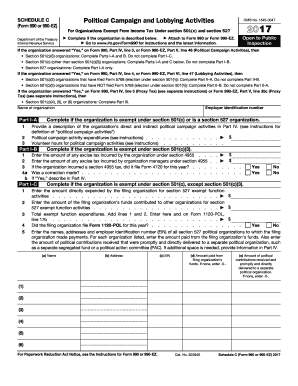

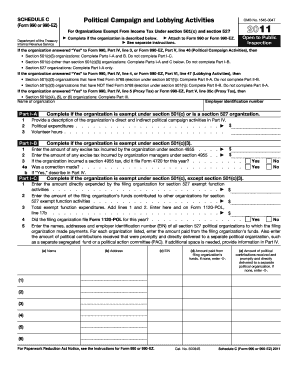

Schedule C (990 Form)

What is Schedule C (990 Form)?

Schedule C (990 Form) is a form used by non-profit organizations to report their income and expenses. It is an important document that provides transparency and accountability to the organization's financial activities.

What are the types of Schedule C (990 Form)?

There are several types of Schedule C (990 Form), depending on the nature of the organization's activities. Some common types include:

Schedule C (990 Form) for educational institutions

Schedule C (990 Form) for healthcare organizations

Schedule C (990 Form) for religious organizations

Schedule C (990 Form) for social welfare organizations

How to complete Schedule C (990 Form)

Completing Schedule C (990 Form) can seem daunting, but with the right guidance, it becomes much easier. Here are some steps to help you complete it:

01

Gather all relevant financial records and documents.

02

Enter your organization's income and expenses in the appropriate sections of the form.

03

Provide detailed explanations for any unusual items or discrepancies.

04

Review the form for accuracy and completeness.

05

Submit the completed Schedule C (990 Form) to the relevant authorities.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What information is included on Form 990?

About Schedule J (Form 990), Compensation Information Organizations that file Form 990 use this schedule to report: compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and. information on certain compensation practices.

Does 990 need Schedule B?

Nonprofit Organizations use schedule B to provide additional information on contributions reported on Form 990, 990-EZ, and 990-PF. Eventually, a Non Profit Organization must file Schedule B with Form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor.

What is a Schedule A for a 990 EZ form?

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

Where do capital gains go on 990?

capital gain dividends should be reported separately from interest and dividend income reported on Line 4 and net realized gain/loss reported on Line 6a.

Does 990 have Schedule C?

Schedule C (Form 990) is used by: Section 501(c) organizations, and • Section 527 organizations. These organizations must use Schedule C (Form 990) to furnish additional information on political campaign activities or lobbying activities, as those terms are defined later for the various parts of this schedule.

Do I report unrealized gains on 990?

Unrealized gain or loss on investments may be grouped with “investment income” on the financial statements. Form 990 does not take into account unrealized gain or loss in arriving at total revenue, thus it is a reconciling item on Schedule D.