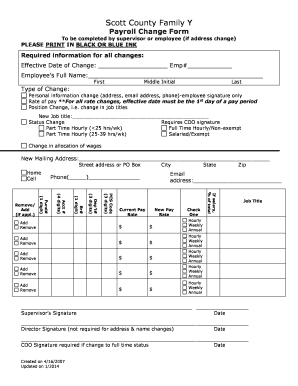

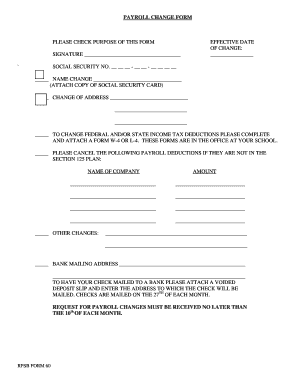

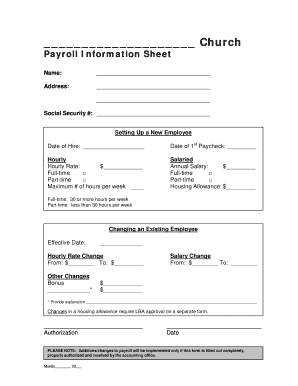

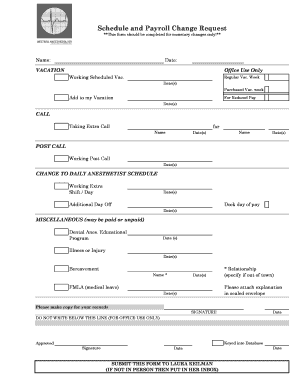

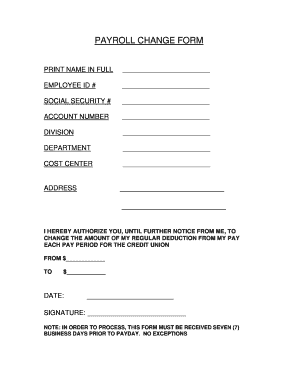

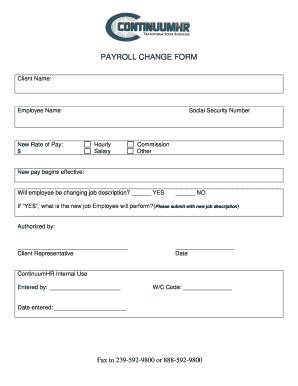

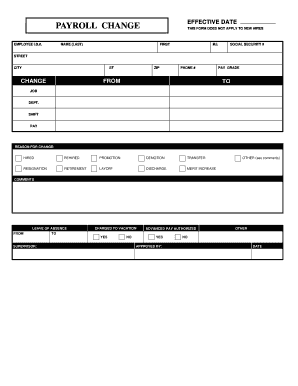

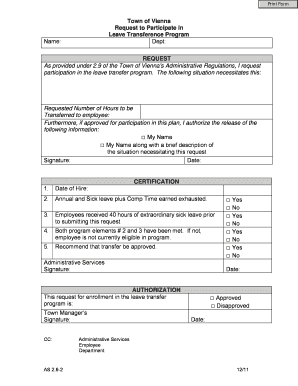

Payroll Change Form - Page 12

What is Payroll Change Form?

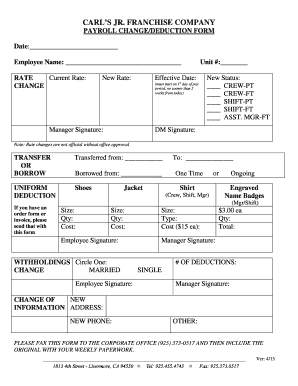

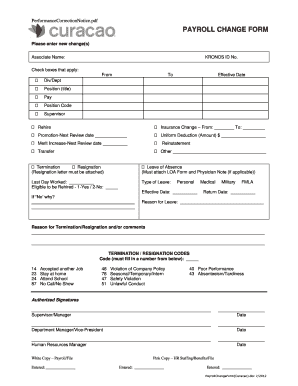

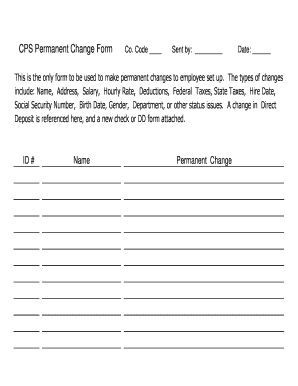

A Payroll Change Form is a document used by companies to record and process changes to an employee's payroll information. It is used when there is a change in an employee's salary, tax withholdings, benefits, or any other payroll-related information. This form helps the HR department and payroll team keep accurate records and ensure that employees are paid correctly and in compliance with the company and legal requirements.

What are the types of Payroll Change Form?

There are various types of Payroll Change Forms that cater to specific changes in an employee's payroll. Some common types include:

How to complete Payroll Change Form

Completing a Payroll Change Form is a simple process that requires attention to detail and accuracy. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.