What is Full Reconveyance - State Of California?

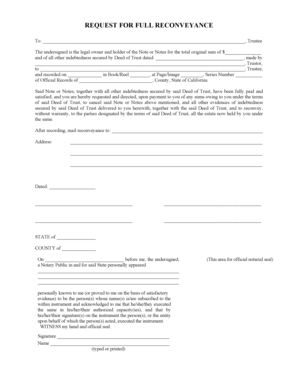

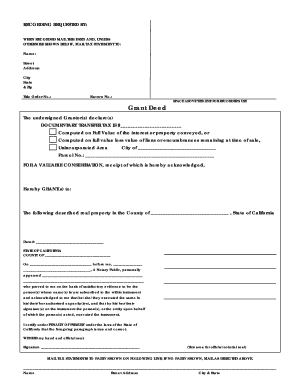

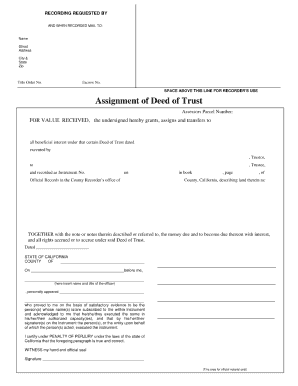

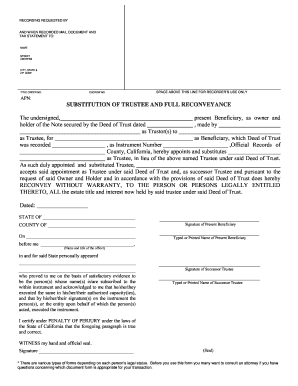

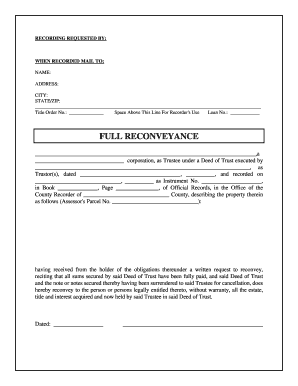

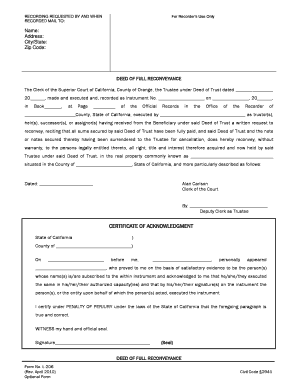

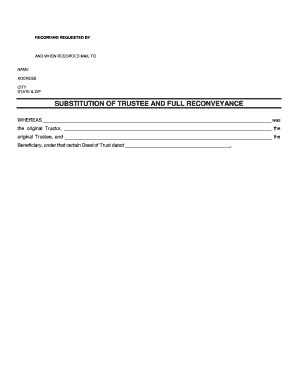

Full Reconveyance is a legal term used in the State of California to describe the process of transferring ownership of a property from a lender, typically a mortgage or trust deed holder, back to the borrower. It is an important step in the real estate process as it signifies that the borrower has successfully paid off their loan in full. This document proves that the lender no longer has a legal claim or lien on the property.

What are the types of Full Reconveyance - State Of California?

There are two main types of Full Reconveyance in the State of California:

Voluntary Full Reconveyance: This occurs when the borrower completes all the necessary payments and requests the lender to issue a Full Reconveyance.

Involuntary Full Reconveyance: This happens when the borrower defaults on their loan and the lender takes legal action to foreclose on the property. Once the foreclosure process is complete, the lender issues a Full Reconveyance.

How to complete Full Reconveyance - State Of California

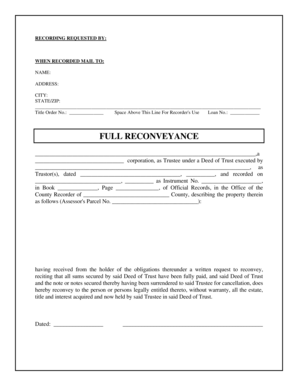

Completing a Full Reconveyance in the State of California requires the following steps:

01

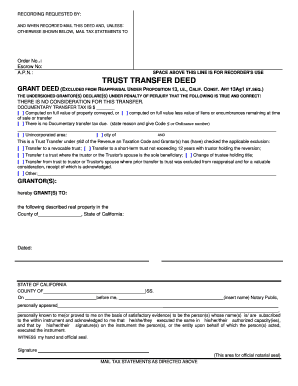

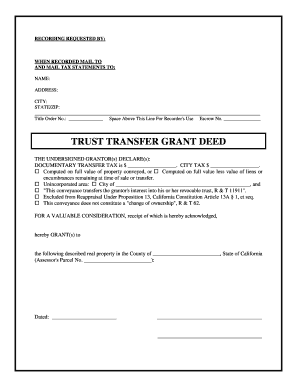

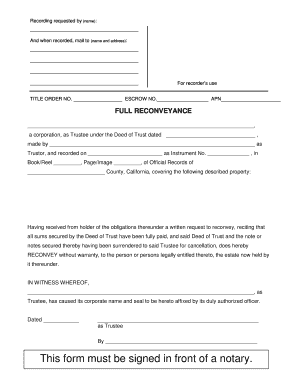

Obtain a copy of the original loan agreement or trust deed.

02

Ensure that all loan payments, including interest and fees, have been made in full.

03

Contact the lender and officially request a Full Reconveyance.

04

Provide any necessary information or documentation requested by the lender.

05

Pay any fees or expenses associated with the Full Reconveyance process, if applicable.

06

Once the lender approves the request, they will prepare the Full Reconveyance document.

07

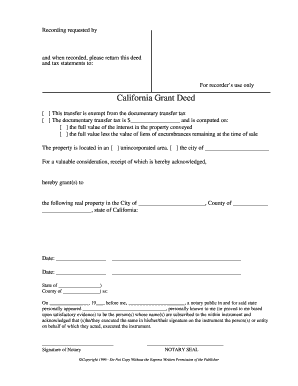

Sign the Full Reconveyance document in the presence of a notary public.

08

File the signed Full Reconveyance document with the appropriate government office, typically the county recorder's office.

09

Keep a copy of the Full Reconveyance document for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.