List Of Household Items For Insurance

What is list of household items for insurance?

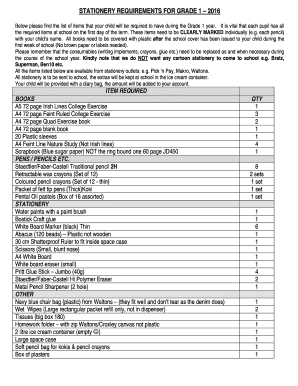

When it comes to insurance coverage for your household items, having a detailed list is crucial. This list includes a comprehensive compilation of all the important possessions in your home that you want to protect. It typically includes items such as furniture, appliances, electronics, jewelry, and clothing. By having a list of household items for insurance, you can ensure that you have adequate coverage in case of loss or damage.

What are the types of list of household items for insurance?

There are two main types of lists for household items insurance: a basic list and a detailed list. A basic list includes general categories of items, such as furniture, electronics, and clothing, without providing specific details. On the other hand, a detailed list includes specific descriptions and estimated values for each item. Both types serve their purpose, but a detailed list offers more comprehensive coverage and helps during the claims process.

How to complete list of household items for insurance

Completing a list of household items for insurance may seem overwhelming, but it doesn't have to be. Here are some steps to help you complete your list:

At pdfFiller, we understand the importance of protecting your household items. With our user-friendly platform, you can easily create, edit, and share your insurance list online. Our unlimited fillable templates and powerful editing tools make pdfFiller the ultimate PDF editor you need to get your documents done efficiently and securely.