Debt Settlement Proposal Letter Template - Page 2

What is Debt Settlement Proposal Letter Template?

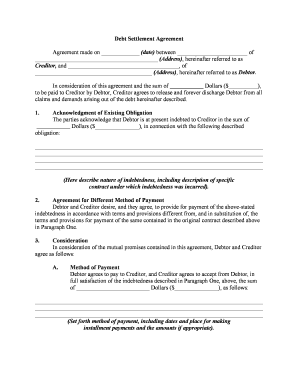

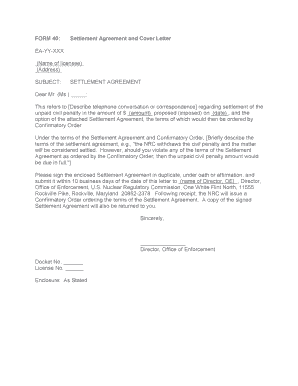

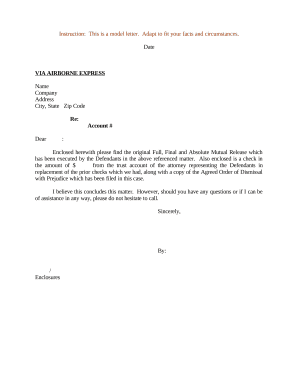

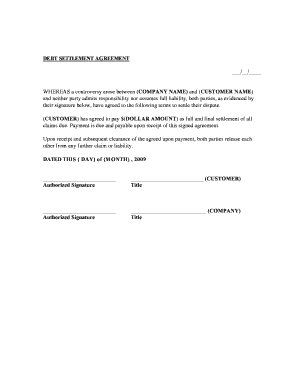

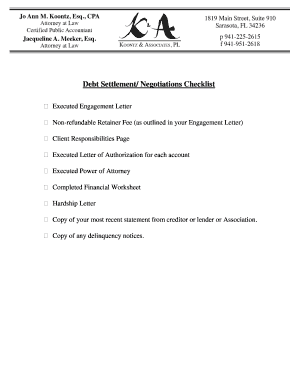

A Debt Settlement Proposal Letter Template is a document that is used by individuals or companies to propose a settlement arrangement for their outstanding debts. It serves as a formal communication to creditors, outlining the terms and conditions of the proposed settlement and requesting their agreement. The template provides a structured format for organizing and presenting the necessary information in a clear and professional manner.

What are the types of Debt Settlement Proposal Letter Template?

There are various types of Debt Settlement Proposal Letter Templates available, each tailored to specific situations and requirements. Some common types include:

How to complete Debt Settlement Proposal Letter Template

Completing a Debt Settlement Proposal Letter Template is a straightforward process that requires careful attention to detail. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.