Mortgage Deed Format For Bank

What is mortgage deed format for bank?

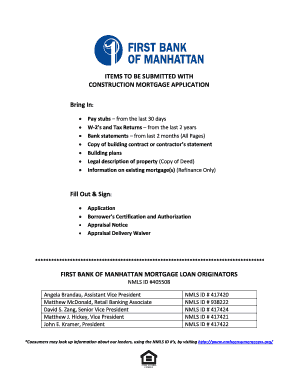

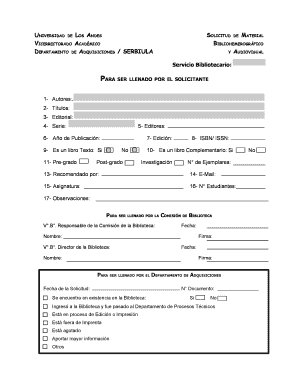

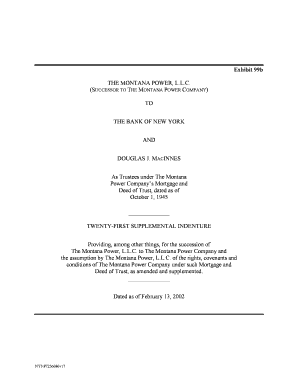

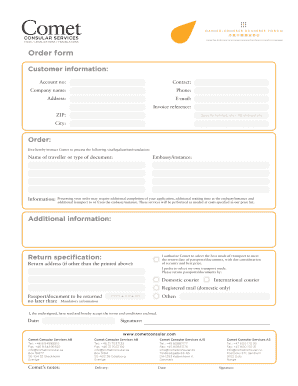

A mortgage deed format for bank refers to the specific layout and structure that a bank follows when creating a mortgage deed. This document is a legal agreement between a borrower and a lender (in this case, a bank) that outlines the terms and conditions of a mortgage loan. It includes details such as the names of the parties involved, the property being mortgaged, the loan amount, interest rate, repayment terms, and any additional clauses or provisions.

What are the types of mortgage deed format for bank?

There are several types of mortgage deed formats that banks may use. The most common types include: 1. Fixed-rate mortgage deed: This format sets a fixed interest rate for the entire duration of the loan. 2. Adjustable-rate mortgage deed: This format allows for changes in the interest rate over time, typically based on a specific index. 3. Balloon mortgage deed: In this format, the borrower makes low monthly payments for a certain period, followed by a larger 'balloon' payment at the end. 4. Interest-only mortgage deed: This format requires the borrower to only pay the interest on the loan for a specific period, after which principal payments are added.

How to complete mortgage deed format for bank

Completing a mortgage deed format for the bank typically involves the following steps: 1. Gather the necessary information: Collect all relevant details, such as the borrower's and lender's names, property address, loan amount, and any specific terms or conditions. 2. Fill in the blanks: Use a tool like pdfFiller to fill in the mortgage deed template online. Simply click on each blank field and enter the corresponding information. 3. Review and check for accuracy: Double-check all the information you have entered to ensure it is accurate and reflects the terms of the loan agreement. 4. Save and share: Once you have completed the mortgage deed, save it as a PDF file and share it with all the parties involved, including the borrower and the bank.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.