Startup Funding Proposal Template

What is Startup Funding Proposal Template?

A Startup Funding Proposal Template is a pre-designed document that outlines a plan for securing funding to start a new business or expand an existing one. It serves as a roadmap that details the financial needs, goals, and strategies of the startup, making it easier for potential investors to evaluate the opportunity.

What are the types of Startup Funding Proposal Template?

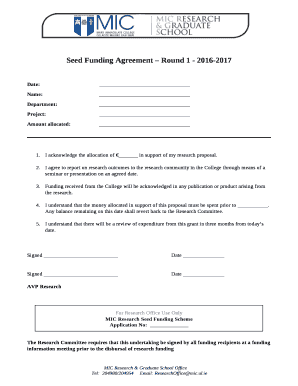

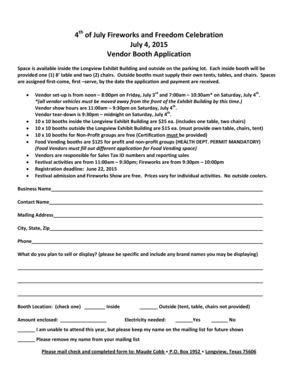

There are various types of Startup Funding Proposal Templates available to cater to different types of businesses and funding needs. Some common types include: 1. Equity Financing Proposal Template: This type of template is used when a startup plans to raise funds by offering ownership stakes in the company to investors. 2. Debt Financing Proposal Template: This template is suitable for startups that plan to raise funds through loans or other forms of debt. 3. Crowdfunding Proposal Template: This template is designed for startups looking to raise funds from a large number of people through online platforms. 4. Grant Proposal Template: This type of template is used when a startup aims to secure funding from government agencies or non-profit organizations through grant programs.

How to complete Startup Funding Proposal Template

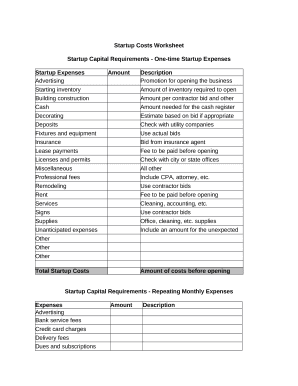

Completing a Startup Funding Proposal Template can seem daunting, but with the right approach, it becomes manageable. Here are the steps to complete the template: 1. Executive Summary: Provide a concise overview of your business, including the problem you're solving, the target market, and your competitive advantage. 2. Company Description: Share detailed information about your startup, including its mission, vision, legal structure, and current stage of development. 3. Market Analysis: Conduct thorough research on your target market, industry trends, and competitors to demonstrate market potential. 4. Funding Request: Specify the amount of funding you need, how it will be used, and how the investors can expect to earn a return on their investment. 5. Financial Projections: Prepare financial forecasts, including income statements, cash flow statements, and balance sheets to demonstrate the startup's financial viability. 6. Use of Funds: Clearly define how the funds will be allocated and how they will contribute to the growth and success of your startup. 7. Appendices: Include any additional documents or supporting materials, such as product demos, patents, or market research findings. By following these steps, you can effectively complete a Startup Funding Proposal Template and increase your chances of securing the funding you need.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.