Free Second Mortgage Form

What is free second mortgage form?

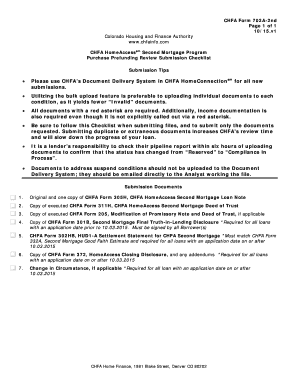

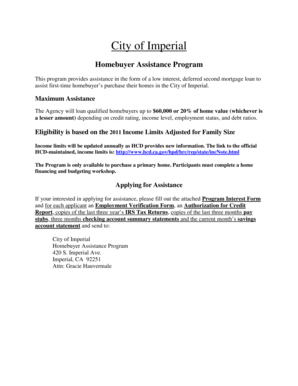

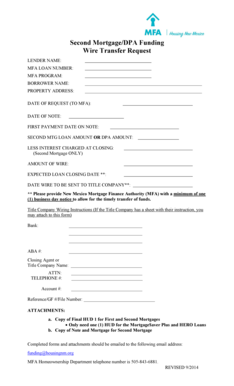

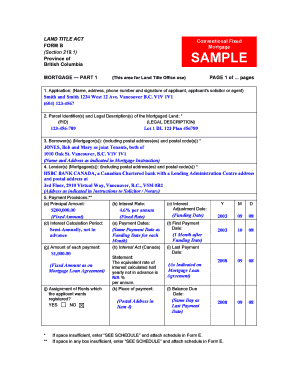

A free second mortgage form is a legal document that allows homeowners to borrow money against the equity in their property. This form is typically used when homeowners need additional funds for various purposes such as home improvements, debt consolidation, or to finance other expenses. By signing this form, homeowners agree to use their property as collateral and grant the lender a second lien on the property until the loan is paid off.

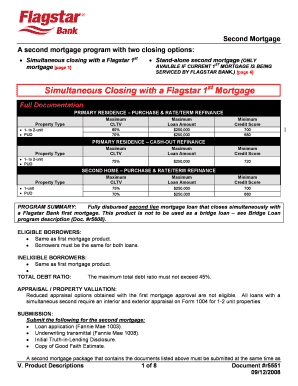

What are the types of free second mortgage form?

There are several types of free second mortgage forms available depending on the lender and the specific requirements. Some common types include: 1. Fixed-Rate Second Mortgage: This type of form offers a fixed interest rate for the entire loan term, allowing homeowners to have predictable monthly payments. 2. Home Equity Line of Credit (HELOC): This form provides homeowners with a line of credit based on the equity in their property, which they can use as needed and pay back over time. 3. Balloon Payment Second Mortgage: With this form, homeowners make lower monthly payments for a specified period, but a large final payment (balloon payment) is due at the end of the term.

How to complete free second mortgage form

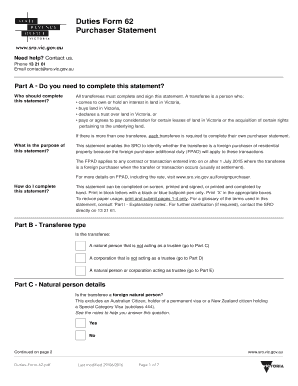

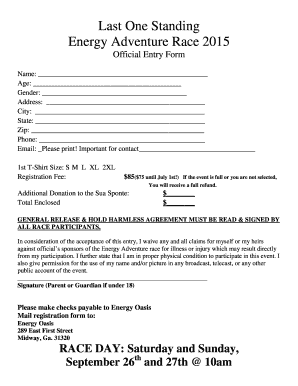

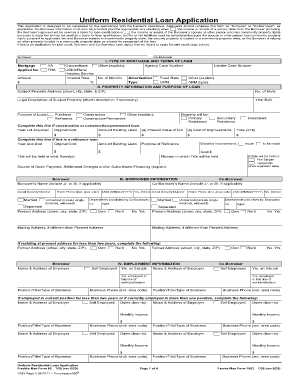

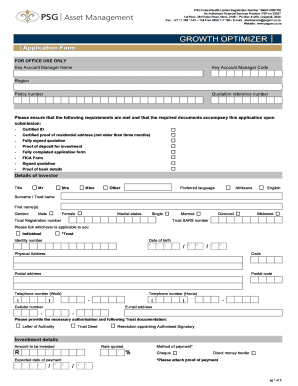

Completing a free second mortgage form may seem daunting, but with the right information and guidance, it can be a straightforward process. Follow these steps to complete the form: 1. Gather the necessary documents: Before starting the form, gather documents such as proof of income, property appraisal, and current mortgage statements. 2. Fill in personal information: Provide your name, contact information, and other required details. 3. Provide property details: Fill in information about the property, including its address, value, and any existing mortgages. 4. Specify loan details: Indicate the loan amount, desired interest rate, and desired loan term. 5. Review and sign: Carefully review the completed form, ensuring all information is accurate, and sign the document.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.