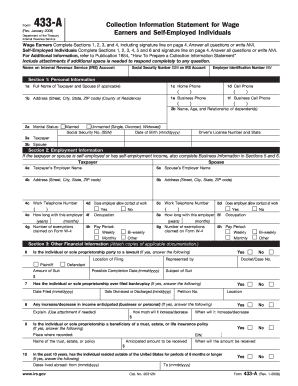

Form 433-a - Page 2

What is Form 433-a?

Form 433-a is a financial statement used by individuals who owe taxes to the Internal Revenue Service (IRS). It provides a detailed overview of the taxpayer's financial situation, including income, assets, expenses, and liabilities. This form is essential for the IRS to assess an individual's ability to pay their tax debt and determine the most suitable repayment plan. By completing Form 433-a accurately and honestly, taxpayers can demonstrate their willingness to resolve their tax obligations.

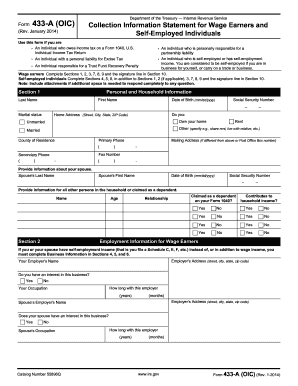

What are the types of Form 433-a?

There are two types of Form 433-a: Form 433-a (OIC) and Form 433-a (SF). Form 433-a (OIC) is used for individuals who are applying for an Offer in Compromise (OIC), which is a settlement option allowing taxpayers to pay less than the full amount they owe. Form 433-a (SF), on the other hand, is used by self-employed individuals to provide more detailed information about their business income and expenses.

How to complete Form 433-a

Completing Form 433-a accurately and thoroughly is crucial to ensure that the IRS has all the necessary information to evaluate your financial situation. Here are the steps to complete Form 433-a:

In order to simplify the process of completing Form 433-a, individuals can utilize pdfFiller. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.