12 Month Cash Flow Statement - Page 2

What is 12 Month Cash Flow Statement?

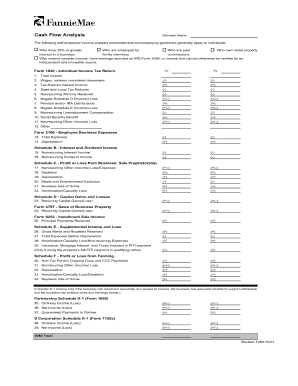

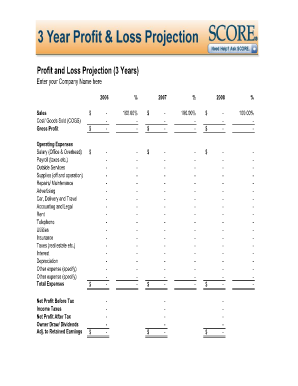

A 12 Month Cash Flow Statement is a financial document that provides an overview of the cash inflows and outflows of a business over a period of 12 months. It helps businesses analyze and track their cash flow to ensure they have enough liquidity to meet their financial obligations.

What are the types of 12 Month Cash Flow Statement?

There are two main types of 12 Month Cash Flow Statement: direct and indirect. 1. Direct Cash Flow Statement: This type presents the actual cash inflows and outflows of a business, providing a detailed picture of the sources and uses of cash. 2. Indirect Cash Flow Statement: This type starts with the net income and adjusts it to account for non-cash items and changes in working capital to determine the cash flow from operating activities.

How to complete 12 Month Cash Flow Statement

Completing a 12 Month Cash Flow Statement involves the following steps: 1. Gather financial data: Collect all relevant financial information, such as income statements, balance sheets, and cash transaction records. 2. Identify cash inflows: Determine all sources of cash inflows, including sales revenue, investments, and loans. 3. Identify cash outflows: Identify all cash outflows, such as operating expenses, loan repayments, and investments. 4. Calculate net cash flow: Calculate the difference between cash inflows and outflows. 5. Analyze results: Analyze the cash flow statement to assess the business's financial health and make informed decisions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.