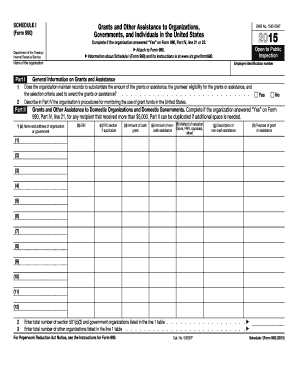

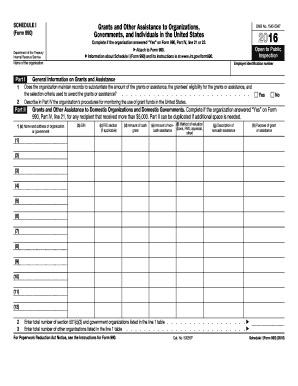

Schedule I (990 Form)

What is Schedule I (990 Form)?

Schedule I is a form used by tax-exempt organizations to provide additional information about their activities, financials, and compliance with tax laws. It is filed as part of the annual Form 990 submission.

What are the types of Schedule I (990 Form)?

There are three types of Schedule I (990 Form):

Part I: Political Campaign and Lobbying Activities

Part II: Grants and Other Assistance to Organizations, Governments and Individuals in the United States

How to complete Schedule I (990 Form)

Completing Schedule I (990 Form) requires careful attention to detail and accurate reporting. Here is a step-by-step guide to help you:

01

Gather all necessary information such as grants, political campaign expenses, and lobbying activities.

02

Section A: Provide detailed information on political campaign and lobbying activities.

03

Section B: Report grants and other assistance given to organizations, governments, and individuals in the United States.

04

Section C: Disclose direct or indirect transfers to or for the use of foreign entities.

05

Section D: Provide additional explanations or disclosures, if necessary.

06

Review the completed form for accuracy and make any necessary corrections.

07

Submit the form to the IRS by the due date.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Schedule I (990 Form)

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What goes on Schedule I of a 990?

Schedule I (Form 990) is used by an organization that files Form 990 to provide information on grants and other assistance made by the filing organization during the tax year to domestic organizations, domestic governments, and domestic individuals. Report activities conducted by the organization directly.

Can IRS Form 990 be filed electronically?

For tax years ending before July 31, 2021, the IRS will accept either paper or electronic filing of Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. For tax years ending July 31, 2021, and later, Forms 990-EZ must be filed electronically.

What information is included on Form 990?

About Schedule J (Form 990), Compensation Information Organizations that file Form 990 use this schedule to report: compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and. information on certain compensation practices.

What is a Schedule A for non profit?

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

Can you file a 990 yourself?

Form 990-EZ can be filed either via mail or electronically for an additional year. After this period you must file electronically. Forms 990-T and 4720 are both required to be filed electronically under the new law, but physical forms will still be accepted while the IRS works to convert them to electronic format.

Where do I file my 990 return?

Mail your Form 990 to the below address: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0027.