Balancing A Checkbook Worksheet

What is balancing a checkbook worksheet?

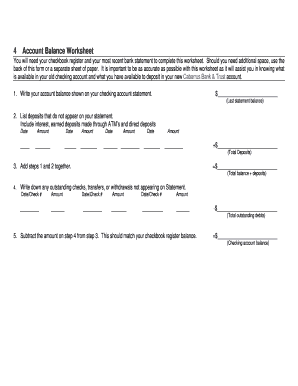

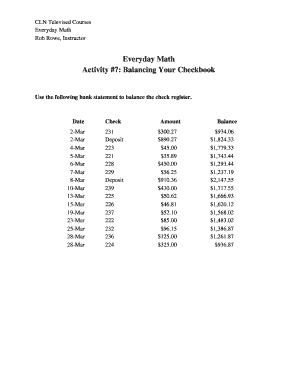

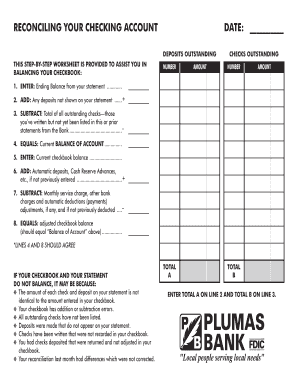

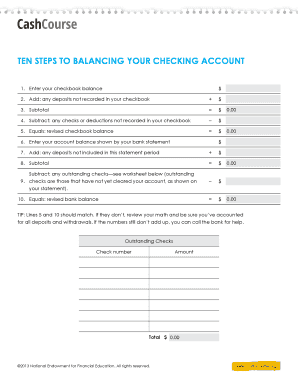

Balancing a checkbook worksheet is a document that helps individuals keep track of their finances and ensure that their bank statements match their recorded transactions. It is a useful tool for managing personal finances and maintaining an accurate account balance.

What are the types of balancing a checkbook worksheet?

There are various types of checkbook worksheets available to assist with balancing finances. Some common types include:

How to complete balancing a checkbook worksheet

Completing a balancing a checkbook worksheet is a straightforward process. Here are the steps to follow:

It's important to regularly update and maintain your balancing a checkbook worksheet to stay on top of your finances. By keeping accurate records, you can easily identify any discrepancies and ensure that your account balance is always accurate. With the help of pdfFiller, you can conveniently create, edit, and share your checkbook worksheet online. With unlimited fillable templates and powerful editing tools, pdfFiller is the perfect PDF editor to assist you in managing your financial documents effectively.