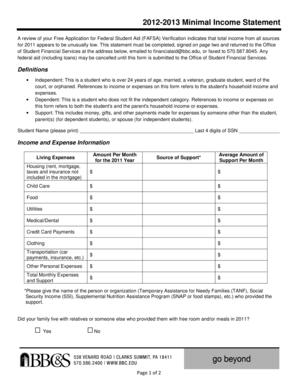

What is income statement definition?

An income statement, also known as a profit and loss statement or P&L statement, is a financial report that shows a company's revenues, expenses, and net income or loss over a specific period of time. It provides valuable insights into a company's financial performance and helps investors, creditors, and stakeholders assess its profitability and financial health.

What are the types of income statement definition?

There are several types of income statements that companies may use, depending on their specific needs and reporting requirements. The most common types include:

Single-Step Income Statement: This type of income statement provides a simple and straightforward summary of a company's revenues and expenses, resulting in a single bottom line figure for net income or loss.

Multi-Step Income Statement: A multi-step income statement includes multiple sections and calculations, such as operating revenues, operating expenses, non-operating revenues or expenses, and taxes. It provides a more detailed analysis of a company's financial performance.

Consolidated Income Statement: A consolidated income statement combines the financial results of a parent company and its subsidiaries, providing a comprehensive financial overview of the entire corporate group.

How to complete income statement definition

To complete an income statement, follow these steps:

01

Gather financial data: Collect all relevant financial information, including revenues, expenses, and any other income or deductions.

02

Organize the data: Categorize and classify the financial data into appropriate sections, such as operating revenues, operating expenses, and non-operating items.

03

Calculate subtotals: Calculate subtotals for each section, such as gross profit, operating profit, and net profit.

04

Double-check the calculations: Review and verify all calculations to ensure accuracy.

05

Include additional information: If necessary, provide additional details or clarifications in the footnotes or accompanying notes.

06

Prepare the final statement: Present the completed income statement, including the company's name, period covered, and final figures for revenues, expenses, and net income or loss.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.