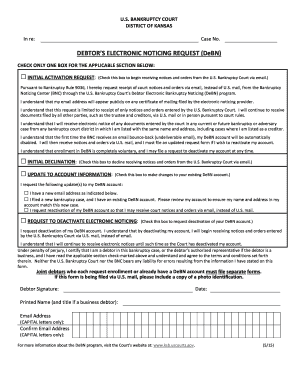

Can 8843 be filed online?

Our Form 8843 online wizard is only for international students on an F, J, M, or Q visa and their dependents, who are non-resident aliens for tax purposes.

How do I file form 8843?

If you don't have to file a 2021 tax return, mail Form 8843 to the Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301-0215 by the due date (including extensions) for filing Form 1040-NR.

Do I need to send form 8843?

Who Should Complete ONLY Form 8843? If you are a nonresident tax filer, and have NO U.S. source income in 2021 you only need complete the IRS Form 8843 to fulfill your federal tax filing obligation.

What happens if I don't file form 8843?

There is no monetary penalty for failure to file Form 8843. However, in order to be compliant with federal regulations one must file Form 8843 if required to do so. (Remember, being compliant can affect the issuing of future US visas or granting of legal permanent resident status.)