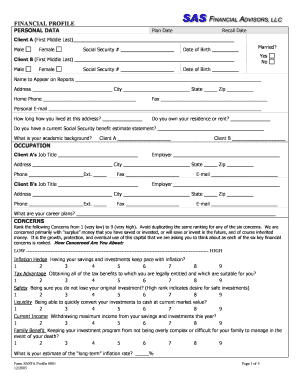

What is Financial Planning Proposal Template?

Financial Planning Proposal Template is a document designed to assist individuals and businesses in creating a comprehensive financial plan. It includes sections for assessing financial goals, analyzing current financial status, developing strategies, and outlining investment plans. This template helps to organize financial information and provides a framework for creating a personalized financial planning proposal.

What are the types of Financial Planning Proposal Template?

Financial Planning Proposal Templates can be categorized into several types based on the specific needs and objectives of the user. Some common types include:

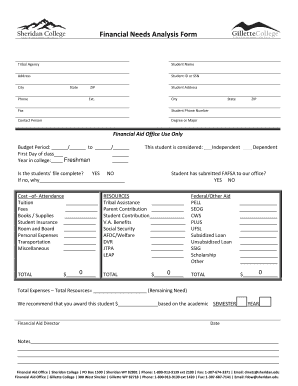

Personal Financial Planning Proposal Template

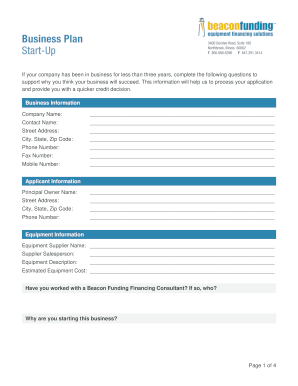

Business Financial Planning Proposal Template

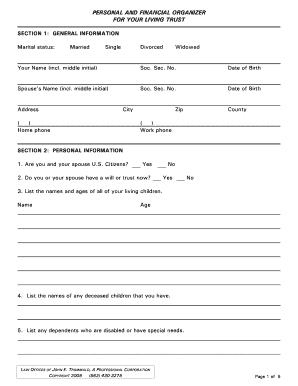

Retirement Financial Planning Proposal Template

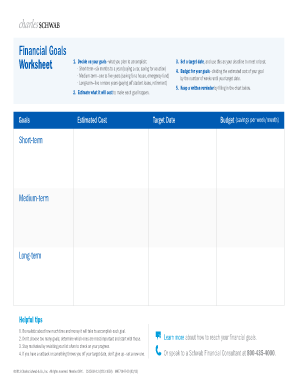

Investment Financial Planning Proposal Template

How to complete Financial Planning Proposal Template

Completing a Financial Planning Proposal Template is a straightforward process. Follow these steps to create an effective proposal:

01

Start by providing personal or business information, such as name, contact details, and company information.

02

Identify and define your financial goals. Clearly articulate what you want to achieve through the financial planning process.

03

Evaluate your current financial situation. This includes analyzing income, expenses, assets, liabilities, and net worth.

04

Develop strategies and action plans to achieve your financial goals. This may involve budgeting, savings plans, debt management, investment strategies, and risk management.

05

Outline your investment plans. Specify the types of investments you are considering, your risk tolerance, and desired returns.

06

Consider any legal or regulatory requirements that may impact your financial planning proposal.

07

Review and revise your proposal to ensure clarity, accuracy, and completeness.

08

Share your proposal with relevant parties, such as financial advisors, clients, or stakeholders, for their review and feedback.

09

Make any necessary revisions based on the feedback received and finalize your financial planning proposal.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.