Strategic Investment Proposal Template - Page 2

What is Strategic Investment Proposal Template?

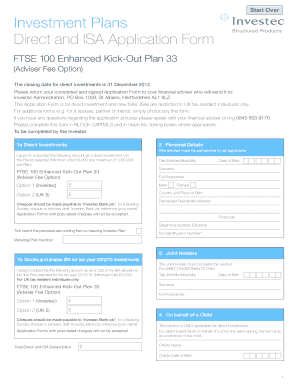

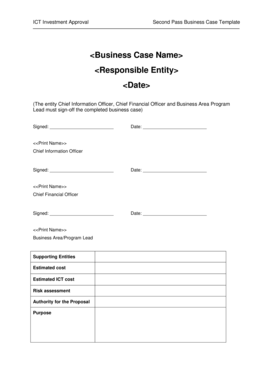

The Strategic Investment Proposal Template is a document that outlines a proposed investment strategy to achieve specific goals. It provides a comprehensive plan for making strategic investment decisions and is essential for businesses and individuals looking to secure funding or attract investors.

What are the types of Strategic Investment Proposal Template?

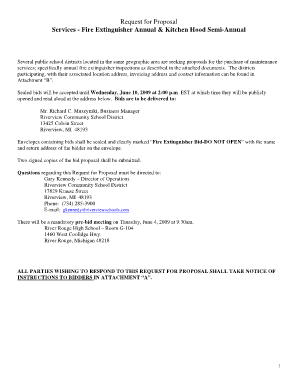

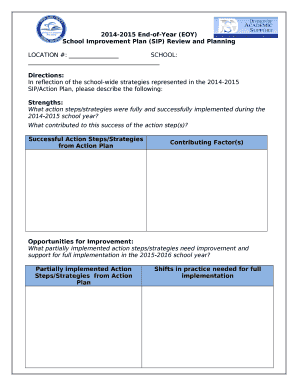

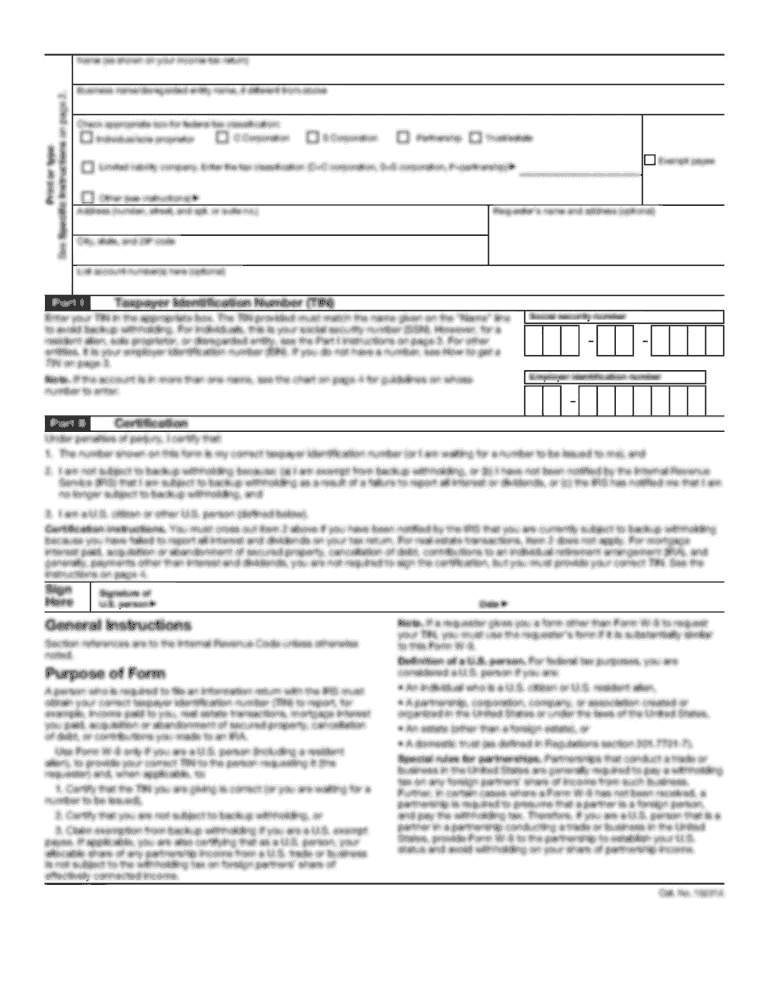

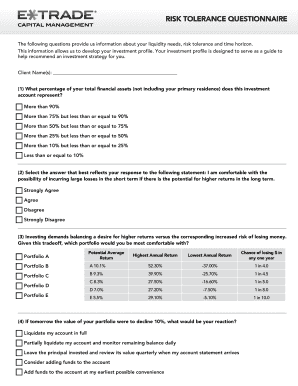

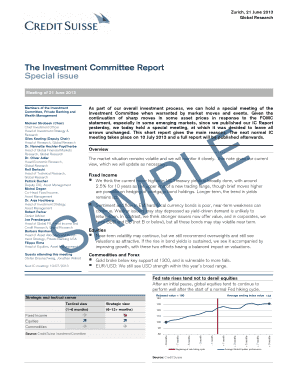

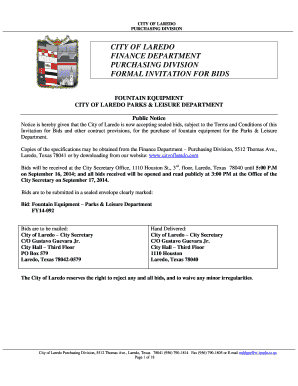

There are various types of Strategic Investment Proposal Templates, each designed for different purposes. Some common types include:

How to complete Strategic Investment Proposal Template

Completing a Strategic Investment Proposal Template is an important step in presenting your investment strategy effectively. Here are some guidelines to follow:

By following these steps and utilizing the features provided by pdfFiller, you can create a compelling Strategic Investment Proposal that will attract potential investors and help you achieve your investment goals.