Insurance Proposal Letter Template

What is Insurance Proposal Letter Template?

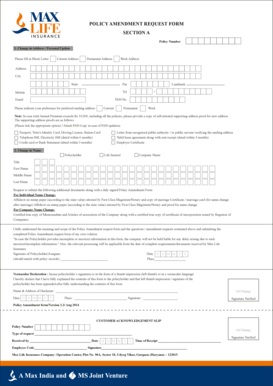

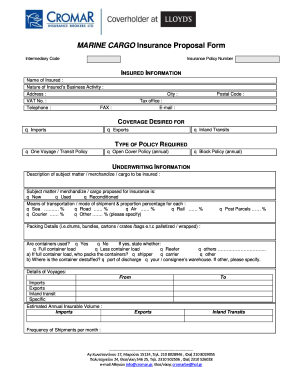

Insurance Proposal Letter Template is a pre-designed document that outlines the details and terms of an insurance proposal. It is used by insurance agencies to present their proposed coverage and policies to potential clients.

What are the types of Insurance Proposal Letter Template?

There are various types of Insurance Proposal Letter Template based on the specific insurance coverage being proposed. Some common types include:

Auto Insurance Proposal Letter Template

Home Insurance Proposal Letter Template

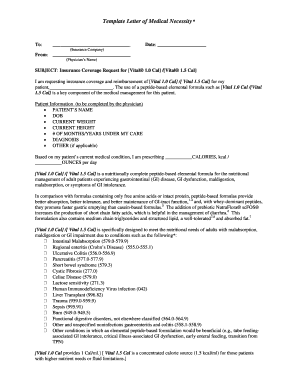

Health Insurance Proposal Letter Template

Life Insurance Proposal Letter Template

Business Insurance Proposal Letter Template

How to complete Insurance Proposal Letter Template

Completing an Insurance Proposal Letter Template is a straightforward process. Follow these steps:

01

Open the Insurance Proposal Letter Template in a PDF editor like pdfFiller.

02

Fill in the necessary details such as the client's name, contact information, and insurance coverage requested.

03

Review the completed letter for any errors or missing information.

04

Save the completed Insurance Proposal Letter as a PDF.

05

Share the letter electronically with the client or print it out for physical delivery.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a form proposal?

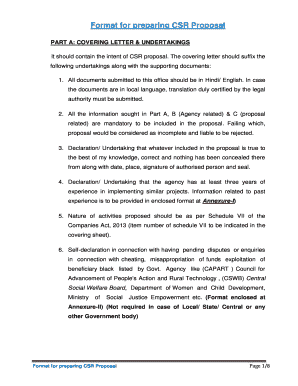

A proposal form is a legal document that seeks relevant information from you so that the insurance company understands you well. A proposal form in insurance is not just about giving out your details such as your name, age, gender and address.

What is a proposal form in insurance?

A proposal form is the form completed by the policyholder when applying for insurance. You will need to fill in information about the risk you are insuring e.g. the rebuild cost of your house or type of car you own.

How do you write a policy proposal letter?

Writing the Policy Proposal Address it to the governmental official who has the most authority to deal with this issue. Use statistical data to define the problem. We do not care which citation format you use so long as it is understandable. Make your recommendations specific, clear, and understandable.

What are the items found in a proposal form?

Common Elements of a Proposal (or Proposal Content and Format) Abstract. Table of Contents. Statement of Work or Research Plan. Budget and Budget Justification. Additional Information. Biographical Sketch. Current and Pending Support. Facilities and Equipment.

How do you present an insurance proposal to a client?

When reaching out to the potential client, make sure to remind them of the benefits of your proposed insurance services. Emphasize how your services can help protect their business or personal assets and provide them with peace of mind. It's also essential to listen to your potential client's needs and concerns.

What are the format of a proposal?

Plan your proposal Introduction. Problem Statement. Goals & outcomes. Methodology. Expected results. Budget. Conclusion.

How do I write an insurance proposal?

In writing an insurance proposal, take note of these steps. Get enough information. You can't write a proposal without getting the necessary information. Research potential clients. Doing a research on your potential clients helps you understand their needs. Begin writing. Add company logo. Have it proofread.

What is meant by insurance proposal form?

What is Proposal Form. Definition: Proposal form is the most important and basic document required for life insurance contract between the insured and insurance company. It includes the insured's fundamental information like address, age, name, education, occupation etc. It also includes the person's medical history.

What is the structure of insurance proposal form?

A proposal form seeks basic information of the proposer and the life assured. This includes the name, age, address, education and employment details of the proposer. The proposal form also gathers information on the medical history of the life to be assured.

How do you start a proposal example?

Introduce yourself and provide background information. State your purpose for the proposal. Define your goals and objectives. Highlight what sets you apart. Briefly discuss budget and how funds will be used. Finish with a call to action and request a follow-up. Close the letter and provide contact details.