Fafsa Calculator

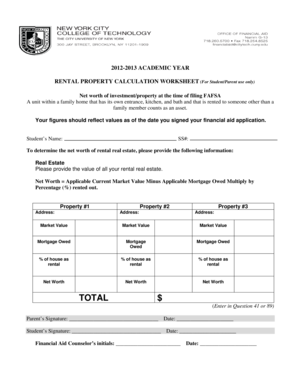

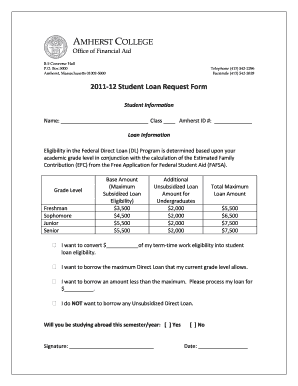

What is fafsa calculator?

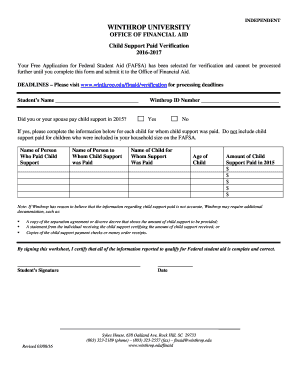

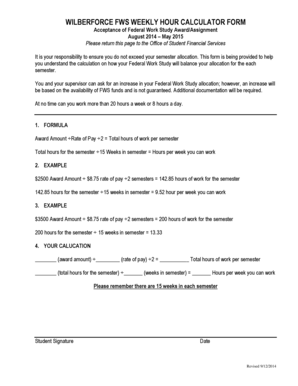

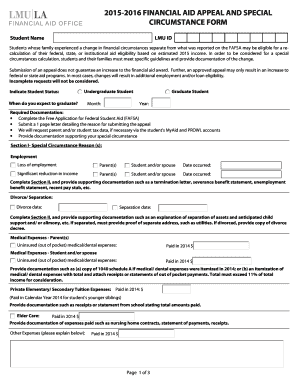

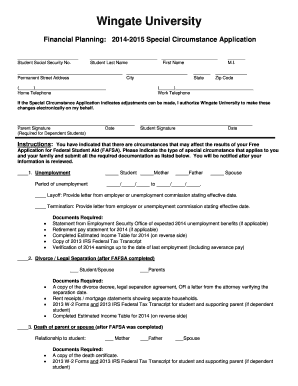

The fafsa calculator is a tool designed to help students estimate their eligibility for financial aid. It takes into account various factors such as income, assets, family size, and cost of attendance to provide an estimate of the amount of federal aid students may qualify for.

What are the types of fafsa calculator?

There are different types of fafsa calculators available to students. Some of the common types include:

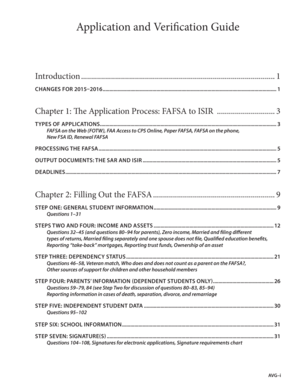

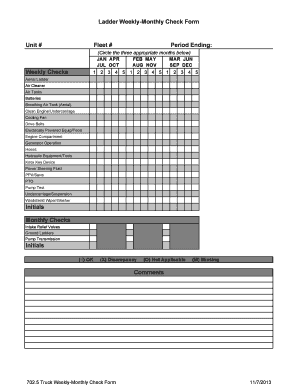

How to complete fafsa calculator

Completing the fafsa calculator is a straightforward process. Here are the steps to follow:

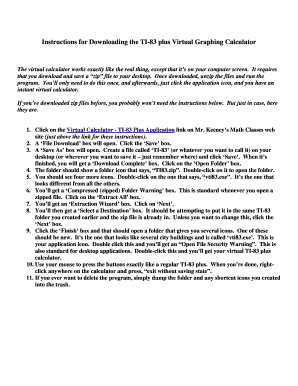

With pdfFiller, the process of completing the fafsa calculator becomes even easier. It empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.