What is irs identity theft process?

IRS identity theft process refers to the steps and procedures that the Internal Revenue Service (IRS) takes to address cases of identity theft involving tax-related issues. Identity theft occurs when someone unlawfully uses another person's personal information, such as their social security number, to commit fraud or other illegal activities relating to taxes. When such incidents are reported to the IRS, they initiate a process to investigate the case and assist the victim in resolving the issue.

What are the types of irs identity theft process?

There are several types of IRS identity theft processes. These may include:

Fraudulent tax return: In this type of identity theft, the thief uses the victim's personal information to file a tax return and claim a refund.

Employment-related identity theft: Here, the thief uses the victim's information to gain employment, leading to discrepancies in the victim's tax records.

Identity theft for tax fraud: In this case, the thief uses the victim's information to commit tax fraud, such as filing false claims or evading taxes.

Business-related identity theft: This occurs when the thief uses the victim's information to create or engage in fraudulent business activities, resulting in tax-related consequences.

How to complete irs identity theft process

To complete the IRS identity theft process, follow these steps:

01

Contact the IRS: Report the incident of identity theft to the IRS and provide them with all the necessary details.

02

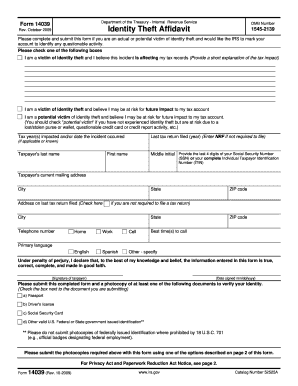

Complete an Identity Theft Affidavit: Fill out the appropriate IRS form to officially notify them about the identity theft and provide supporting documentation.

03

File a police report: Contact your local law enforcement agency and file a report regarding the identity theft.

04

Review your credit reports: Check your credit reports for any fraudulent activities and dispute any unauthorized accounts or transactions.

05

Implement security measures: Take steps to safeguard your personal information to prevent further instances of identity theft.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.