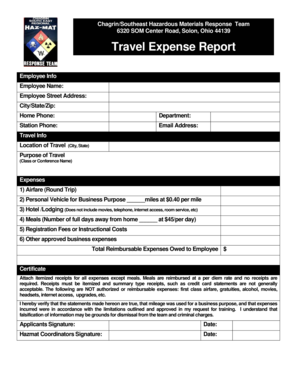

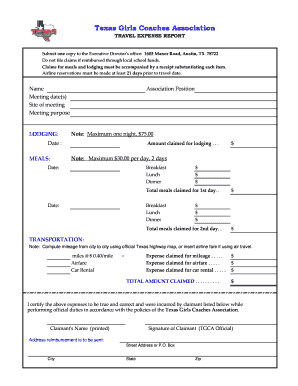

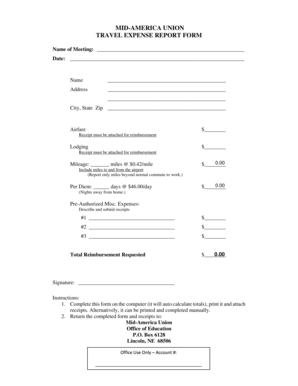

Travel Expense Report Template

What is Travel Expense Report Template?

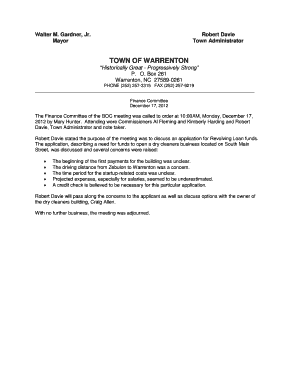

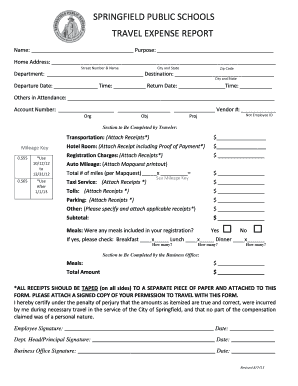

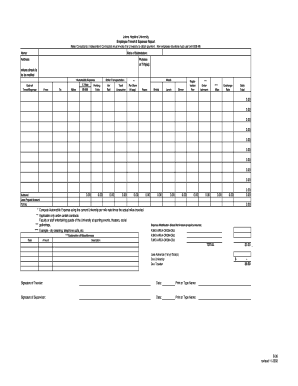

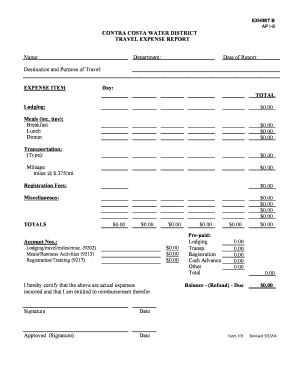

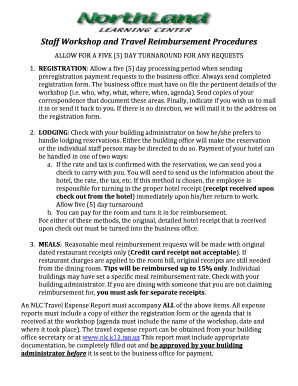

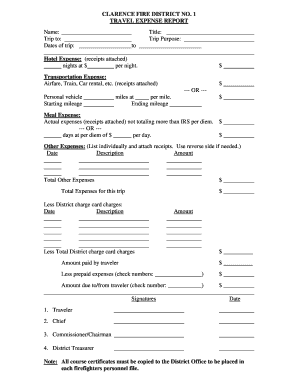

A Travel Expense Report Template is a pre-designed document that allows individuals or companies to keep track of their travel-related expenses. It provides a structured format for recording details such as transportation costs, accommodation expenses, meals, and other miscellaneous expenses incurred during a trip.

What are the types of Travel Expense Report Template?

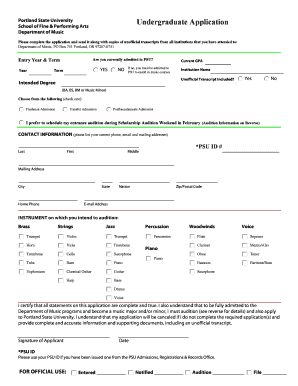

There are various types of Travel Expense Report Templates available, catering to different needs and preferences. Some common types include:

How to complete Travel Expense Report Template

Completing a Travel Expense Report Template is a simple and straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.