What is Payroll Spreadsheet?

A payroll spreadsheet is a document that helps businesses keep track of employee salaries, wages, deductions, and other payroll-related information. It is an essential tool for accurately calculating and managing payroll.

What are the types of Payroll Spreadsheet?

There are various types of payroll spreadsheets available depending on the specific needs of a business. Some common types include:

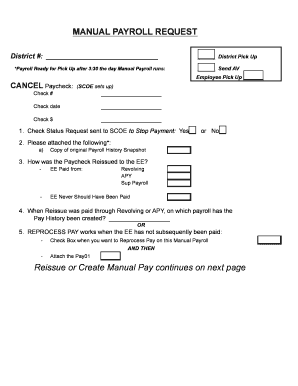

Basic Payroll Spreadsheet: This type of spreadsheet includes basic employee information, hours worked, and wage calculation.

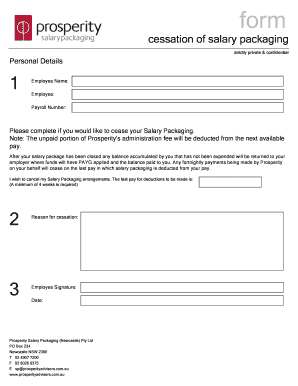

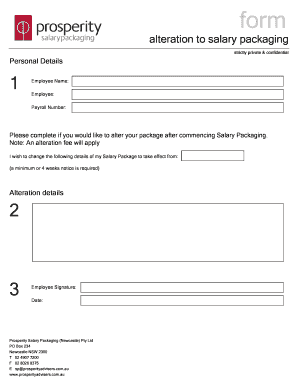

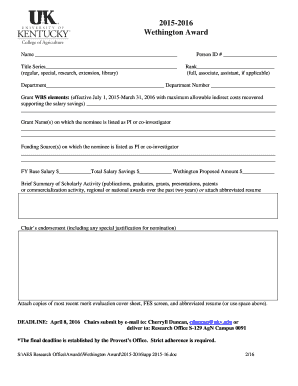

Salary Payroll Spreadsheet: Designed for businesses that pay employees a fixed salary, this spreadsheet focuses on salary calculations and deductions.

Hourly Payroll Spreadsheet: Ideal for businesses with hourly employees, this spreadsheet tracks hours worked and calculates wages accordingly.

Commission Payroll Spreadsheet: This type of spreadsheet is used by businesses that pay employees based on sales commissions, tracking sales and calculating commission amounts.

How to complete Payroll Spreadsheet

Completing a payroll spreadsheet accurately is crucial to ensure timely and correct payments to employees. Here are some steps to help you complete a payroll spreadsheet:

01

Gather employee information: Collect all necessary employee data such as hours worked, wages, deductions, and tax information.

02

Input data: Enter the collected data into the corresponding cells of the payroll spreadsheet. Double-check for any errors or typos.

03

Calculate totals: Use formulas or built-in functions to automatically calculate totals for wages, deductions, and net pay.

04

Validate data: Verify the accuracy of the entered data by cross-referencing with source documents or previous payroll records.

05

Review and adjust: Review the completed spreadsheet for any discrepancies or inconsistencies. Make necessary adjustments if required.

06

Save and share: Save the completed payroll spreadsheet and share it with relevant stakeholders or payroll administrators.

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online, including payroll spreadsheets. With its unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for users to efficiently manage their payroll process.