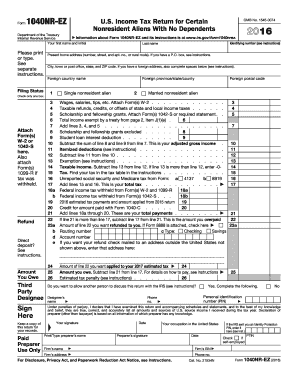

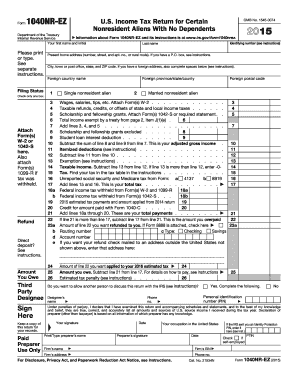

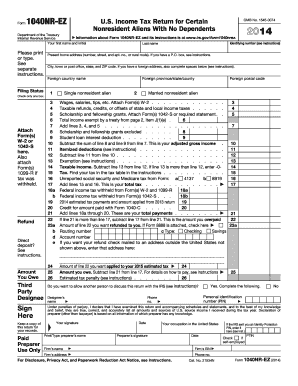

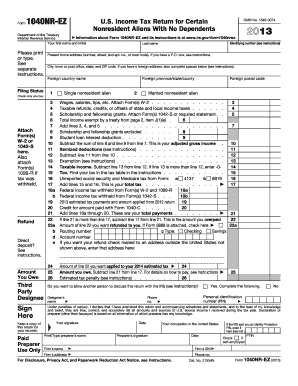

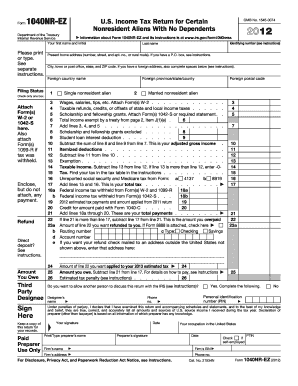

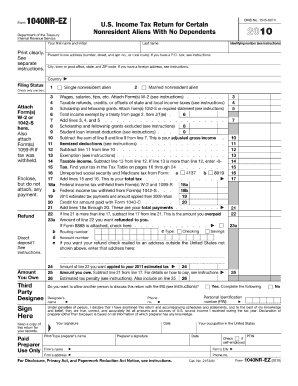

1040NR-EZ Form

What is 1040NR-EZ Form?

The 1040NR-EZ Form is a simplified version of Form 1040NR, which is used by non-resident aliens to report their income in the United States. It is designed for individuals who do not have any dependents and have a limited number of income sources. This form allows non-resident aliens to fulfill their tax obligations in a straightforward manner.

What are the types of 1040NR-EZ Form?

There is only one type of 1040NR-EZ Form, which is the simplified version mentioned earlier. This form is specifically tailored to meet the needs of non-resident aliens who do not have any dependents and have a relatively simple tax situation. It is important to ensure that you qualify for the 1040NR-EZ Form before using it to file your taxes.

How to complete 1040NR-EZ Form

Completing the 1040NR-EZ Form is a relatively straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.