Bank Privacy Policy Template - Page 2

In this catalog, you can find and select from Bank Privacy Policy templates to keep your paperwork structured. If you are uncertain which of the templates in category fits you best, there are recommendations that explain how and when to utilize the template. Consult these guidelines and find exactly the form you need for easy and efficient document management. Save any template to your account for fast access or come back to the catalog if you want a similar template. All the templates in the catalog are predesigned and customizable to save you time. All you need for editing is to add your specifics to the document.

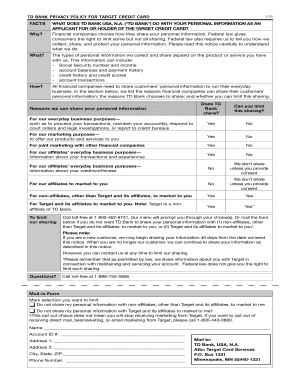

What is Bank Privacy Policy Template?

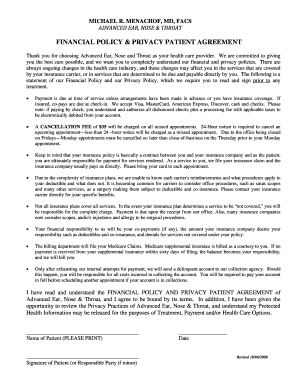

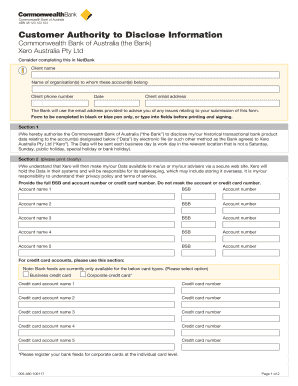

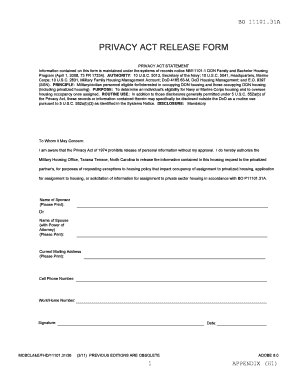

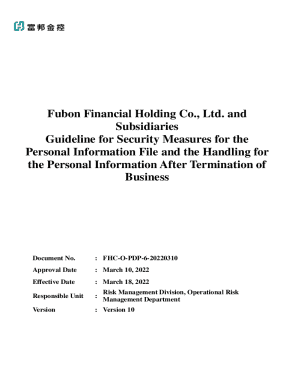

The Bank Privacy Policy Template is a document that outlines the policies and procedures regarding the collection and use of customer information by a financial institution. It includes details on how the bank will protect the privacy and security of customer data.

What are the types of Bank Privacy Policy Template?

There are several types of Bank Privacy Policy Templates available, including:

How to complete Bank Privacy Policy Template

Completing a Bank Privacy Policy Template is essential to ensure compliance with regulations and to build trust with customers. Here are the steps to complete the template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.