Cash Flow Statement - Page 2

What is Cash Flow Statement?

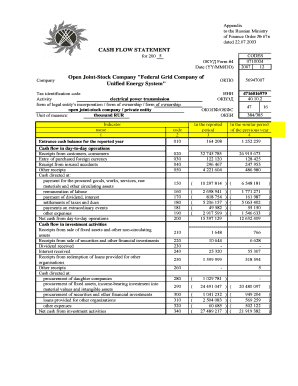

A cash flow statement is a financial statement that provides information about the cash generated and used by a company during a specific period. It shows the inflows and outflows of cash, which helps in evaluating the financial health and liquidity of a business. The cash flow statement is an essential tool for investors, creditors, and other stakeholders to understand how a company manages its cash.

What are the types of Cash Flow Statement?

There are typically three types of cash flow statements: 1. Operating Activities: This section represents the cash flows from the core operations of the business, such as revenue from sales and payments to suppliers and employees. 2. Investing Activities: It includes the cash flows related to investments in assets, like purchasing or selling property, plant, and equipment. 3. Financing Activities: This section shows the cash flows from activities like obtaining loans, issuing stocks, or paying dividends to shareholders.

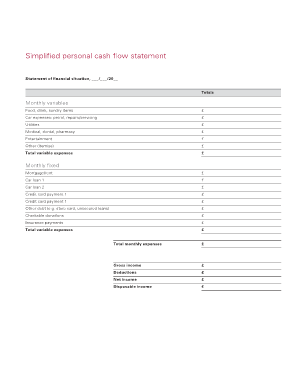

How to complete Cash Flow Statement?

Completing a cash flow statement involves the following steps: 1. Gather Financial Data: Collect all relevant financial information, such as income statements, balance sheets, and transaction details. 2. Identify Cash Flows: Categorize the cash flows into operating, investing, and financing activities. 3. Calculate Net Cash Flow: Determine the net cash flow by subtracting cash outflows from cash inflows for each activity category. 4. Prepare the Statement: Organize the cash flow information into a formal statement, starting with the opening and closing cash balances.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.