Business Expense Report Form - Page 2

What is Business Expense Report Form?

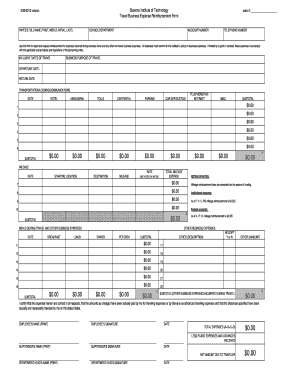

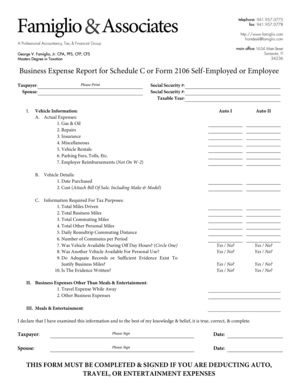

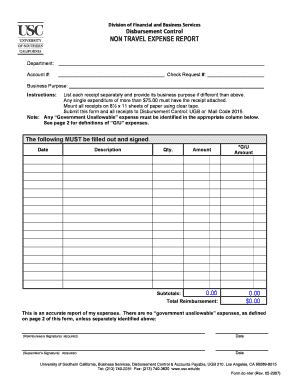

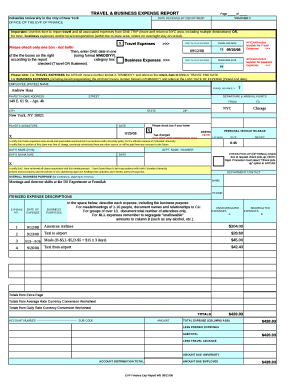

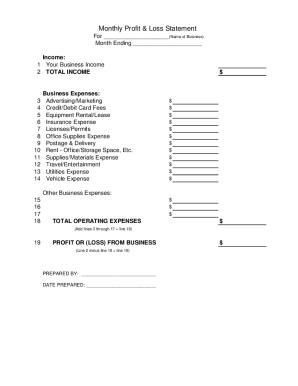

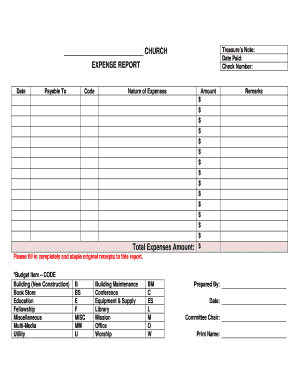

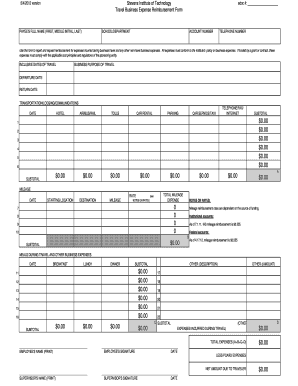

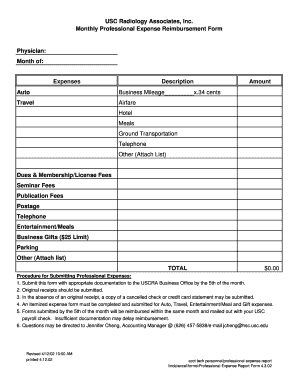

A Business Expense Report Form is a document used by employees to track and report expenses incurred while performing business-related activities. It serves as a record of all the expenses that need to be reimbursed by the employer.

What are the types of Business Expense Report Form?

There are several types of Business Expense Report Forms, including but not limited to:

Mileage Expense Report Form

Travel Expense Report Form

Meal Expense Report Form

Entertainment Expense Report Form

Office Supplies Expense Report Form

How to complete Business Expense Report Form

To complete a Business Expense Report Form, follow these steps:

01

Gather all your receipts and make sure they are organized.

02

Fill in the necessary details such as date, amount, and purpose of the expense.

03

Attach all receipts to the form for verification purposes.

04

Submit the completed form to the appropriate person or department for approval and processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Business Expense Report Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be included as expense?

Examples of expenses include rent, utilities, wages, salaries, maintenance, depreciation, insurance, and the cost of goods sold. Expenses are usually recurring payments needed to operate a business.

What is a business expense report?

An expense report contains a categorized and itemized list of expenses that were made on behalf of the organization. This report helps the employer or finance team determine what money was spent, what was purchased, and how much of the expenditure is approved for reimbursement.

What are examples of business expenses?

Business expenses are ordinary and necessary costs a business incurs in order for it to operate.What Are Examples of Business Expenses? Payroll (employees and freelance help) Bank fees and interest. Rent. Utilities. Insurance. Company car. Equipment or Equipment rental. Software.

What should I write as a business purpose on an expense report?

Why - The expense report must provide information as to why the expense was incurred. The business purpose should substantiate why the expenses are reasonable and appropriate for the university. The “why” should include the primary reason for the expense.

How do I write a business expense report?

How Do You Create an Expense Sheet? Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

How do I create a small business expense report?

In short, the steps to create an expense sheet are: Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.