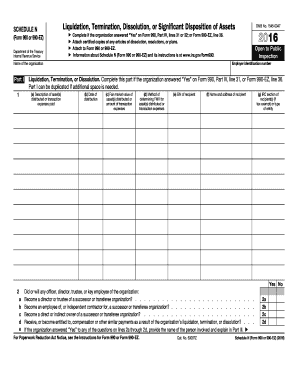

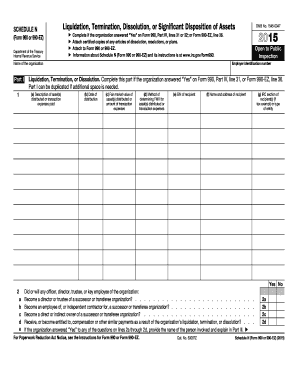

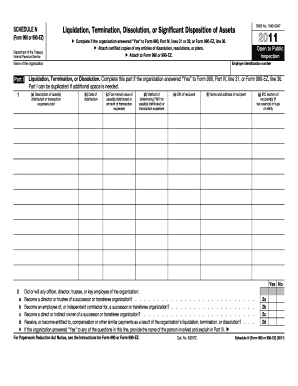

Schedule N (990 Form)

What is Schedule N (990 Form)?

Schedule N (990 Form) is a section of the IRS Form 990 that must be completed by tax-exempt organizations to provide information about certain transactions with interested persons.

What are the types of Schedule N (990 Form)?

There are three types of Schedule N (990 Form) based on the type of transaction:

Schedule N (Form 990): General Information and Compensation

Schedule N (Form 990-EZ): General Information and Compensation

Schedule N (Form 990-PF): General Information and Compensation

How to complete Schedule N (990 Form)

To complete Schedule N (990 Form), follow these steps:

01

Gather all necessary information about the organization's transactions with interested persons.

02

Fill in the organization's general information, such as name and address.

03

Provide details about each transaction with interested persons, including the nature of the transaction and the amount involved.

04

Calculate and enter the total compensation received by each interested person.

05

Review the completed form for accuracy and make any necessary corrections.

06

Sign and date the form before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Schedule N (990 Form)

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the deadline for filing 990-N?

Filing Due Date Form 990-N is due every year by the 15th day of the 5th month after the close of your tax year. You cannot file the e-Postcard until after your tax year ends. Example: If your tax year ended on December 31, the e-Postcard is due May 15 of the following year.

Do I have to file 990-N every year?

Note: The requirement to file Form 990-N is an annual requirement.

Do you have to extend a 990-N?

For more information on the filing requirements, see the instructions for Forms 990, 990-EZ, and 990-PF. Note: The 990-N due date cannot be extended, but there is no penalty for submitting it late unless it's the third (and only) year.

Can you e file 990-N?

Form 990-N must be completed and filed electronically. There is no paper form. Do not use a smartphone or tablet to file your Form 990-N. Use the Form 990-N Electronic Filing System (e-Postcard) User GuidePDF while registering and filing.

Can IRS Form 990 be filed electronically?

For tax years ending before July 31, 2021, the IRS will accept either paper or electronic filing of Form 990-EZ, Short Form Return of Organization Exempt from Income Tax. For tax years ending July 31, 2021, and later, Forms 990-EZ must be filed electronically.

What do I need to file a 990-N?

How to Fill Out and Read Form 990-N Tax year. Legal name and mailing address. Any other organization names. Name and address of a principal officer. Web site address. Proof that the organization's annual gross receipts are $50,000 or less.