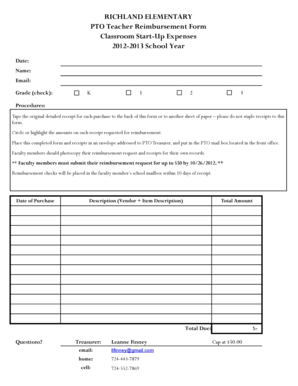

Startup Expenses

What is Startup Expenses?

Startup expenses refer to the costs incurred during the initial phase of setting up a new business. These expenses are essential for getting the business off the ground and include various items such as equipment purchases, legal fees, marketing expenses, and office rent.

What are the types of Startup Expenses?

There are several types of startup expenses that entrepreneurs need to consider. These include:

One-time expenses: These are costs that are incurred only once during the startup phase, such as incorporation fees and trademark registration.

Fixed expenses: These expenses remain constant regardless of the level of business activity, such as rent and utilities.

Variable expenses: These costs fluctuate based on the volume of business, such as inventory and shipping expenses.

Marketing expenses: These expenses include advertising, promotions, and market research costs to attract customers.

Legal and administrative expenses: These expenses include legal fees, permits, and licenses required to operate the business.

Technology and equipment expenses: These costs include purchasing or leasing necessary equipment and software.

Employee-related expenses: These expenses include salaries, benefits, and training costs for employees.

How to complete Startup Expenses

Completing startup expenses can be a daunting task, but with the right approach, it can be streamlined. Here are the steps to complete startup expenses:

01

Identify and categorize expenses: Start by listing all the expenses involved in starting your business. Categorize them into different types, such as one-time, fixed, variable, marketing, legal, technology, and employee-related expenses.

02

Estimate costs: Research and estimate the costs associated with each expense category. This may involve contacting vendors, service providers, and conducting market research to get accurate cost estimates.

03

Create a budget: Based on the estimated costs, create a budget that outlines how much you will need to spend on each expense category. This will help you allocate funds and manage your finances effectively.

04

Track expenses: As you incur startup expenses, keep track of them diligently. Use a spreadsheet or accounting software to record every expense, including receipts and invoices.

05

Review and adjust: Regularly review your startup expenses to ensure they align with your budget. Adjust your spending if necessary to avoid overspending or running out of funds.

06

Seek professional advice: If you are unsure about managing startup expenses, consider seeking professional advice from accountants or financial advisors. They can provide guidance and help you make informed financial decisions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Startup Expenses

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you draft a startup budget?

7 Easy Steps to create a startup budget Set a target. While you're reading this, grab a book, computer, any tool that you usually use. List income sources. Categorize costs into revenue buckets. Determine variable costs. Accommodate Interest and Taxes. Create estimates for financial statements.

What are the 7 steps in a budget?

7 Steps to a Budget Made Easy Step 1: Set Realistic Goals. Step 2: Identify your Income and Expenses. Step 3: Separate Needs and Wants. Step 4: Design Your Budget. Step 5: Put Your Plan Into Action. Step 6: Seasonal Expenses. Step 7: Look Ahead.

What are 3 examples of a start up expense?

What are examples of startup costs? Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

What should a startup spend money on?

A large portion of the budget should go towards marketing and sales. Additionally, salaries need to be paid and other expenses covered. Startups spend their funding on growth, marketing, and R&D. These three areas are critical to the success of any startup.

What is not a start up expense?

Money you spend getting credentialed to work in a particular field can't be included in startup costs (and are generally not tax-deductible). For example, if you want to open a real estate company, you can't deduct the cost of acquiring your real estate license.

What are the 5 steps of budget preparation?

Six steps to budgeting Assess your financial resources. The first step is to calculate how much money you have coming in each month. Determine your expenses. Next you need to determine how you spend your money by reviewing your financial records. Set goals. Create a plan. Pay yourself first. Track your progress.