Lost P45

What is lost p45?

Lost P45 refers to a situation where an employee misplaces or fails to receive their P45 form. The P45 form is a vital document that depicts an individual's tax position when they leave a job. It contains details such as earnings, tax paid, and the tax code used by their previous employer. Losing this form can cause inconveniences and may require certain steps to be taken in order to rectify the situation.

What are the types of lost p45?

There are primarily two types of lost P45 situations. The first type occurs when an employee loses their physical P45 form, typically due to misplacing or accidentally discarding it. The second type is when an employee does not receive their P45 form from their previous employer, typically due to a failure or delay in providing the form.

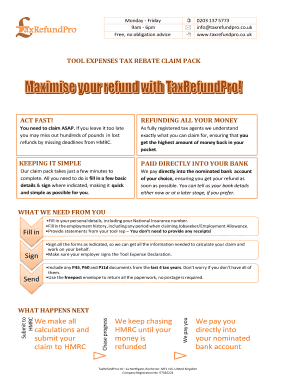

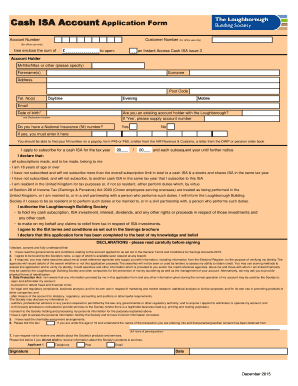

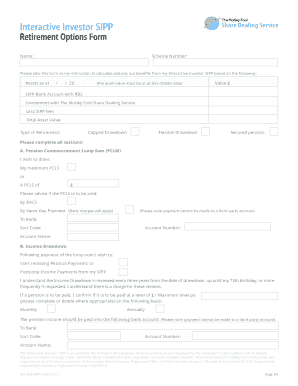

How to complete lost p45

Completing the process for a lost P45 requires taking certain steps to ensure that your tax position is accurately updated. Here is a list of actions to be taken:

At pdfFiller, we understand the challenges that can arise from a lost P45 situation. That's why our platform empowers users to create, edit, and share documents online seamlessly. With our unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for individuals who need to efficiently manage and complete their documents.