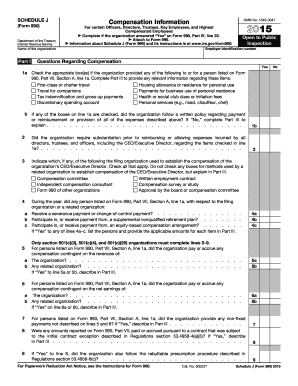

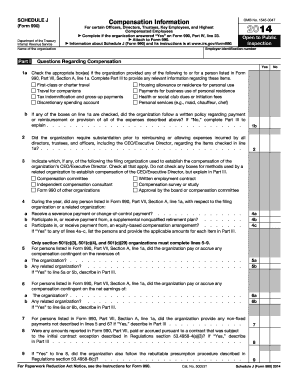

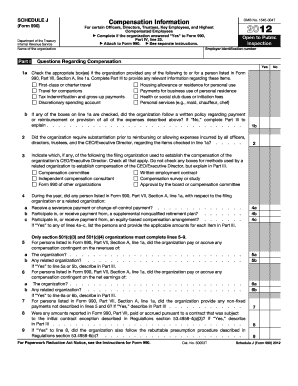

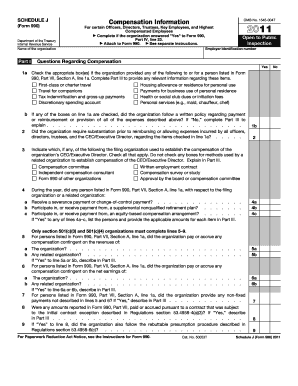

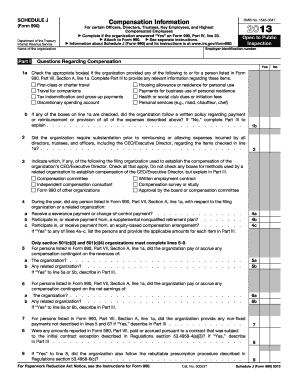

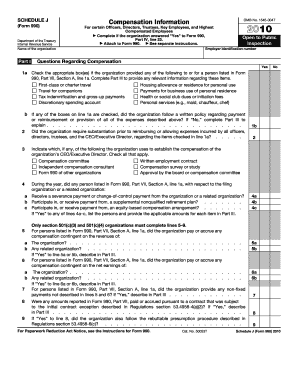

Schedule J (990 Form)

What is Schedule J (990 Form)?

Schedule J (990 Form) is a supplementary form for tax-exempt organizations required by the Internal Revenue Service (IRS) in the United States. It helps organizations report compensation information for certain key employees, highly-compensated employees, and directors.

What are the types of Schedule J (990 Form)?

There are two types of Schedule J (990 Form). The first type is used by organizations to report compensation information about top management officials, highly-compensated employees, and independent contractors. The second type is used to provide additional information about employee benefit plans offered by the organization, such as pension plans, health plans, and other welfare benefit plans.

How to complete Schedule J (990 Form)

Completing Schedule J (990 Form) requires careful attention to detail. Here is a step-by-step guide to help you:

By using pdfFiller, you can easily complete and submit Schedule J (990 Form) online. pdfFiller not only empowers you to fill out the form digitally but also offers unlimited fillable templates and powerful editing tools to ensure your documents are done efficiently and professionally.