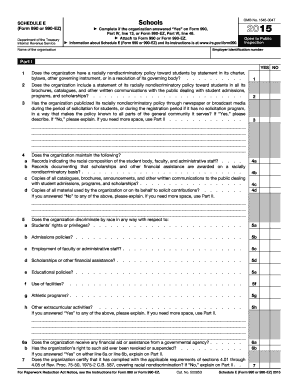

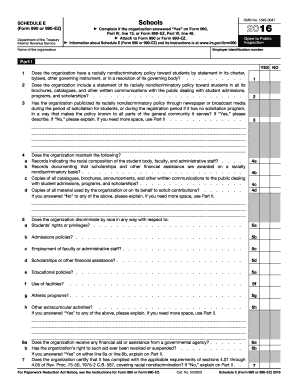

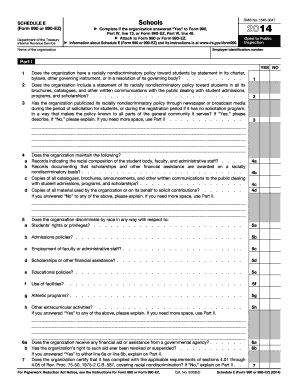

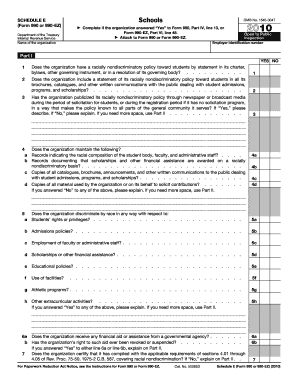

Schedule E (990 Form)

What is Schedule E (990 Form)?

Schedule E (990 Form) is a section of the Form 990 that is used by tax-exempt organizations to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It provides detailed information about the organization's various types of income and helps in calculating the organization's overall financial status.

What are the types of Schedule E (990 Form)?

Schedule E (990 Form) includes the following types:

Rental Real Estate Income or Loss

Royalties Income

Partnerships Income

S Corporations Income

Estate or Trust Income

Residual Interests in REMICs Income

How to complete Schedule E (990 Form)

To complete Schedule E (990 Form), follow these steps:

01

Provide the organization's name and EIN (Employer Identification Number)

02

Fill in the details about the types of income reported on each line of Schedule E

03

Attach additional schedules if necessary, and provide a brief description of the attached schedule

04

Calculate the total income or loss from Schedule E

05

Transfer the total income or loss to the appropriate lines on Form 990

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What goes on Schedule I of a 990?

Schedule I (Form 990) is used by an organization that files Form 990 to provide information on grants and other assistance made by the filing organization during the tax year to domestic organizations, domestic governments, and domestic individuals. Report activities conducted by the organization directly.

Do you need extension for 990-N?

Extensions of time to file Need an extension? To request an automatic 6-month extension, file Form 8868 by the original deadline for your nonprofit's 990. The 990-N due date cannot be extended, but there is no penalty for submitting it later than 5 months and 15 days after the close of the nonprofit's fiscal year.

Is Schedule B required for Form 990?

Generally, a NPO must attach Schedule B to its Form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. There are special rules for certain 501(c)(3) NPOs that may raise the reporting threshold above $5,000.

Is Schedule B required for 990?

Generally, a NPO must attach Schedule B to its Form 990 if it receives contributions of the greater of $5,000 or more than 2% of revenues from any one contributor. There are special rules for certain 501(c)(3) NPOs that may raise the reporting threshold above $5,000.

Do 990s get an automatic extension?

Use Form 8868, Application for Extension of Time To File an Exempt Organization ReturnPDF, to request a 6-month automatic extension of time to file any of the following returns: Form 990, Return of Organization Exempt from Income TaxPDF.

What are the filing requirements for Form 990?

An organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either Form 990, Return of Organization Exempt from Income TaxPDF, or Form 990-EZ, Short Form Return of Organization Exempt from Income TaxPDF.