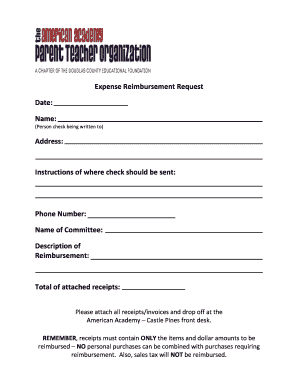

Free Expense Reimbursement Form Template

What is free expense reimbursement form template?

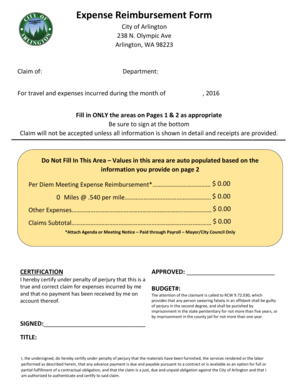

A free expense reimbursement form template is a pre-designed document that allows individuals or organizations to easily document and submit reimbursement requests for expenses incurred. This template provides a standardized format for capturing necessary information such as the date of the expense, description, amount, and supporting documentation.

What are the types of free expense reimbursement form template?

There are various types of free expense reimbursement form templates available, depending on the specific needs and requirements. Some common types include:

How to complete free expense reimbursement form template

To complete a free expense reimbursement form template, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.