Deed Of Reconveyance Form - Page 2

What is Deed Of Reconveyance Form?

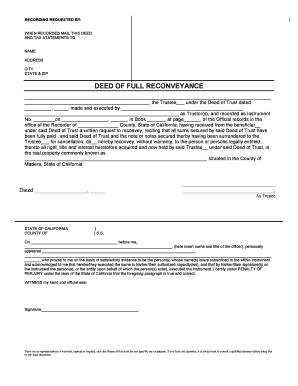

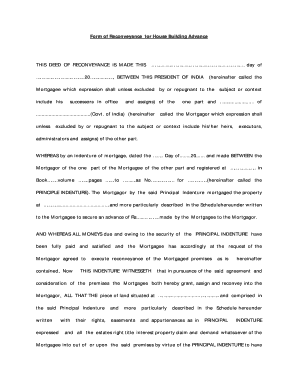

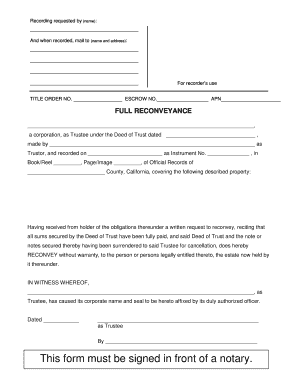

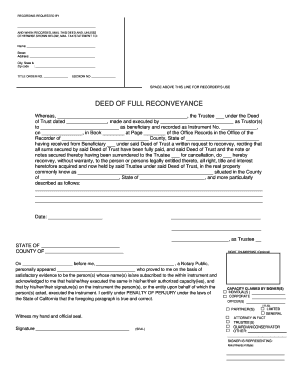

A Deed of Reconveyance Form is a legal document that is used to transfer the title of property from a lender to a borrower once a loan has been fully paid off. It serves as proof that the borrower has satisfied all obligations of the loan and that the lender no longer has any claim on the property.

What are the types of Deed Of Reconveyance Form?

There are two main types of Deed of Reconveyance Forms: General and Specific. 1. General Deed of Reconveyance: This form is used when the loan has been fully paid off, and the lender is releasing their interest in the entire property. 2. Specific Deed of Reconveyance: This form is used when the loan has been partially paid off, and the lender is releasing their interest in a specific portion of the property.

How to complete Deed Of Reconveyance Form

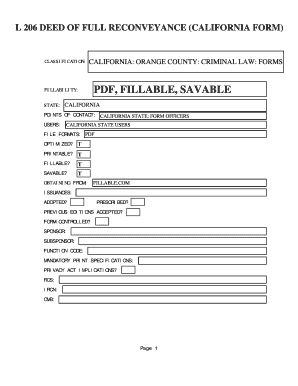

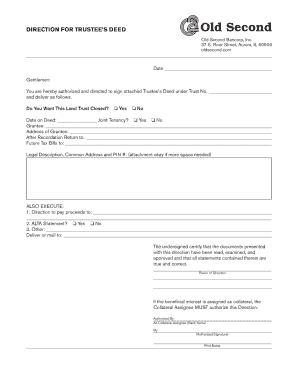

Completing a Deed of Reconveyance Form is a straightforward process. Here are the steps to follow: 1. Obtain the form: You can download a Deed of Reconveyance Form from a reliable legal website or obtain it from your lender or attorney. 2. Fill in the borrower's information: Provide the borrower's name, address, and contact details. 3. Fill in the lender's information: Provide the lender's name, address, and contact details. 4. Specify the property details: Include the complete address and legal description of the property. 5. State the loan details: Mention the loan amount, the date it was originated, and any other relevant loan information. 6. Sign and date the form: Have both the borrower and the lender sign the form and include the date of signing. 7. Notarize the form (optional): Some states require the Deed of Reconveyance to be notarized. 8. File the form: Once the form is completed and signed, file it with the appropriate county recorder's office or land records office.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.