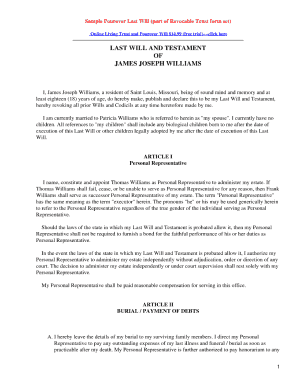

Pour Over Will Form - Page 4

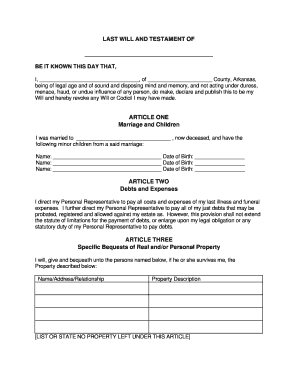

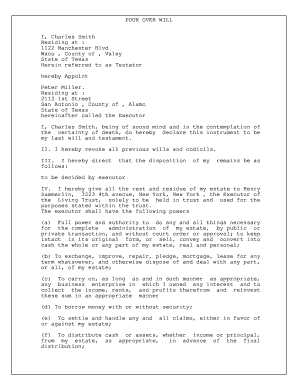

What is a Pour Over Will Form?

A Pour Over Will Form is a legal document that works in conjunction with a living trust. It ensures that any assets not specifically designated in the trust will be 'poured over' into the trust upon the individual's death.

What are the types of Pour Over Will Forms?

There are generally two types of Pour Over Will Forms: individual and joint. An individual Pour Over Will Form is for a single person, while a joint Pour Over Will Form is for a married couple creating a trust together.

How to complete a Pour Over Will Form

Completing a Pour Over Will Form is a straightforward process that involves filling in your personal details, naming a trustee to manage the assets, and clearly outlining how you want your assets distributed. Make sure to review the document carefully before signing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.