What is Risk Management Proposal Template?

A Risk Management Proposal Template is a document that outlines the approach to identify, assess, and mitigate risks in a project or business. It provides a structured framework for risk management activities, ensuring that potential risks are identified and addressed effectively.

What are the types of Risk Management Proposal Template?

There are several types of Risk Management Proposal Templates available, depending on the specific needs and requirements of the project or business. Some common types include:

Project Risk Management Proposal Template

Business Risk Management Proposal Template

Financial Risk Management Proposal Template

IT Risk Management Proposal Template

How to complete Risk Management Proposal Template

Completing a Risk Management Proposal Template is a straightforward process. Here are the steps you can follow:

01

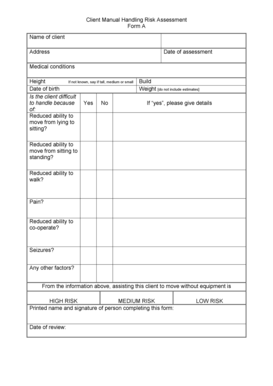

Start by providing the necessary details about the project or business for which the proposal is being created.

02

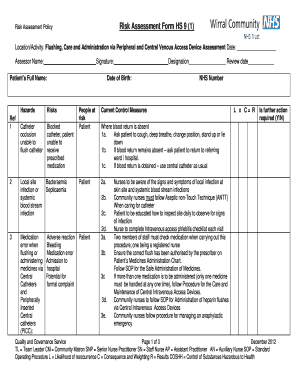

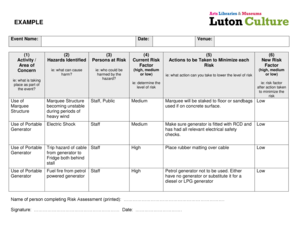

Identify potential risks by conducting a thorough risk assessment. Consider both internal and external factors that may impact the project or business.

03

Evaluate the identified risks based on their likelihood and potential impact. Prioritize risks based on their severity and likelihood of occurrence.

04

Develop a risk management plan that outlines the strategies and actions to mitigate each identified risk. Include contingency plans and risk response strategies.

05

Clearly communicate the proposed risk management strategies and their potential benefits to stakeholders, ensuring their buy-in and support.

06

Review and finalize the Risk Management Proposal Template, making sure all necessary information is included and all sections are well-structured and coherent.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.