Monthly Payment Schedule Template

What is a monthly payment schedule template?

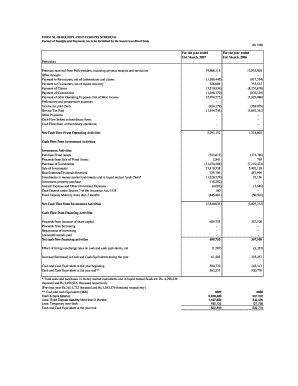

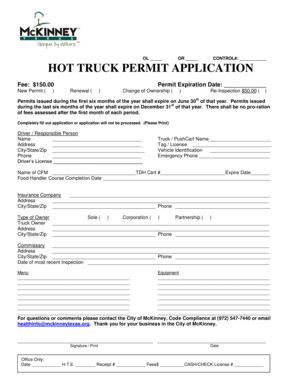

A monthly payment schedule template is a document that helps individuals or businesses keep track of their monthly payments and due dates. It provides a clear and organized overview of all the upcoming payments, including the amount, due date, and any additional details. This template serves as a useful tool for budgeting and financial planning.

What are the types of monthly payment schedule templates?

There are various types of monthly payment schedule templates available, depending on the specific needs and preferences of the user. Some common types include:

How to complete a monthly payment schedule template

Completing a monthly payment schedule template is a simple and straightforward process. Here are the steps to follow:

By following these steps, you can effectively utilize a monthly payment schedule template to stay organized and maintain a clear overview of your financial obligations.